by Michael Fabian, FMD Capital Management

Could the high yield bond market be sending a precursor message to the Fed, signaling them not raise rates until 2016?

While that’s a notable possibility, the market just doesn’t seem hungry enough to gobble up excess inventory from record outstanding high yield debt levels. Especially with intermediate to long-term fundamental challenges such as the imminent probability of a short-term interest rate hike and a barbell shaped rollover calendar centered in the 2019-2020 time frame.

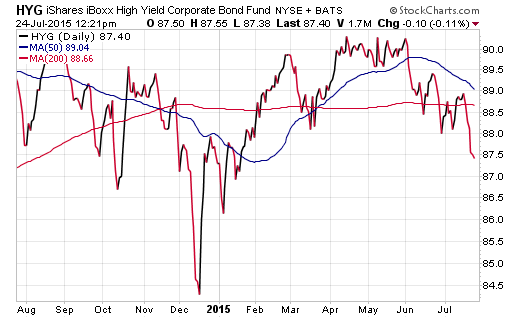

These key convergences, alongside a spotty risk asset environment, have caused a breakdown from the established 2015 trading range in both the iShares High Yield Bond ETF (HYG) and SPDR High Yield Corporate Bond ETF (JNK). Nevertheless, investors should take note that defaults have not meaningfully ticked higher and junk bonds are basically flashing the same warning signs as equities. All the while, the credit markets feel sluggish and opportunities viewed through the lens of risk aversion seem sparse.

Looking at a total return attribution, with most high yield bond indexes yielding between 5-6%, investors have experienced slowly eroding bond prices with merely the income to keep them near the flat line for the year. Even shorter dated indexes have felt the sting of the credit related malaise as evidenced by the recent under performance of the PIMCO 0-5yr High Yield Corporate Bond ETF (HYS), which up until recently was a favorite within our Strategic Income Portfolio.

Looking back over the last several months, we have made our case clear that income investors should be shifting a larger portion of their fixed-income sleeve to higher quality Treasury, MBS, and investment grade corporate securities following the recent rise in interest rates of longer dated bonds. For our clients, we have crossed into the territory of a quality-heavy stance, which although sacrifices a small amount of yield, will further bolster and offset other risk assets within our portfolio. Moving into year end, we do not suspect longer dated interest rates to rise much further than they already have.

Viewing the high yield bond market from a strategic perspective, we plan to keep a close eye on high yield bond spreads relative to Treasuries, which has crept back above the 5% level. If we see this uptrend continue, we will begin to shift our fixed-income sleeve back toward the aforementioned high yield ETFs, because we will be getting paid more to assume the additional credit risk.

Just bear in mind that a longer term downtrend could materialize as evidenced in past Fed rate increase cycles. So attempting to jump the gun with new purchases right away is not recommended. Instead, pick common sense locations from a technical and fundamental point of view, and average in slowly.

With a properly timed exit and reentry, income investors can rest assured they can reinstate a higher cash flow once prices have softened.

Copyright © FMD Capital Management