by Cullen Roche, Pragmatic Capitalism

Commodities have been crushed in the last 5 years. Gold is down over 40%, silver is off 70%, copper is down 45%, oil is down 55% and the Bloomberg Commodity Index is down 60% from its 2008 peak.

We all know by now that many of the theories for owning commodities ended up being dead wrong. Anyone following this site over the years knows why QE didn’t cause hyperinflation or high inflation. Peak oil never happened. China didn’t buy up all of the world’s commodities. My position on commodities has been very clear over the years - you’re being irrational if you construct a portfolio around them. But all the recent bearishness has me wondering – are we seeing peak bearishness in commodities?

In a recent AMA question I was asked if Jason Zweig of the Wall Street Journal was right to refer to gold as a “pet rock”. I responded:

Commodities are non-financial assets. This means that they are generally cost inputs in the capital structure. As such, they should not be viewed as “investments”. They are, at best, hedging tools in a portfolio. I always say that commodities are something you rent, not something you own. There are times when commodities are quite beneficial in a portfolio. For instance, historically, late in the business cycle commodities perform well because wages are rising, inflation is rising and the economy starts to boom. This is positive for commodities and can create an environment that generates a positive uncorrelated return asset in addition to equities (since bonds generally won’t be performing as well at this point in the cycle).

Gold is just one of many commodities, however. I am not sure why it’s viewed as something special. In today’s financial asset based monetary systems there is nothing special about gold. It is not a currency and it is not “money”. It should be viewed as another industrial commodity and nothing more.

That said, I don’t think it’s ever wise to build a portfolio around commodities. They should be, at best, a hedging component and an outlier beta component. A portfolio should be built around financial assets and instruments that have a cash flow producing stream that makes their returns somewhat predictable over the ENTIRETY of the business cycle as opposed to commodities which just hedge at times during the business cycle.

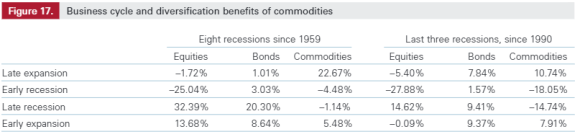

This isn’t theory or ideology. It’s just based on operational realities. And the operational view for owning commodities at times is quite rational. As Vanguard has noted in the past, commodities are usually late cycle assets.¹ That is, they tend to perform poorly early in the business cycle because wages are weak, inflation is low, demand is weak, etc. Likewise, they tend to perform best late in the business cycle when these trends have reversed.

In fact, commodities have performed extremely well later in the business cycle with returns averaging 22.67% relative to negative stock returns and flat bond returns:

All this bearishness in the commodity space makes me wonder if we’re not getting close to peak bearishness in commodities. And given the fact that we’re now 72 months into a recovery I think it’s safe to say that we’re at least mid way through the recovery and very likely entering the late expansion phase. Of course, it’s important to keep in mind what I stated above. Commodities are never an asset to own, but rather something you rent with the hope of providing an uncorrelated return to further protect your stock and bond allocations. And they should never be the core piece of your asset allocation as they are cost inputs in the capital structure and not the instruments that provide long-term predictable cash flow streams. That said, all this bearishness has me feeling more bullish about the potential that we’re moving into a late expansion phase and a phase where commodities might do better than stocks and/or bonds at points in the coming years.

Sources:

¹ - Investment case for commodities? Myths and Reality – Vanguard

2 – Commodities, They Have Almost No Place in your Portfolio – Pragcap

Copyright © Pragmatic Capitalism