by David Templeton, Horan Capital Advisors

With Greece headlines dominating news stories over this past weekend, investors might be on edge regarding future equity market returns on Monday and the coming weeks. A number of headlines this evening are using the words plunge and slide as U.S. futures are down less than 1.5%. Yes, much can change before the U.S. markets open Monday morning, but it is the sensational headline that generates reader clicks and article views. I have written several times over the past few years about these shocks to the equity market and how the market damage generally has been short lived, (here and here.)

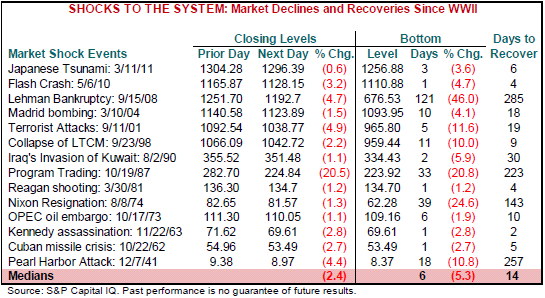

S&P Dow Jones Indices published a report in September 2013, Shocks & Stocks, that analyzed market shocks and the initial market decline and the time necessary to recover the losses. Included in the report is the below table.

|

As can be seen in the above table, of the fourteen shock events listed, the average market decline was 5.3% and losses were recovered in an average of 14 days. Several of the losses were much greater than the average and the recovery time period much larger than the average. S&P notes though,

- "Granted, even though selected events took much longer to play out than the medians would suggest, these extreme situations usually occurred within the confines of a long-term bear market and did not precipitate the initial decline. Examples of these include: 1) Pearl Harbor, 2) President Nixon’s resignation, 3) the terrorist attacks on 9/11, and 4) the collapse of Lehman Brothers. So should history repeat itself, and there is no guarantee it will, unanticipated events that occur within bull markets that throw markets for a loop are typically assessed for their economic impact in short order, allowing opportunistic traders to step in and quickly push share prices back to break-even and beyond."

A a word of caution for investors wishing to sell stocks early Monday morning, rememebr, these crisis events generally have a short lived impact on the return in equity indices.