by Ben Carlson, A Wealth of Common Sense

Zero Hedge posted an interview conducted by Goldman Sachs with Nobel-prize winning economist Robert Shiller yesterday. You can just tell the end-of-the-world blogger loved highlighting the following passage:

This time around, bonds and, increasingly, real estate also look overvalued. This is different from other over-valuation periods such as 1929, when the stock market was very overvalued, but the bond and housing markets for the most part weren’t. It’s an interesting phenomenon.

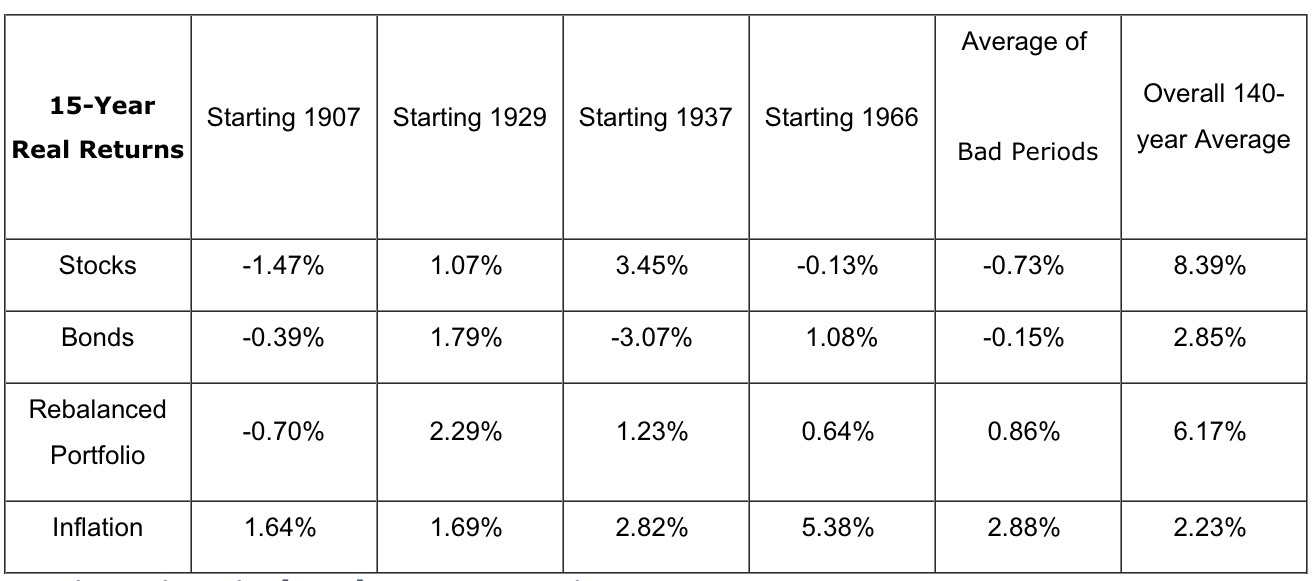

In thinking about the possibility of poor stock and bond performance from these valuation and interest rate levels, it’s worth putting some historical context around this debate even if the past is not prologue. Michael Kitces re-posted some timely data from his blog yesterday outlining the worst case scenario:

Each of these periods align with a catastrophic economic outcome. The Panic of 1907 was a severe depression which saw economic output fall by a third. JP Morgan had to more or less singlehandedly save the entire banking system that year. 1929 marked the start of the Great Depression. 1937 was among the worst recessions of the 20th century as GDP dropped by one fifth. Also, these are after-inflation returns. Even in the 1966 scenario the nominal returns were decent. It was sky high inflation from a commodity price shock at the time that makes the real returns so much worse.

There’s a huge difference between above average price-to-earnings multiples and economic calamities. Elevated profit margins, high CAPE ratios, high margin debt and historically low interest rates are not the same thing as an economic depression. This is not to say that we can’t see a crash or much lower than average returns from these levels, but more times than not these events are triggered by enormous excesses in the economy, not some valuation model.

And remember, bonds can be held to maturity. In a way it’s difficult for the bond market to be overvalued in the same sense as the stock market can be. Fixed income investors have to worry about default and credit risk, but really the biggest risk for high quality bonds is inflation, not an outright crash. Long-term bond market performance is much easier to estimate than the stock market by using the starting yield levels, but this has always been the case. It’s just that with rates so low now there’s not as much of a cushion if inflation picks up in the future, so volatilty will likely be higher than normal in bonds.

It’s also very difficult to say that “everything” is overvalued since investors have to put their money somewhere. There’s no such thing as an equilibrium level that the system gets reset to all at once. You have to consider relatives as well as absolutes in this case. Since most people these days only read the scary headline, many probably missed the fact that Shiller also said the following in his interview (emphasis mine this time):

And as a general principle, I think people should diversify across assets and geographies because there is no way to predict what any one asset will do with any accuracy. I’ve been talking down US stocks because of their high valuation, but I would invest something into US stocks; I would just put a heavier contribution in stocks around the world, where CAPE ratios look lower. I keep coming back to the theme that there are lots of places outside of the US to invest. And I would also own bonds, real estate and commodities.

I’ve probably spent far too much time writing on this subject lately, but I think it’s an important one to think about considering there’s a deluge of prognosticators making some fairly dire predictions. To say that everything is overvalued has more to do with expectations than anything. Investors should expect periods of below average performance to follow periods of above average performance. This is how mean reversion works. But trying to predict a crash, an economic shock or exactly what future stock market returns will be is much harder than it looks or sounds in theory.

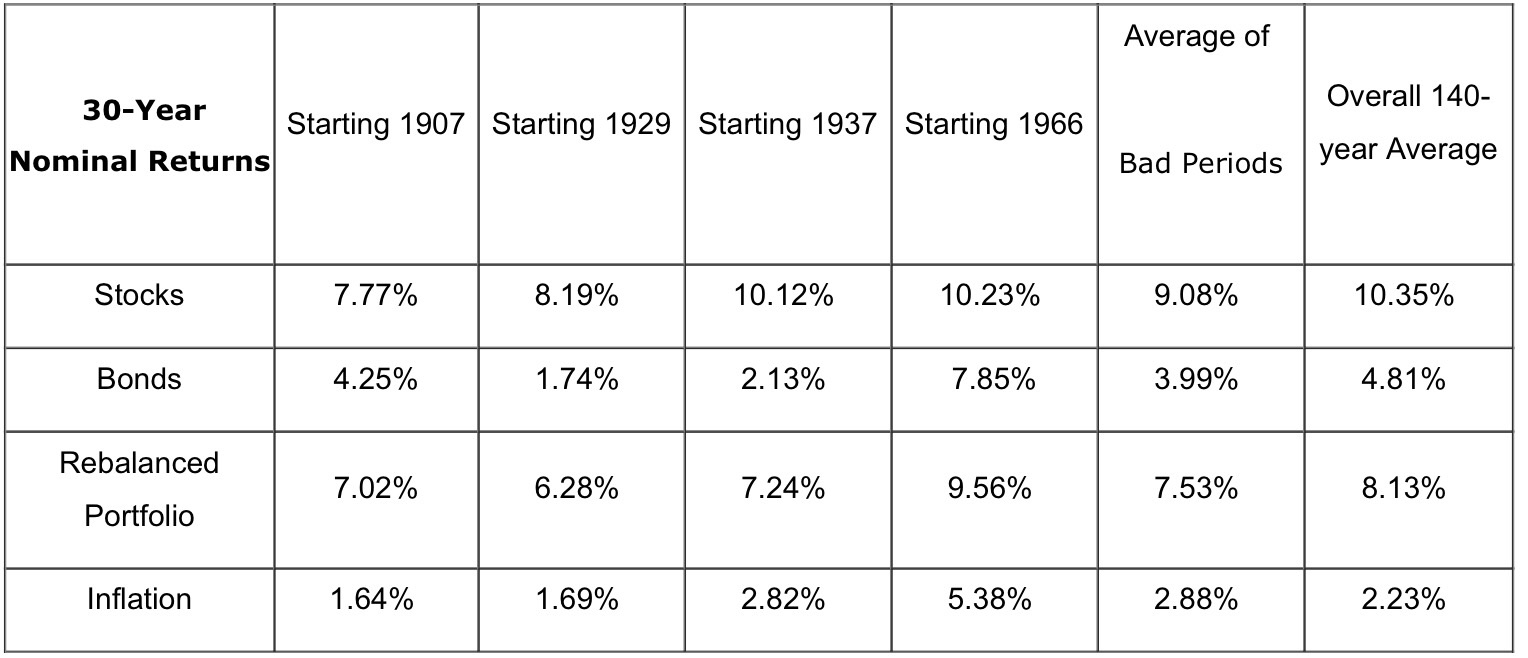

To end things on a more positive note, check out the 30 year return numbers from the same starting points as those dreadful 15 year returns from above (note that these are nominal, not real, returns this time):

Not bad.

Further Reading:

What Does the Bursting of a Bond Bubble Look Like?

Market Returns During Ray Dalio’s 1937 Scenario

What’s the Worst 10 Year Returns from a 50/50 Stock/Bond Portfolio?

Sources:

Robert Shiller: Unlike 1929 This Time Everything – Stocks, Bonds And Housing – Is Overvalued (Zero Hedge)

What Returns Are Safe Withdrawal Rates REALLY based upon? (Nerd’s Eye View)

Subscribe to receive email updates and my quarterly newsletter by clicking here.

Follow me on Twitter: @awealthofcs

Copyright © A Wealth of Common Sense