Key Takeaways

- A lack of liquidity continues to plague the bond market, as indicated by elevated dealer holdings of long-term bonds and light trading volume. Volatility may remain elevated in the short term.

- Knowing your breakeven can help bond investors assess how resistant their current portfolio is to rising interest rates, and identify areas that offer value.

by Anthony Valeri, Fixed Income and Investment Strategist, LPL Financial

During difficult times, a measure of how much pain investments can endure can help investors make decisions and also identify potential areas of value. Identifying a potential “breakeven” is important. For bond investors, this means knowing how much a rise in interest rates can be sustained before a loss is incurred. Long-term, high-quality bonds remain volatile as illiquid trading conditions persist, which suggests investors should know their breakevens.

The current bond sell-off appears not to have been driven by fundamentals, nor fear of Federal Reserve (Fed) action, but rather imbalanced positions as we discussed in last week’s Bond Market Perspectives (“Taper Tantrum Redux,” May 12, 2015). A poor trading environment, characterized by illiquid trading conditions, has not only exacerbated weakness but has led to sharp price swings from day to day.

The current bond sell-off appears not to have been driven by fundamentals, nor fear of Federal Reserve (Fed) action, but rather imbalanced positions as we discussed in last week’s Bond Market Perspectives (“Taper Tantrum Redux,” May 12, 2015). A poor trading environment, characterized by illiquid trading conditions, has not only exacerbated weakness but has led to sharp price swings from day to day.

Liquidity (or Lack Thereof) Matters

A lack of liquidity, the ease with which investments can be bought and sold, continues to plague the Treasury market and may be worsening price declines. On Monday, May 18, 2015, Treasuries sold off sharply on virtually no fundamental news and light trading volume, which would suggest that a lack of liquidity and difficult trading conditions once again weighed on bond prices.

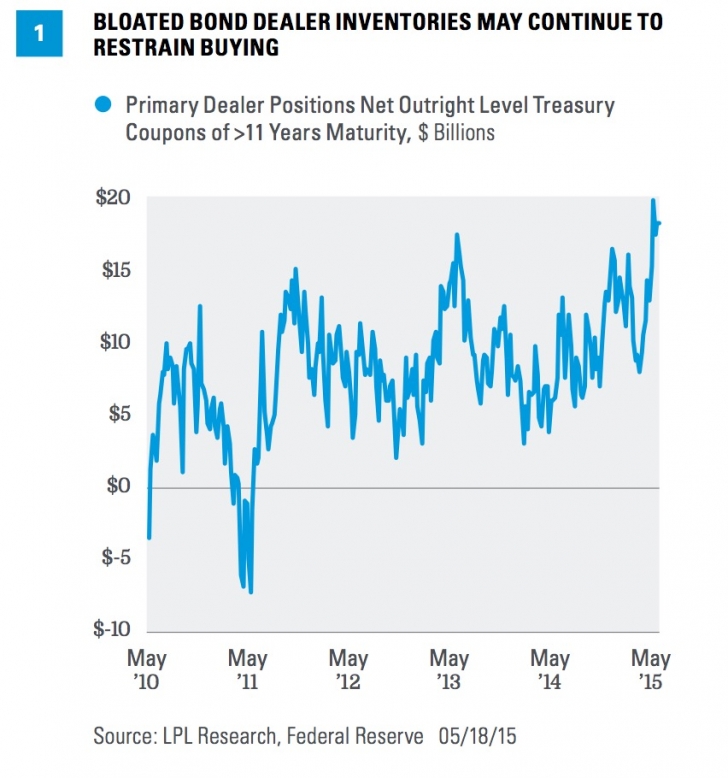

Poor liquidity persists and suggests that recent bond volatility may not have run its course. Primary dealer (the 21 firms required by the U.S. Treasury to make markets in all Treasury securities) holdings of long-term Treasuries remain at multiyear highs and indicate that bond dealers may remain hesitant to support the bond market [Figure 1] for fear of additional losses. Primary dealers’ holdings of Treasuries can be a good contrarian indicator as high inventory levels typically restrain buying that might help engineer a market reversal. Conversely, low inventory levels can help add fuel to price gains. With sellers persisting, primary dealers have had little appetite for adding to long-term Treasuries holdings.

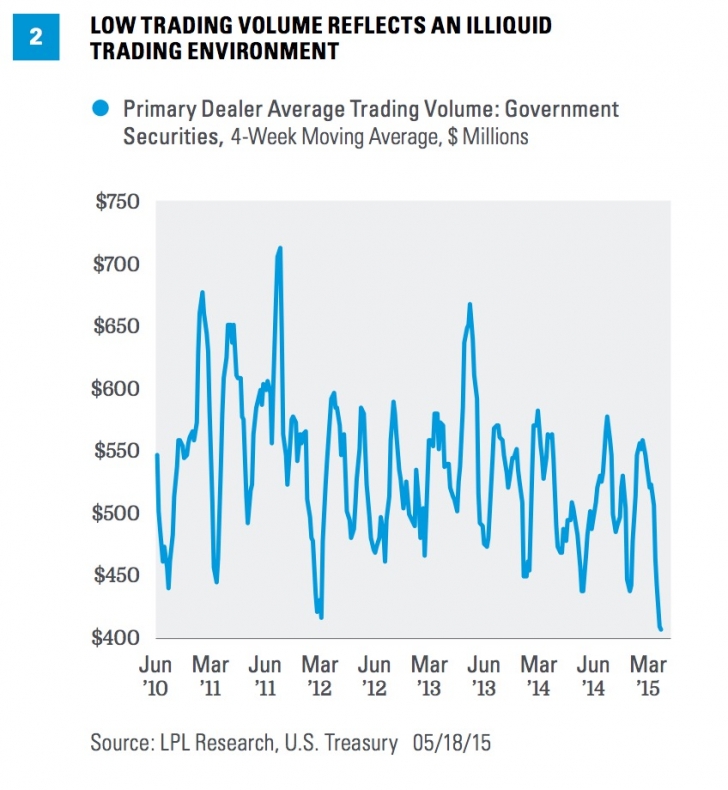

A measure of primary dealers’ average trading volume declined to the lowest level since 2009 and provides further evidence that a liquidity problem may be plaguing the bond market [Figure 2]. The combination of elevated holdings of long-term Treasuries and limited trading volume indicates bond market volatility may continue in the near term.

Assessing Breakevens

For most fixed income investments held over the longer term (for one year or more), a small rise in interest rates may not translate to a loss, as interest income offsets price declines for a positive total return. At some point, however, if the rise in interest rates becomes severe enough, price declines overwhelm interest income. Knowing the specific point at which a rise in interest rates will translate into a loss is referred to as the “breakeven.” Most investors are familiar with the “breakeven” inflation rate implied by Treasury Inflation-Protected Securities (TIPS), another breakeven that refers to total returns.

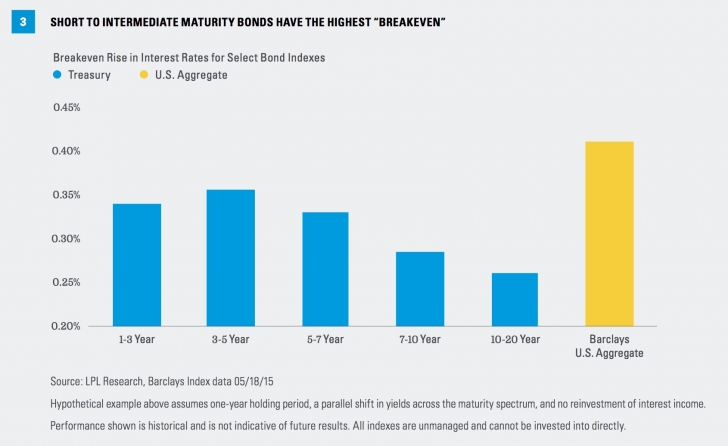

Breakevens can help assess which maturities may be most attractive or help select sectors for investments. Short to intermediate maturity bonds [Figure 3] possess the highest breakevens within the Treasury sector and therefore can endure the largest rate increase before total returns turn negative. Adding other higher-yielding sectors, such as corporate bonds and mortgage-backed securities (represented by the Barclays Aggregate Bond Index), helps boost breakevens.

Breakeven analysis shows that, while holding all other inputs constant, a rise in interest rates of 0.41% is required before the broad bond market, as measured by the Barclays Aggregate Bond Index, sustains a potential loss. This “defense” (of 0.41%) is somewhat limited relative to history and due in large part to today’s low-yield environment. It is also a reason why we expect roughly flat bond market total returns in 2015, as outlined in our Outlook 2015: In Transit.

Breakevens are used to calculate defense, but the weakness of the measure is the failure to capture offense, or what happens in the event interest rates fall. In this case, long-term bonds provide greater price gains for a given decline in interest rates. Of course, these bonds have the lowest breakeven and potential downside if rates rise. Therefore, we still find intermediate bonds provide the best risk-reward by capturing many of bonds’ diversification benefits without undue interest rate risk.

Stay Diversified

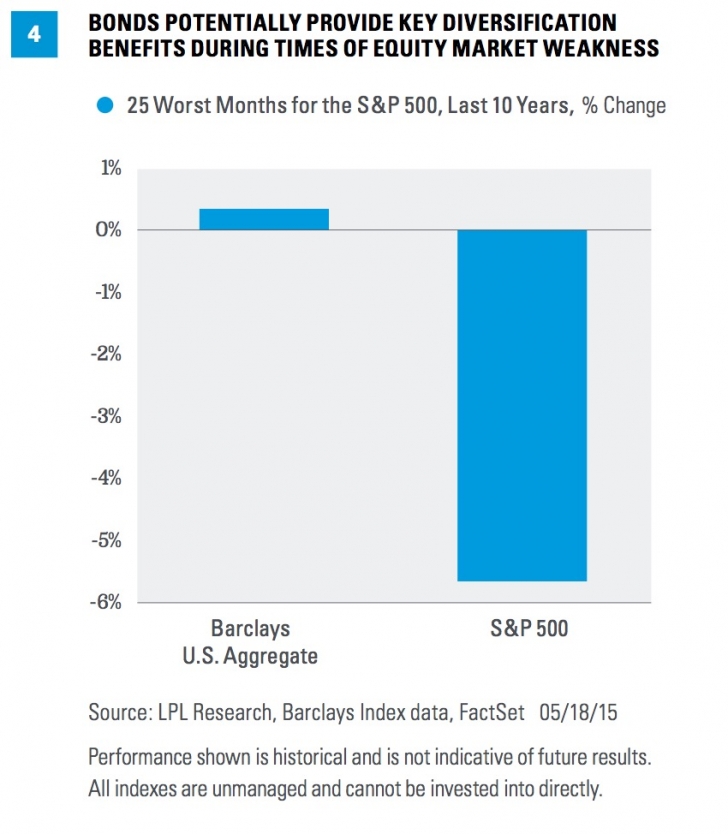

Even at lower yields, bonds can still provide important diversification benefits. Although the last few weeks serve as a reminder of why we remain cautious, with a lower than benchmark allocation of bonds, we are maintaining exposure to high-quality intermediate bonds. Stocks, as measured by the broad S&P 500 Index, have rebounded to reach new all-time highs. But should another downdraft occur, and several modest ones have occurred thus far in 2015, bonds may once again provide a key buffer. Our base case is that a significant stock market correction is unlikely in 2015, but in the event one occurs bonds could potentially help provide protection [Figure 4].

Even at lower yields, bonds can still provide important diversification benefits. Although the last few weeks serve as a reminder of why we remain cautious, with a lower than benchmark allocation of bonds, we are maintaining exposure to high-quality intermediate bonds. Stocks, as measured by the broad S&P 500 Index, have rebounded to reach new all-time highs. But should another downdraft occur, and several modest ones have occurred thus far in 2015, bonds may once again provide a key buffer. Our base case is that a significant stock market correction is unlikely in 2015, but in the event one occurs bonds could potentially help provide protection [Figure 4].