“Beware of false knowledge; it is more dangerous than ignorance” George Bernard Shaw

My own ignorance has been bothering me this week. I have had the good fortune to engage with some very smart people on Twitter on both finance and other topics and find myself frequently disappointed in my own lack of knowledge, surrounded as I am by ‘experts’. That said, I’m happy to display my ignorance in the hope of self-improvement, which is something I sense many tweeters are not prepared to do.

As a fiduciary, having a clear understanding of the limits of your own knowledge is essential, but perhaps not as common as one would hope. A combination of hubris and over-confidence can lead to poor decision-making as admitting 'I don’t understand’ is difficult when you have been hired on the basis of your experience and expertise. Fiduciaries should embrace stupid: ignorance can be a valuable tool.

In an industry of specialists where even the most junior are frequently too embarrassed to admit to gaps in their knowledge, I was lucky enough to work for a very talented analyst who was very comfortable with being 'stupid’. His humble approach frequently led CEOs, CFOs and rating agency analysts into over-sharing as they tried to 'help’ the ingénue. I try to emulate his approach, not trying to impress with what I know but to convince others to help me learn.

This approach is invaluable as an allocator. When meeting with a broad range of managers it is common to be blinded by science, bombarded with technical terms that might be outside your frame of reference. Some allocators don’t ask the questions that they really need answering for fear of appearing foolish and losing the respect of the manager: they are after all there to assess his ability to manage money, so they should understand what he does already, right? By shying away from obtaining a full understanding of the business for reasons of ego and hubris they are neglecting their fiduciary responsibility and may end up making poor allocation decisions based on partial information.

Allocators by definition cannot be experts in all of the strategies in which they invest, but they need to understand 'enough’. Where 'enough’ lies rather depends on the individual, and the culture of their firm.

I favour a very simplistic principle of not investing in anything I don’t understand, no matter how appealing the returns or how sought-after the manager. It may sound obvious but in an environment of benchmarking it is easy to get caught up in chasing returns and hard to resist the pull of the fund which is about to 'hard-close’ or the hot new manager who used to work for Moore/Soros/Brevan* (*delete as applicable). Conversely if the investment manager himself is not keen to help an investor understand and fully engage with what he is doing then alarm bells should start ringing. Consider the mortgage fund manager who refused to explain his re-REMIC allocation because 'investors don’t usually ask, they just look at the returns’ and 'you wouldn’t understand’. Similarly I met a marketer who couldn’t explain why the return profile of the fund he was pushing that ostensibly pursued a split-strike conversion strategy looked nothing like one would expect. Two short meetings, two bullets dodged.

‘Stupid’ questions aren’t necessarily if they get you information you wouldn’t obtain any other way. Embrace your ignorance and you might get more than you expect.

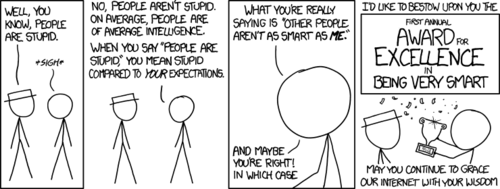

Thanks to xkcd.com

Copyright © Notes From the Hedge