by Ben Carlson, A Wealth of Common Sense

I read plenty of stories in the financial media about the coming retirement crisis, but I see far fewer people willing to offer legitimate solutions to the problem of under-saving by the majority of Americans.

Legendary author and investor Charley Ellis put out a book at the end of last year — Falling Short: The Coming Retirement Crisis and What to Do About It — that outlines the issues many are going to face when it comes to keeping up their standard of living in retirement. But the book also offers some solutions for those dealing with this problem.

Ellis laid out the four most important factors that help determine whether or not you’ll have a large enough nest egg to cover your living expenses during retirement:

1. Earnings. The higher our earnings, the smaller the proportion provided by Social Security and the higher our own required saving rate.

2. Age when saving starts. The earlier we start saving, the lower the required rate of saving needed for any given retirement age.

3. Age at retirement. The later we retire, the lower our required saving rate.

4. Rate of return. The higher the rate of return on our investments, the lower our required saving rate.

We have varying degrees of control over each of these. People have the power to earn more money by enhancing their career prospects. The age in which you retire could be affected by poor health or employment issues that force people to retire earlier than they would like, so this one is a toss-up. And no one has any control over the financial market returns that the markets offer (although people do control how much of those returns they earn).

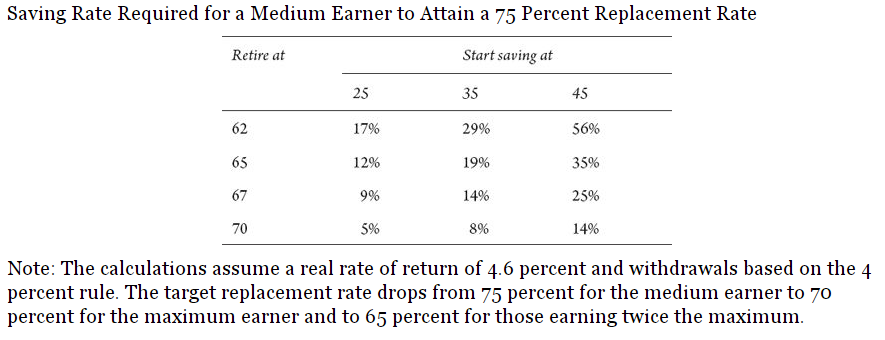

Out of the four, the second option — the age when saving starts — is the one people have the most control over. Ellis goes on to outline a study that shows just how important this one can be over time as you can see the different savings rates required depending on the start and end dates:

The conclusion of the study sums this up nicely (emphasis mine):

Starting to save at age 25, rather than age 45, cuts the required annual saving rate by about two-thirds. And delaying retirement from age 62 to age 70 reduces the required annual saving rate by more than two-thirds— from 17 percent to 5 percent (or 29 percent to 8 percent for those who start at 35, or 56 percent to 14 percent for those who start at 45.) Taken together, starting at 25 and working to 70— compared to starting at 45 and retiring at 62— reduces the required annual saving rate by a factor of 10!

This simple example shows how the power of compound interest can provide the majority of the heavy lifting for you if you’re able to use it to your advantage. William Bernstein shared a similar stat in his book, The Investor’s Manifesto (again emphasis mine):

Each dollar you do not save at 25 will mean two inflation-adjusted dollars that you will need to save if you start at age 35, four if you begin at 45, and eight if you start at 55. Since a 25-year-old should be saving at least 10% of his or her salary, this means that a 45-year-old will need to save nearly half of his or her salary.

You could play around with the rates of return and savings rates in these simulations, but the conclusion is clear that starting to save money at an early age is one of the best things you can do to build wealth. It allows you to save less money overall and lowers the burden on your future self so you aren’t forced to scramble to play catch-up later in life.

One of the best ways to get useful financial advice is to ask those who are older than you what they wish they would have done at your age. A recent study from Wells Fargo did just that. Three out of four survey respondants 40 years of age or older said their biggest financial regret is that they didn’t start saving money eariler. Yet of the non-retirees in that group, more than half said they are still waiting to ramp up their current savings rate to make up for the shortfall. They know where they went wrong, but they still can’t bring themselves to correct the mistake.

As with most financial habits, knowing what you need to do is the easy part. Following through with it is where most people run into trouble.

Sources:

Falling Short: The Coming Retirement Crisis and What to Do About It

The Investor’s Manifesto

Further Reading:

When Saving Trumps Investing

A Simple Way to Reduce Portfolio Risk

Subscribe to receive email updates and my quarterly newsletter by clicking here.

Follow me on Twitter: @awealthofcs

Copyright © Ben Carlson, A Wealth of Common Sense