by Greg Guenther, The Midnight Trader

For the past couple of weeks, every media outlet in the financial world has been trying to one-up the other with the zaniest Chinese stock market story possible.

My absolute favorite critique of the raging Chinese bull thus far is that these so-called traders are buying stock tip sheets on the streets of Shanghai for the equivalent of a couple of bucks. And some of these newer traders are *gasp* barely educated.

Here’s Bloomberg:

More than two thirds of new equity investors exited the education system by middle school — which in China means around the age of 15. More than 30 percent exited at age 12 or below. Household wealth for new investors is about half the level of existing investors.

Who said the peasants could try and get in on this rally? These people probably haven’t even had the chance to learn about Efficient Market Theory yet.

Thankfully, we don’t have to deal with this kind of rabble trying to buy stocks here in the U.S. Instead, we have highly educated engineers who quit their jobs in the late 90s to daytrade tech stocks, dentists trying to flip houses for twice what they’re worth ten years later, and lawyers losing six-figures buying the Etsy IPO yesterday.

Here’s the reality of the situation:

China has entered a powerful bull market. Call it a mania. Call it a bubble. Call it whatever you want. They’re buying stocks hand over fist– and no one knows when it’s going to end.

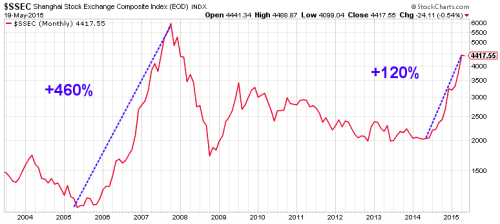

Instead of mocking the rally, let’s take an objective look at a 10-year chart of the Shanghai Composite. Note the massive, BRIC-induced boom of 2006-2007 that shot the index up 460%. Then look at the next six years:

After a short-lived recovery in early 2009, Chinese stocks just drifted lower. For years. It’s been decades since we’ve seen market stagnation like that here in the U.S.

So why is it so surprising that the Shanghai has popped about 120% since it broke out of its big coil last year? Why are we so shocked to see an endless parade of new speculators from a nation of nearly 1.4 billion people just as the Chinese government lifts a few key trading restrictions?

If the Shanghai doubled again over the next 12 months, would that really be the craziest thing to happen to world market over the past five years? Please.

I’m not saying it’s going to happen. And to be clear, I’m not saying this boom will continue without (at the very least) some heartwrenching pullbacks. But it’s entirely possible that this monster continues to grow.

So you have a choice.

You can sit around and smugly deride every limit-up move in Chinese stocks for the next month, 6 months, 3 years or however long this thing lasts.

Or you can admit your MBA doesn’t magically shield you from the emotional rollercoaster of investing– and that you’re not smarter than the Chinese stock market.

—

Follow me on Twitter

Photo by 2 Dogs

Copyright © The Midnight Trader