KEY TAKEAWAYS

- Intermediate to long-term Treasury yields increased by 0.01% to 0.11% for the week ending April 24, 2015, despite weaker economic data.

- Fed rate hike expectations reached their most market-friendly point.

- Rate hike expectations remain notably below the Fed’s recently reduced rate forecasts by a roughly 50% margin over the next three years.

by Anthony Valeri, Investment Strategist, LPL Financial

Cross Currents

Cross currents continue to push and pull the bond market, leaving bond prices and yields range bound ahead of another Federal Reserve (Fed) meeting and key batch of monthly economic reports. Intermediate to long-term Treasury yields increased by 0.01% to 0.11% for the week ending April 24, 2015, despite weaker economic data. U.S. manufacturing activity, as measured by the preliminary Purchasing Managers’ Index (PMI) surveys, decelerated in April 2015, disappointing hopes for a second quarter rebound, and PMIs across Europe, and in China, fell short of expectations. In contrast, reduced fears of an immediate Greek default and better corporate earnings news caused investors to turn their attention once again to riskier investments and away from high-quality bonds.

WHAT’S PRICED IN

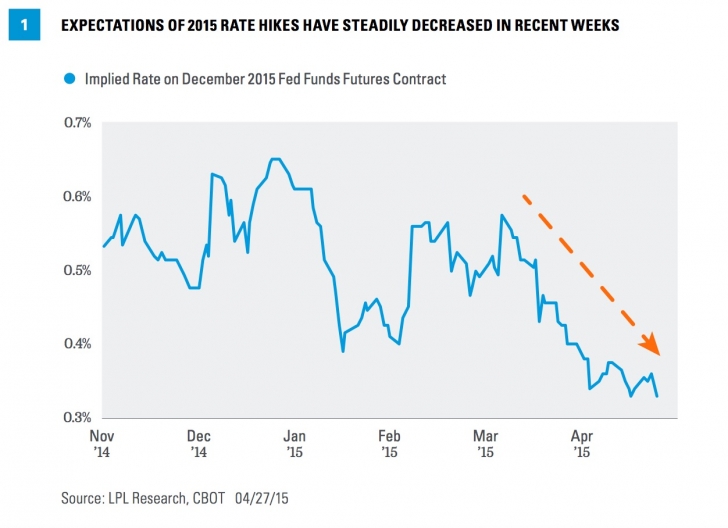

Fed rate hike expectations reached their most market-friendly (dovish) point yet as of Monday, April 27, 2015. Despite fluctuations in intermediate to long-term Treasury yields, the implied yield on the December 2015 fed fund futures contract, a good market-based gauge of how much the Fed may raise rates in 2015, has steadily decreased since early March [Figure 1]. The declining yield reflects a falling probability of Fed rate hikes in 2015. In fact, the December 2015 fed fund future no longer reflects that a rate hike in 2015 is a certainty. The implied rate by December is 0.33%, below the 0.38% rate representing the midpoint of a 0.25–0.50% range (versus 0–0.25% currently). While it still suggests a high probability of a first rate hike at the conclusion of the December Fed meeting, it now reflects some doubt. A first rate hike is not fully priced in until January 2016, according to futures.

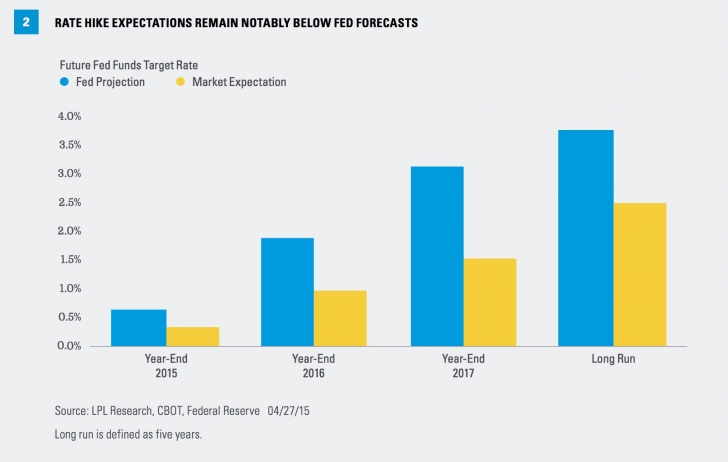

Looking more broadly beyond the end of 2015, the bond market largely expects a more benign Fed [Figure 2]. Rate hike expectations remain notably below the Fed’s recently reduced rate forecasts by a roughly 50% margin over the next three years. In other words, futures have priced in a lot of good news about a friendly Fed, taking away a potential upside catalyst.

LOOKING FORWARD

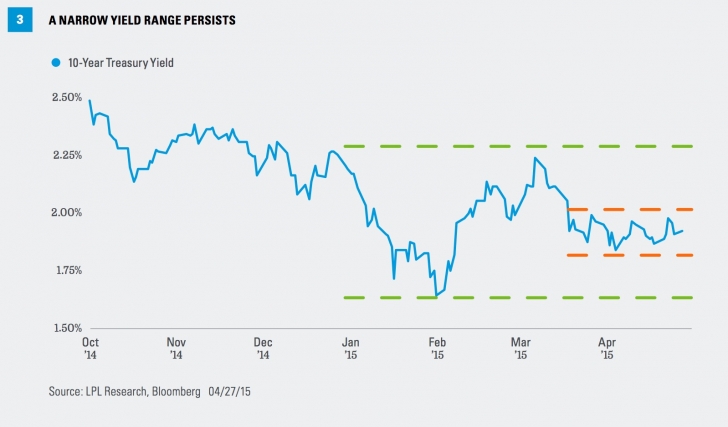

Although Fed rate hike expectations have declined, 10- and 30-year Treasury yields have been range bound. Longer-term Treasuries are more influenced by economic growth and inflation expectations, with Fed interest rate expectations playing a lesser role.

Of course, the other side of the coin of a more market-friendly Fed is better future growth and potentially higher future inflation that may result from the Fed remaining on hold for longer. Both economic growth and inflation expectations are primary drivers of longer-term Treasuries. Several factors aside from Fed expectations influenced a modest rise in 10- and 30-year Treasury yields, including:

· Better economic data from Europe. German business optimism recently reached a new high and first quarter 2015 economic growth expectations for the Eurozone have increased. This former threat to global growth appears to be turning the corner.

· Improving earnings in Europe. Like the U.S., earnings reporting season is underway in Europe and results have been positive with most companies exceeding expectations. First quarter earnings news follows lackluster earnings over recent quarters.

· Better U.S. earning results. With 40% of S&P 500 companies reporting thus far, earnings are on track for a lesser deceleration of -1.0% versus a -3.0% expectation just a few weeks ago. Better earnings results, along with oil price stabilization and fading U.S. dollar strength, have improved hopes for better earnings over the second half of 2015.

· Positive news on Greece. News that the cash crunch in Greece was not as dire as previously thought, and a more constructive stance toward a potential resolution from the Greek government, appeared to alleviate market fears. However, a Greek default remains a risk and at best Greece may have simply bought more time.

All the factors above appeared to outweigh weaker domestic economic data, at least last week, as higher long-term bond yields reflected a nod by investors to improvement over the balance of 2015. However, expectations of a second quarter bounce back remain uncertain and a weak reading on domestic business investment last week led to reductions in first quarter economic growth expectations, as measured by gross domestic product (GDP). Consensus forecasts for first quarter GDP now stand at 1.0%.

Signs of a second quarter bounce back remain elusive and the path of improvement remains unclear, helping to keep longer-term Treasury yields range bound. The 10-year Treasury yield has been in a narrow range for the past four weeks [Figure 3]. Although yields are still lower on a year-to-date basis, they remain confined to a larger range that began in late 2014. Stabilization in oil prices, a halt in U.S. dollar strength, and better news out of Europe have exerted upward pressure on yields, but not enough to break free of the current range. Yields may remain range bound until the paths of second quarter 2015 economic growth and the Fed become clearer.

Speaking of the Fed, this week’s Fed meeting on April 28–29, 2015, may not provide much insight for investors. (For more on the upcoming FOMC meeting, see our April 27, 2015, Weekly Economic Commentary, “A Weak Week?”) No press conference or updated forecasts follow this meeting and the Fed has already ruled out a rate hike. Investors may have little to go on. The extent to which the Fed acknowledges the slowdown in first quarter growth, and whether it may persist, will be closely scrutinized, but otherwise the range trade may persist until clarity emerges from top tier economic data, starting with the Institute for Supply Management’s (ISM) manufacturing survey, released Friday, May 1, 2015, and the release next Friday, May 8, 2015, of the April 2015 employment report.

Read/Download the complete report below, or here:

Bond Market Perspectives 04282015

*****

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance reference is historical and is no guarantee of future results. All indexes are unmanaged and cannot be invested into directly.

The economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values and yields will decline as interest rates rise, and bonds are subject to availability and change in price.

Government bonds and Treasury bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

Investing in foreign fixed income securities involves special additional risks. These risks include, but are not limited to, currency risk, political risk, and risk associated with foreign market settlement. Investing in emerging markets may accentuate these risks.

High-yield/junk bonds are not investment-grade securities, involve substantial risks, and generally should be part of the diversified portfolio of sophisticated investors.

INDEX DESCRIPTIONS

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

DEFINITIONS

The Purchasing Managers’ Index (PMI) is an indicator of the economic health of the manufacturing sector. The PMI is based on five major indicators: new orders, inventory levels, production, supplier deliveries, and the employment environment.

The Institute for Supply Management (ISM) index is based on surveys of more than 300 manufacturing firms by the Institute of Supply Management. The ISM Manufacturing Index monitors employment, production inventories, new orders, and supplier deliveries. A composite diffusion index is created that monitors conditions in national manufacturing based on the data from these surveys.

The presidents of regional Federal Reserve Banks are commonly classified as hawks or doves. Hawks generally favor tighter monetary policy, with less monetary support from the Federal Reserve. Doves are the opposite, generally favoring easing of monetary policy.

Copyright © LPL Financial