by Jeffrey Saut, Chief Investment Strategist, Raymond James

Spring has definitely sprung here in Florida as pollen is in the air and raindrops fall on my tin roof with the sound of golf balls. “Tra la! It's May! The lusty month of May! That lovely month when ev'ryone goes blissfully astray,” to steal a line from the play Camelot. But many market pundits are worried about the softening economic reports, prompting me to dredge up my annual missive about the book “Being There” by author Jerzy Kosinski. The story revolves around a simple-minded man named Chance “the gardener,” who knows only gardening and what he sees on television. For his whole adult life Chance has not ventured outside the grounds of his employer’s Washington D.C. manor. Eventually, however, the employer dies and Chance is cast out onto the streets, where through an auto mishap he encounters the wife of a D.C. powerbroker. Thinking her car was the reason for the accident, she insists that Chance “the gardener,” who she interprets to be Chauncey Gardiner, comes with her to her husband’s estate. Benjamin Rand (the husband) is completely taken with Chauncey’s simple, direct approach, and mistakenly attaches profundities to Chauncey’s ramblings about gardening. Viewing him somewhat as a savant, Rand introduces Chauncey to Washington’s elite, including the President. In one verbal exchange regarding the current economic conditions Chauncey remarks, “As long as the roots are not severed there will be growth in the spring.”

Well, it’s spring, yet this year instead of the typical cries of “As long as the roots are not severed there will be growth,” many Wall Street pundits are worried. Yet, I am feeling rather confident that as the weather warms “there will be growth.” To be sure, it appears there is huge pent up demand as the folks above the 40ᴼ N latitude, and given the extent of the wicked winter and maybe as low as above the 30ᴼ N latitude, are going to go on a spending spree as the weather warms. Also impacting the economic reports is the negative impact from the longshoreman’s strike in Los Angeles. Accordingly, I remain fairly confident the economic stats will improve in the months ahead. Jeffrey Rosenberg is BlackRock’s Chief Investment Strategist for Fixed Income, and he seems to agree and says so in this missive:

Don’t count out the U.S. economy just yet. While it’s true that economic performance in the U.S. broadly disappointed in the first quarter — with the exception of jobs data — temporary factors such as colder than seasonally anticipated weather, as well as the West Coast ports shutdown and the collapse in oil-related investments presented one-off events that temporarily depressed output in the quarter. But this pattern of weak first-quarter data has been the case for most of the past five years. Average gross domestic product (GDP) has come in at just 0.6% in the first quarter from 2010 to 2014, substantially lower than in other quarters (2015 first-quarter GDP will be unveiled on April 29). So, lower bond yields in March and April have come in an environment of steadily disappointing economic data. And, in that environment, the Federal Reserve’s more dovish communication furthered expectations for a more benign interest rate environment. However, investors should be careful not to read too much into these latest developments.

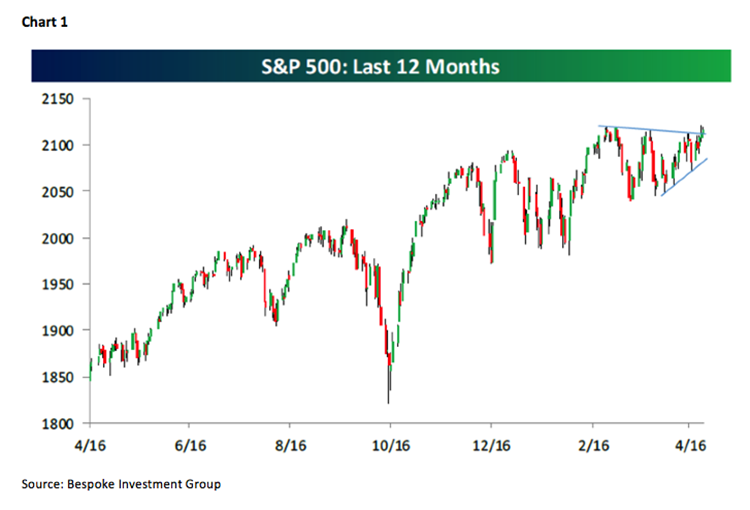

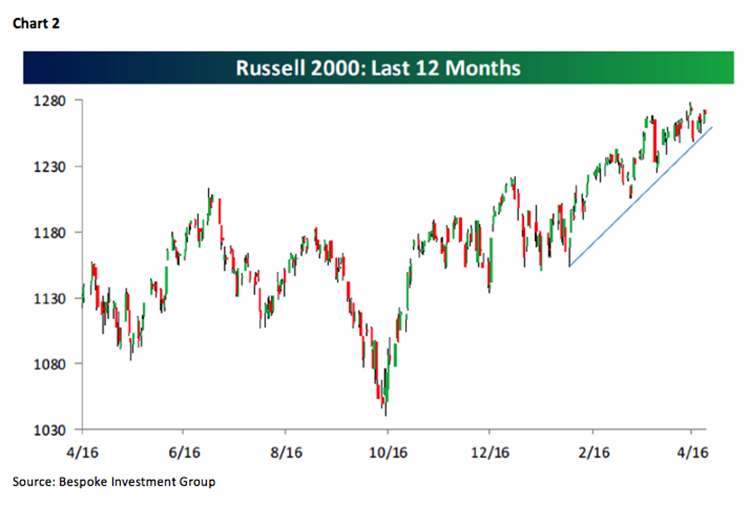

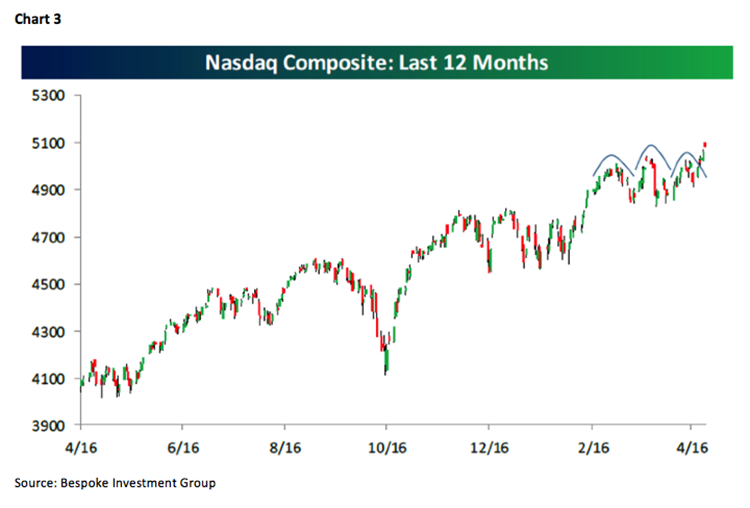

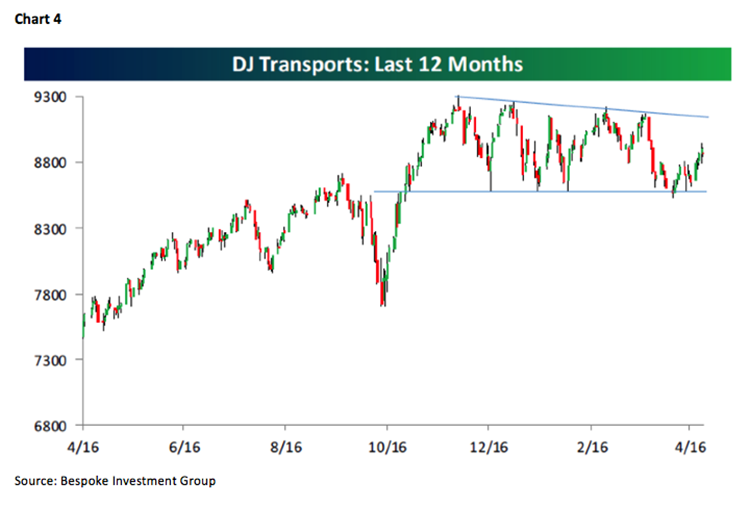

“As long as the roots are not severed there will be growth in the spring;” and, I believe that will be the case this year. Just maybe the equity markets “sniffed” that out last week as the S&P 500 (SPX/2117.69) broke above the downtrend line that has been a months in the making (see chart 1 on page 3) and is very close to trading out to new all-time highs (above 2120). Ditto the market-leading, small-cap/growth-stock-peppered Russell 2000 (RUT/1267.54), which we have repeatedly suggested should not be acting so perky if the stock market was about to turn nasty (chart 2). It is, however, somewhat of a head-scratcher that more than 30% of the small caps are down 20% or more from their highs. Then there is the tech-heavy NASDAQ Composite (COMPQ/5092.08), which after 15 years has finally made a new all-time high and in the process destroyed the “Bear Boo’s” argument that a market-killing head-and-shoulders top was in place (chart 3). Even the troublesome D-J Transportation Average (TRAN/8880.17) has bounced off its spread quadruple bottom and rallied 4.13% from its intraday low of April 4th, and gained an eye-popping 2.69% last week (chart 4). While I suspect there are numerous reasons for last week’s 1.75% S&P spurt, my hunch is it was the better than expected earnings. Verily, so far 66.5% of the companies that have reported have topped expectations, but the bears will be quick to point out only 52.3% have bested revenue estimates. To counter their argument, I would note both of those numbers are up from the previous week’s 63.7% (earnings) and 42% (revenues), respectively.

Speaking to earnings, the good folks at the invaluable Bespoke Investment Group publish their “Triple Plays” every earnings quarter. That would be companies that have beaten earnings and revenue estimates and raise forward earnings guidance. In last week’s list there were three companies from Raymond James’ research universe that look good on our algorithms and are favorably rated by our fundamental analysts. They are: Aaron’s (AAN/$32.80/Outperform), Monolithic Power Systems (MPWR/$49.96/Outperform), and Manhattan Associates (MANH/$54.90/Strong Buy).

Last week of the 13 economic reports that were released nine came in below estimates as the string of softer figures continued. This week the markets are going to have to contend with a pretty punk GDP report. The expectation is for 1% GDP growth, but it would not surprise to see something shy of that. Private sector GDP is expected to rise by 1.8% and government spending is anticipated to slow by 3%. The IMF growth estimations are much higher with 3.5% global growth still expected, while the IMF lowered U.S. growth estimates from 3.5% to 3.1%. This week there will be 28 economic releases, but obviously the 1Q15 Advance GDP report will be the most important. I expect many of them to be on the softer side, but I think that changes with the “lusty month of May.”

Last week I gave a keynote speech at our Raymond James Financial Services national conference. While there were many topics discussed, the main topic was about the secular bull market we are in and how that becomes a state of mind as the various stages unfold. Due to space constraints I don’t have time to go into all of them, but suffice it to say I think we are at the Guarded Optimism stage with Enthusiasm, Exuberance, and Unreality yet to come before the secular bull market is over.

The call for this week: In last Monday’s strategy report I wrote, “My colleague Andrew Adams and I are in Las Vegas to deliver a keynote address at Raymond James Financial Services’ National Conference. If past is prelude, something impactful will happen in the equity markets in our absence.” Well, last week something impactful did happen, the NASDAQ Composite made a new all-time closing high and the SPX made a new intraday all-time high. Surprisingly, of the 10 S&P Macro Sectors, only the Consumer Discretionary sector made a new all-time high, implying somebody other than me believes this consumer-centric economy is going to improve. Unsurprisingly, two other sectors are close to achieving new all-time highs, namely Healthcare and Information Technology. This morning the preopening S&P futures are marginally high (+4.5) as the sun rises over the transom of my boat on no news, begging the question, “Breakout, or fake out?” I think it is an upside breakout, but it would be classic to see a pullback into the 2090 to 2100 zone before a move higher.

Copyright © Raymond James