Q1/15 Market Recap

by Ryan Lewenza, CFA, CMT, Private Client Strategist, Raymond James

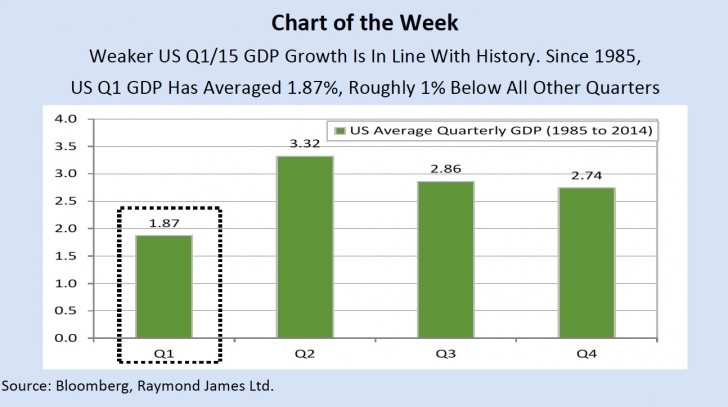

• The North American economy experienced a clear downshift in economic activity over the first quarter. In the US, manufacturing and exports were hurt by the stronger dollar, while in Canada economic growth was impacted by weak oil prices. Extreme weather conditions also likely weighed on activity during the quarter. As a result, expectations have fallen significantly with consensus estimates for CAD/US Q1/15 growth declining from 2.3% and 2.8%, respectively, to roughly 1% for both countries.

• Europe rebounded in Q1 with the weaker Euro and European Central Bank (ECB) stimulus providing a boost to the economy. Europe’s Purchasing Managers Index (PMI) rebounded from 50.6 in December to 52.2 in March, and industrial production bounced back in the quarter.

• Growth in the emerging markets (EM) continued to weaken with Brazil, Russia and China all seeing slower economic activity.

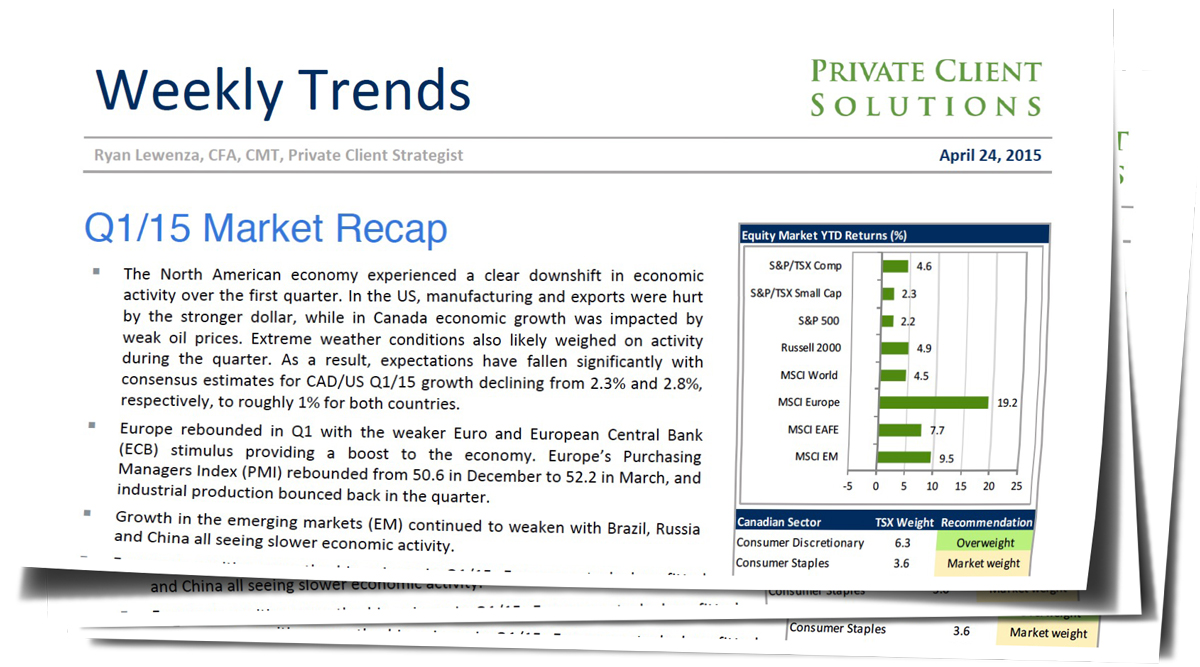

• European equities were the big gainers in Q1/15. European stocks benefitted from improving economic momentum and ECB stimulus. This helped propel Germany’s DAX and the Euro Stoxx 50 up 22% and 17.5%, respectively.

• The S&P/TSX Composite (S&P/TSX) was up 1.8% in the quarter, outperforming the S&P 500 Index (S&P 500) by 1.4%. Despite the better performance from the S&P/TSX in Q1/15, we still see the S&P 500 outperforming in 2015. One key factor supporting this call is the stronger earnings profile for the S&P 500 relative to the S&P/TSX.

Read/Download the complete report below: