Breaking Up is Hard To Do

KEY TAKEAWAYS

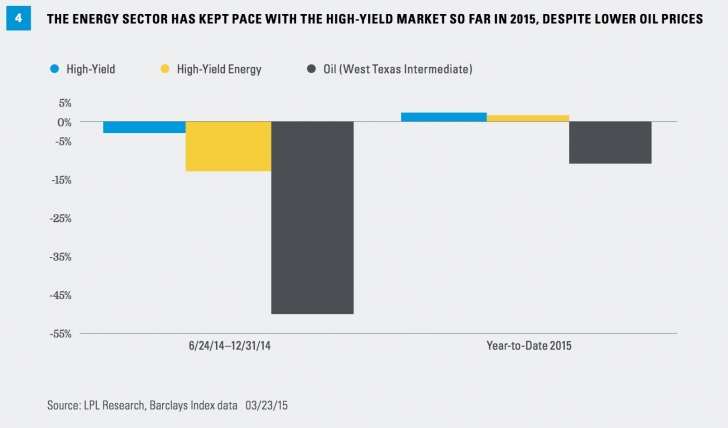

• The high-yield energy sector has kept pace with the broader high-yield bond market in 2015 even as oil prices weakened, a notable difference from 2014.

• Although we don’t believe the high-yield bond market will return to the June 2014 peak, the current yield spread may still represent good value given still strong corporate fundamentals and low defaults.

by Anthony Valeri, Investment Strategist, LPL Financial

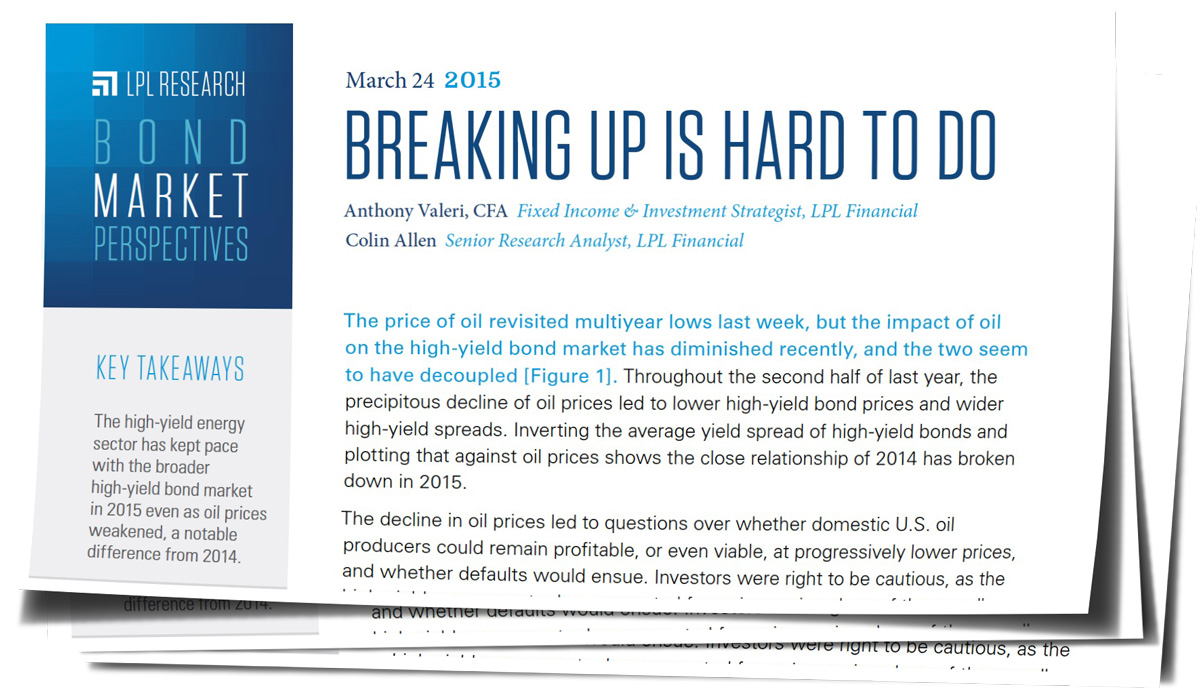

The price of oil revisited multiyear lows last week, but the impact of oil on the high-yield bond market has diminished recently, and the two seem to have decoupled [Figure 1]. Throughout the second half of last year, the precipitous decline of oil prices led to lower high-yield bond prices and wider high-yield spreads. Inverting the average yield spread of high-yield bonds and plotting that against oil prices shows the close relationship of 2014 has broken down in 2015.

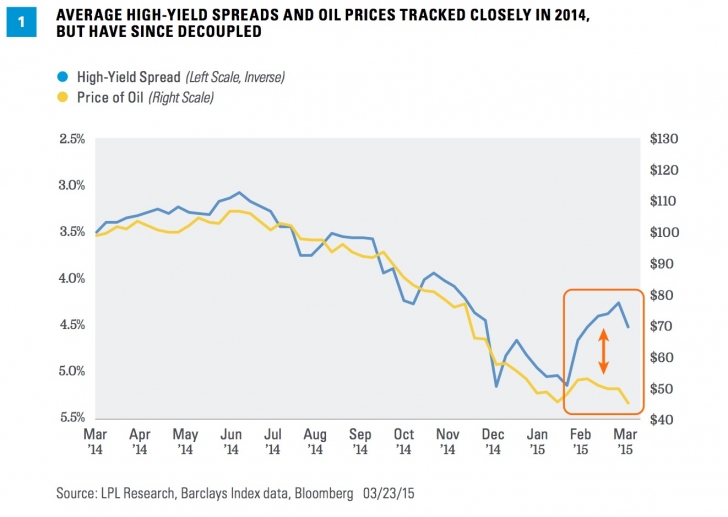

The decline in oil prices led to questions over whether domestic U.S. oil producers could remain profitable, or even viable, at progressively lower prices, and whether defaults would ensue. Investors were right to be cautious, as the high-yield energy sector has accounted for an increasing share of the overall high-yield bond market, growing to 15% from 5% over 10 years [Figure 2]. However, at one point in December 2014, average high-yield bond prices implied defaults of 90% of CCC-rated (or lower) high-yield energy issues and widespread defaults across the energy sector, not just the lower-rated tiers.

The fears over mass defaults have not materialized. Through March 23, 2015, only one company with publicly traded debt, Quicksilver Resources, has filed for bankruptcy and is likely to be the first default resulting from the decline in oil prices. Energy company defaults may increase over 2015, but so far energy companies have managed and, where needed, been able to obtain financing outside of fickle financial markets.

The fears over mass defaults have not materialized. Through March 23, 2015, only one company with publicly traded debt, Quicksilver Resources, has filed for bankruptcy and is likely to be the first default resulting from the decline in oil prices. Energy company defaults may increase over 2015, but so far energy companies have managed and, where needed, been able to obtain financing outside of fickle financial markets.

DECOUPLING

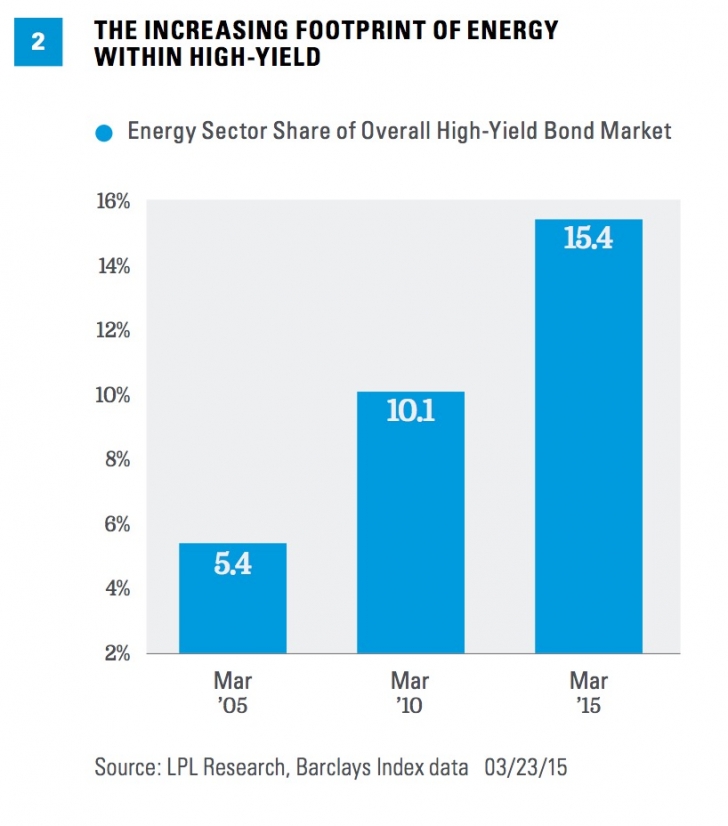

The decoupling may reflect investors’ acknowledgment that the fears over high-yield energy defaults may have been overblown. Another way to observe the breakdown in the relationship of high-yield bonds and oil prices is the falling correlation between the two. In 2014, the price of oil was almost perfectly negatively correlated with high-yield bond spreads (correlation measures the degree to which investments move with or opposite one another). The correlation was a -0.94, meaning the two moved in inverse lockstep with one another. The correlation prior to 2014, and thus far in 2015, has been far less significant. In other words, as oil prices declined, the average yield spread—an indication of risk—increased almost in direct proportion [Figure 3].

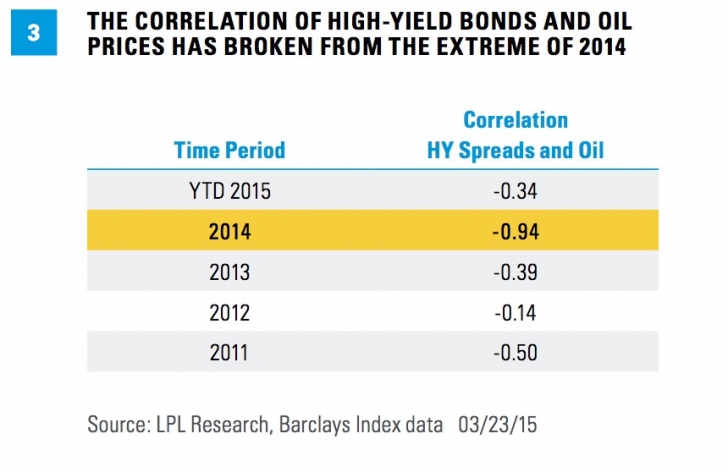

The decoupling is also visible in total returns. Both the broad high-yield bond market and high-yield energy sector have managed gains despite oil prices having declined almost 11% so far in 2015. The high-yield energy sector has slightly underperformed the overall high-yield market in 2015, suggesting high-yield is now less sensitive to the price of oil than it was in 2014 [Figure 4].

LOWER FOR LONGER

Last week’s Federal Reserve (Fed) meeting could potentially provide a tailwind for high-yield bonds and other credit-sensitive sectors like bank loans. The Fed sharply cut its forecasts of future overnight borrowing rates, suggesting a later start and slower pace of interest rate hikes. The lower for longer theme is generally supportive of high-yield bonds, as lowering borrowing costs and providing easy access to financial markets may help reduce default risk, a main concern for high-yield investors.

The year-to-date improvement in high-yield bond prices has left the average yield spread at 5% as of March 23, 2015. Although we don’t believe that the high-yield bond market will return to the June 2014 peak, the current yield spread may still represent good value given still strong corporate fundamentals and low defaults.

Although high-yield bonds have begun to decouple from oil prices, oil still represents a risk. If oil prices drop meaningfully below $40/barrel, high-yield bonds and oil prices may resume their close relationship as the market prices in greater default risks. The sharp decline in oil rig counts suggests that excess capacity is being taken offline, which is a sign that oil prices may be in a bottoming process.

Aside from another sharp downturn in oil prices, we believe the influence of oil on the high-yield bond market is diminishing and investors will continue to focus on fundamentals. First quarter 2015 earnings season is still a few weeks away, but we expect the debt servicing ability of high-yield companies to remain strong and keep defaults low. We continue to find high-yield bonds attractive given this positive backdrop and healthy yield advantage to Treasuries.

Read/Download the complete report below or here:

Bond Market Perspectives 03242015

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance reference is historical and is no guarantee of future results. All indexes are unmanaged and cannot be invested into directly.

The economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values and yields will decline as interest rates rise, and bonds are subject to availability and change in price.

Government bonds and Treasury bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

Commodity-linked investments may be more volatile and less liquid than the underlying instruments or measures, and their value may be affected by the performance of the overall commodities baskets as well as weather, geopolitical events, and regulatory developments.

High-yield/junk bonds are not investment-grade securities, involve substantial risks, and generally should be part of the diversified portfolio of sophisticated investors.

DEFINITION

Different agencies employ different rating scales for credit quality. Standard & Poor’s (S&P) and Fitch both use scales from AAA (highest) through AA, A, BBB, BB, B, CCC, CC, C to D (lowest). Moody's uses a scale from Aaa (highest) through Aa, A, Baa, Ba, B, Caa, Ca to C (lowest).

INDEX DESCRIPTION

The Barclays U.S. Corporate High-Yield Index measures the market of USD-denominated, noninvestment-grade, fixed-rate, taxable corporate bonds. Securities are classified as high yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below, excluding emerging market debt.