We normally just comment on the USD Dollar versus the CAD Dollar relationship, but this week for the SIA Equity Leaders Weekly, we are going to look at another important currency relationship that shows the US Dollar's strength and appreciation versus the Euro. We will also take a closer look at a European ETF to see if there are Global Equity additions you may want to consider in light of the weakness in the Euro.

United States Dollar/Euro (USDEUR)

We commented on the USDCAD last week and have kept a very close eye on that relationship, but helping to understand the USDEUR is important as well to see the strength the U.S. Dollar has risen versus other major currencies and its affect as well. Looking at the USDEUR chart, this relationship has risen to new 10-year highs surpassing levels it hasn't seen since 2003.

There was a very strong trend in favor of the Euro from 2002 to the middle of 2008, but this relationship has traded in range bound mostly over the last 5 years until breaking through its long-term downtrend line circled on the chart in late 2014. This trend has continued in favor of the USD upwards towards the first resistance level at $0.9583. Further resistance above this is found around the par value at $0.9973 which would be a dramatic level to hit seeing as just last July it was trading around $0.72/Euro.

Support to the downside can be found around the $0.8939 level and below this at $0.85 should this strength reverse. But with the SMAX score of 10 out of 10 for near term strength in favor of the USD, there are no current indications this relationship is changing right away unless other macro-economic factors come into play or a resistance level above holds.

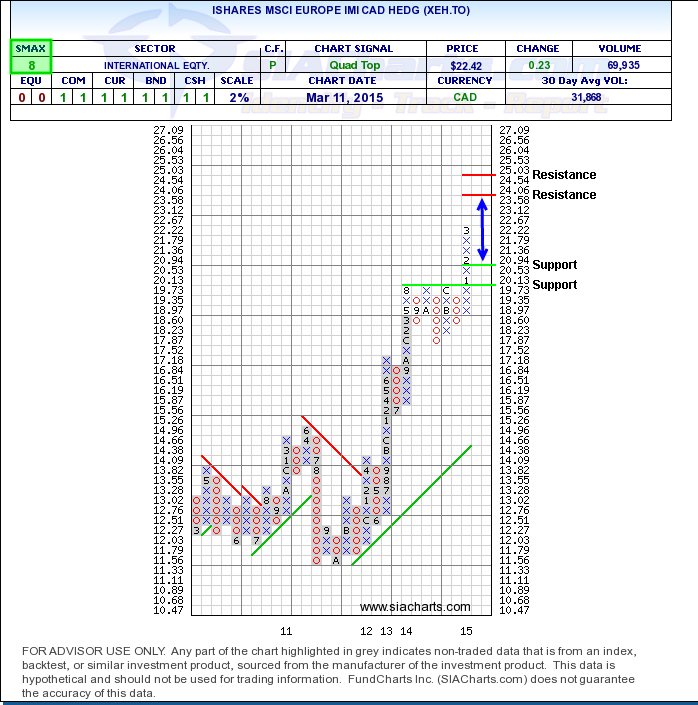

iShares MSCI Europe IMI Index ETF CAD-Hedged (XEH.TO)

So does the Euro currency depreciation affect European ETFs as well? With the weakening of the Euro versus the US Dollar (and to a lesser extent the Canadian Dollar as well), there has been some more strength recently in European ETFs which are priced in USD to start 2015. The iShares MSCI Europe IMI Index ETF (XEU.TO) is up ~13.25% YTD and the Canadian hedged version (XEH.TO) is up ~10.9% YTD so far.

Although these ETFs are relatively new, we can still get a good idea from the index they are following to help us understand potential resistance and support levels. As you can see in the point and figure chart, resistance levels can be seen above around $24.06 and $25.03 should this strength continue for XEH.TO. To the downside, support is found around $20.53. With an SMAX score of 8 out of 10, XEH.TO is showing near-term strength against all asset classes except U.S. Equity, which still ranks higher than International Equity on the SIA Asset Class rankings.

The strengthening of the U.S. dollar against many currencies including the Euro and Canadian dollar is an important relationship to watch. It could lead to some benefits or create threats in your portfolio. By monitoring the hedged and un-hedged versions of ETF's on the appropriate economies we can use relative strength ranking to help make better choices.

Any questions or to learn more about these relationships, Global Equity strength, or other information, please call or email us at 1-877-668-1332 or siateam@siacharts.com.

Click on Image to Enlarge

SIACharts.com specifically represents that it does not give investment advice or advocate the purchase or sale of any security or investment. None of the information contained in this website or document constitutes an offer to sell or the solicitation of an offer to buy any security or other investment or an offer to provide investment services of any kind. Neither SIACharts.com (FundCharts Inc.) nor its third party content providers shall be liable for any errors, inaccuracies or delays in content, or for any actions taken in reliance thereon.

Copyright © SIACharts.com