by Erik Swarts, Market Anthropology

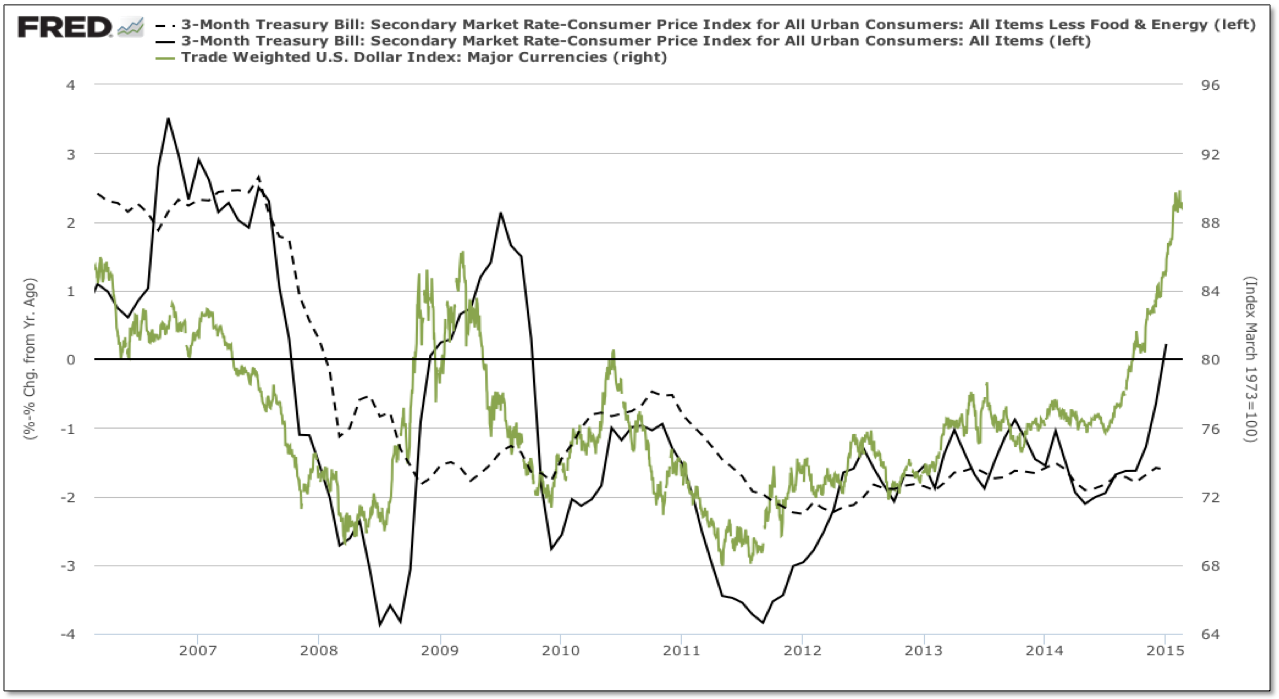

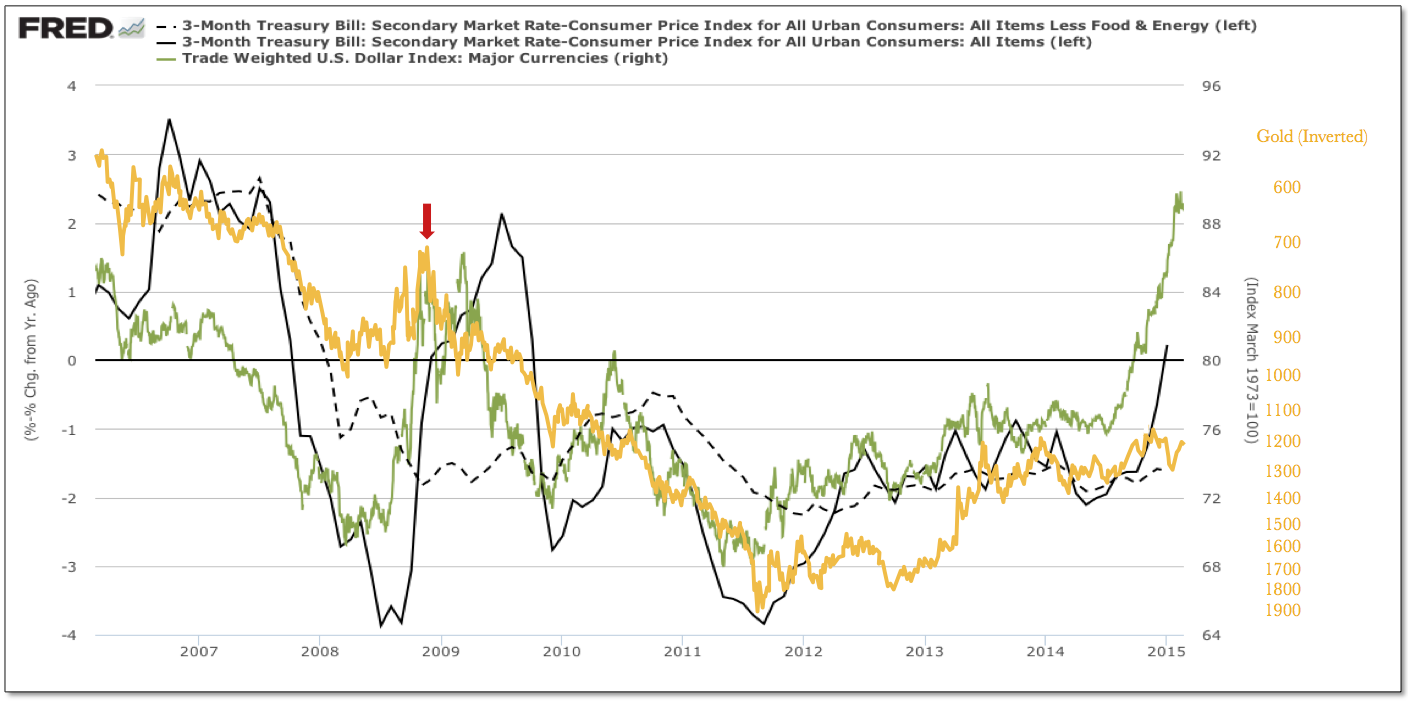

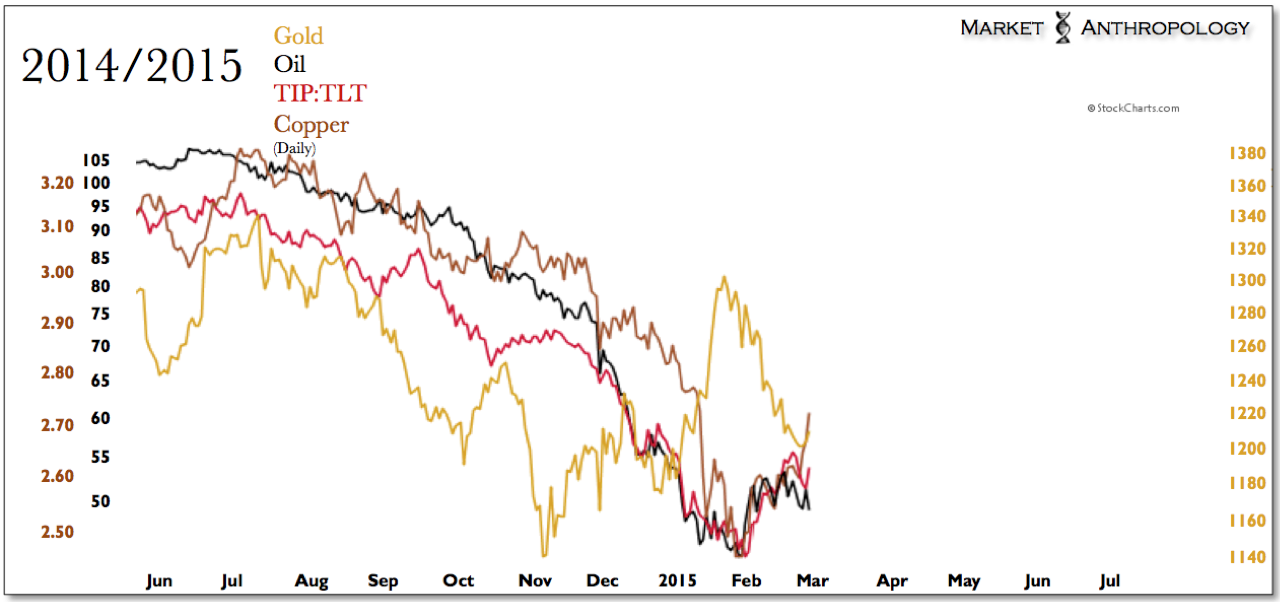

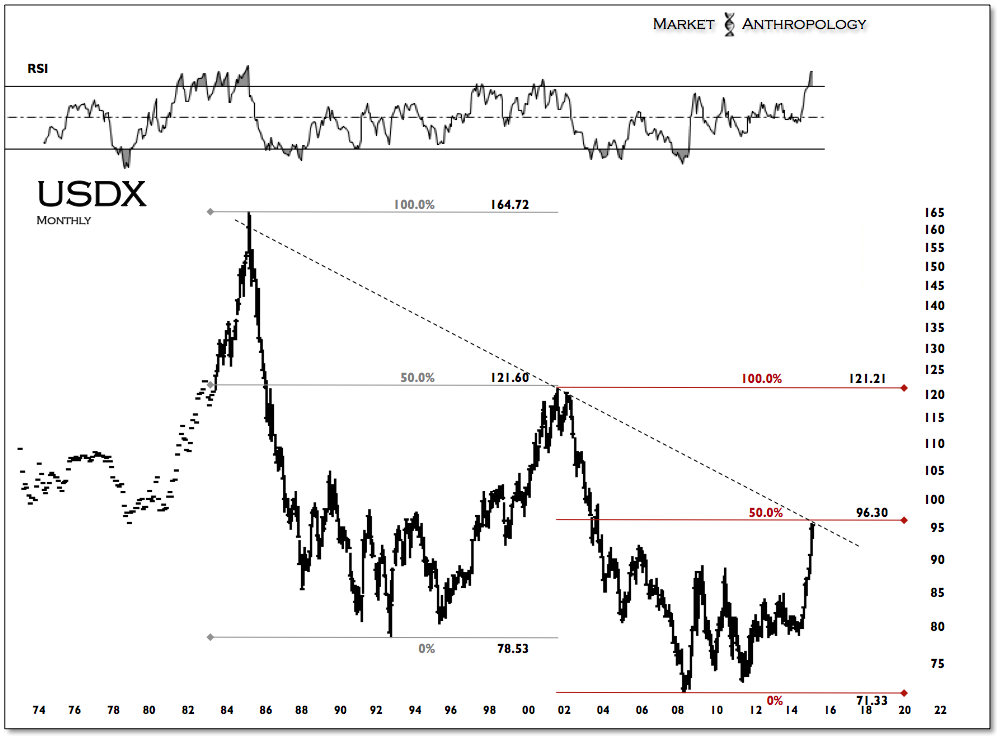

Not surprising - considering the surge in the dollar since last summer, headline CPI for January posted its biggest drop since 2008 yesterday, falling 0.7% in January. Core CPI, however, exceeded expectations and rose 0.2% last month. The chart below that we've shared since last fall, shows 3 month Treasury yields less headline and core CPI (hashed), which has closely trended with the dollar - but with a several month lag. Despite the rise this month in core CPI, we expect to see more soft inflation data as the move in the dollar is further absorbed downstream.

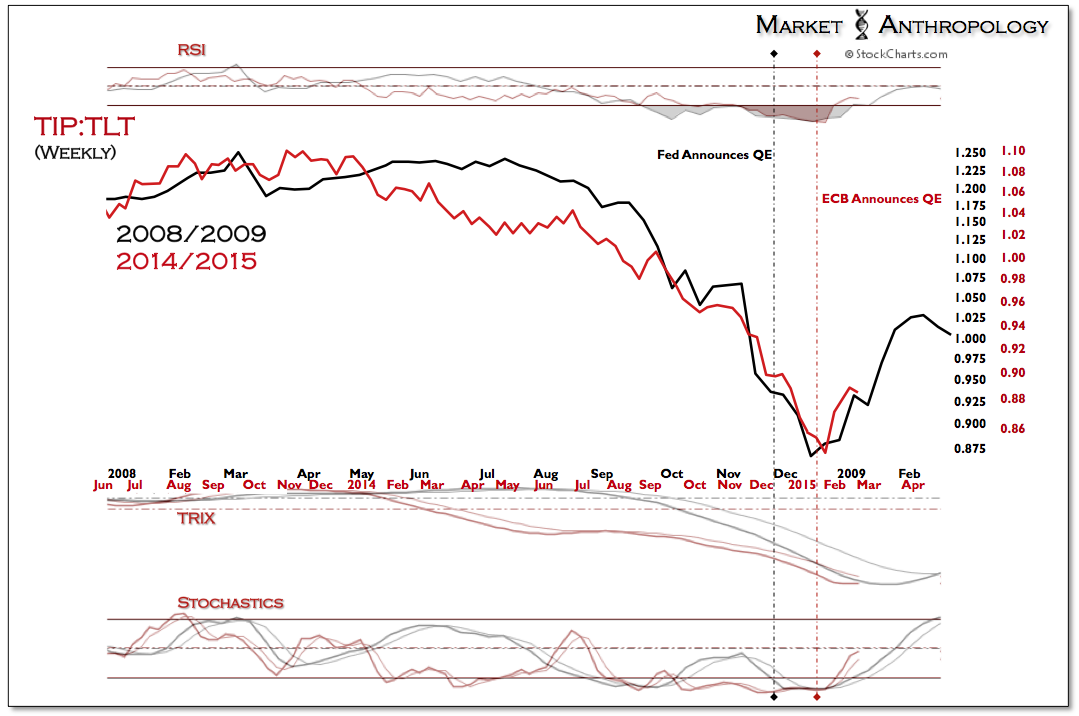

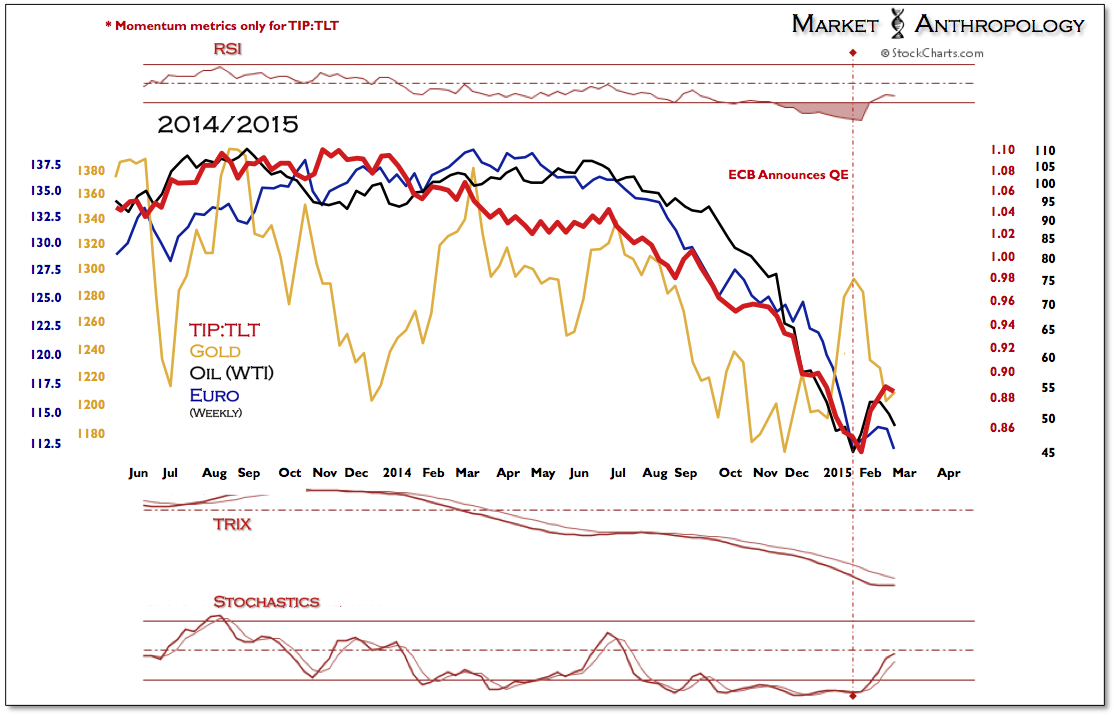

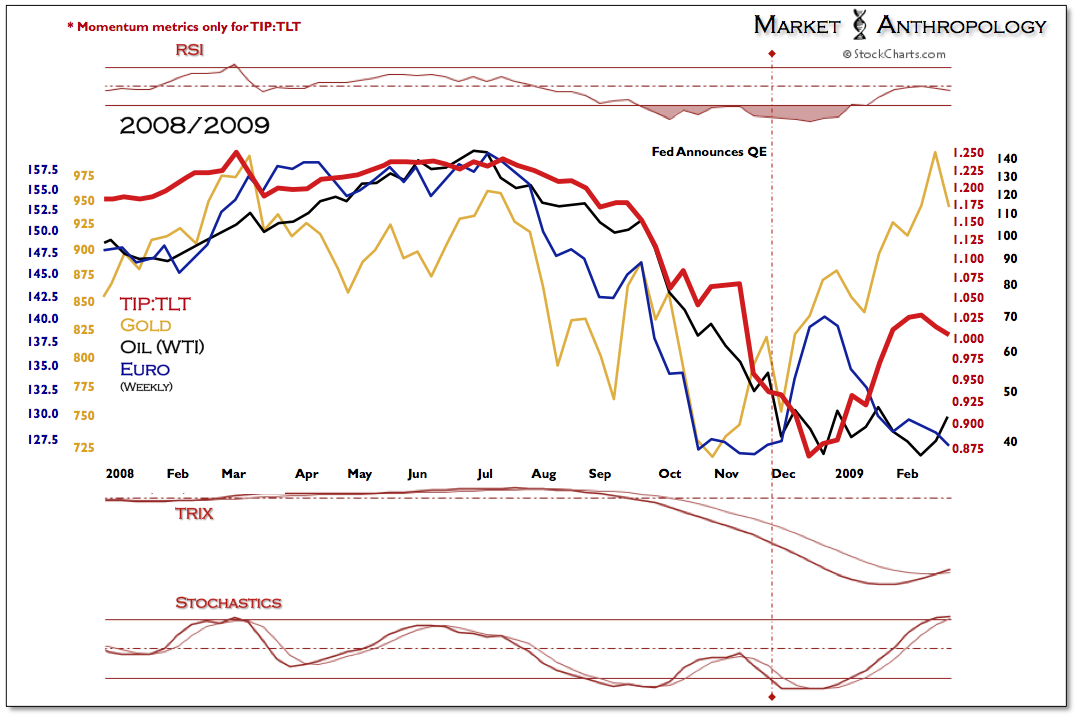

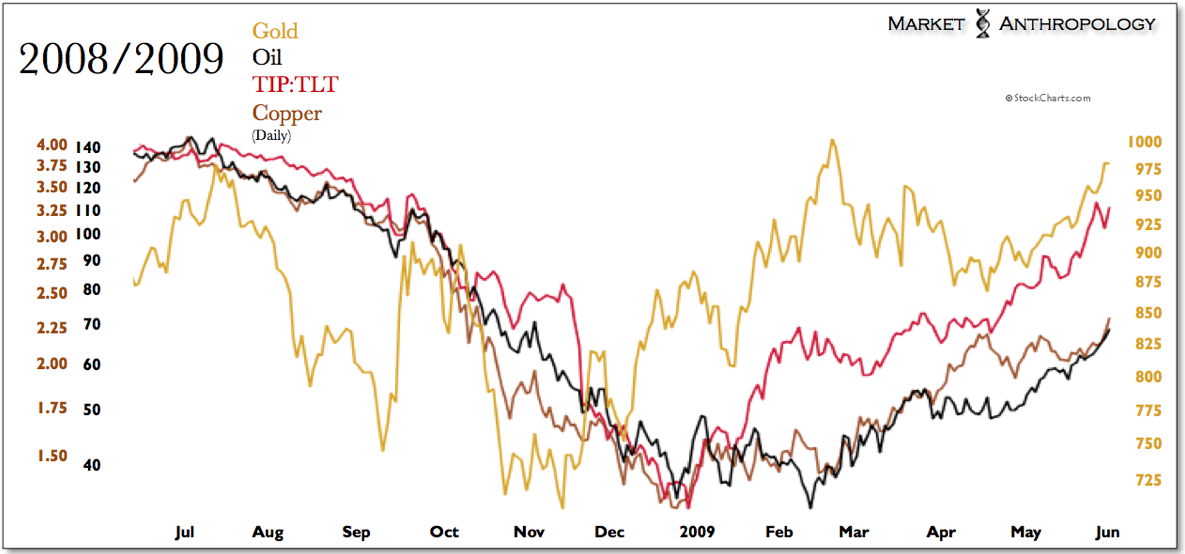

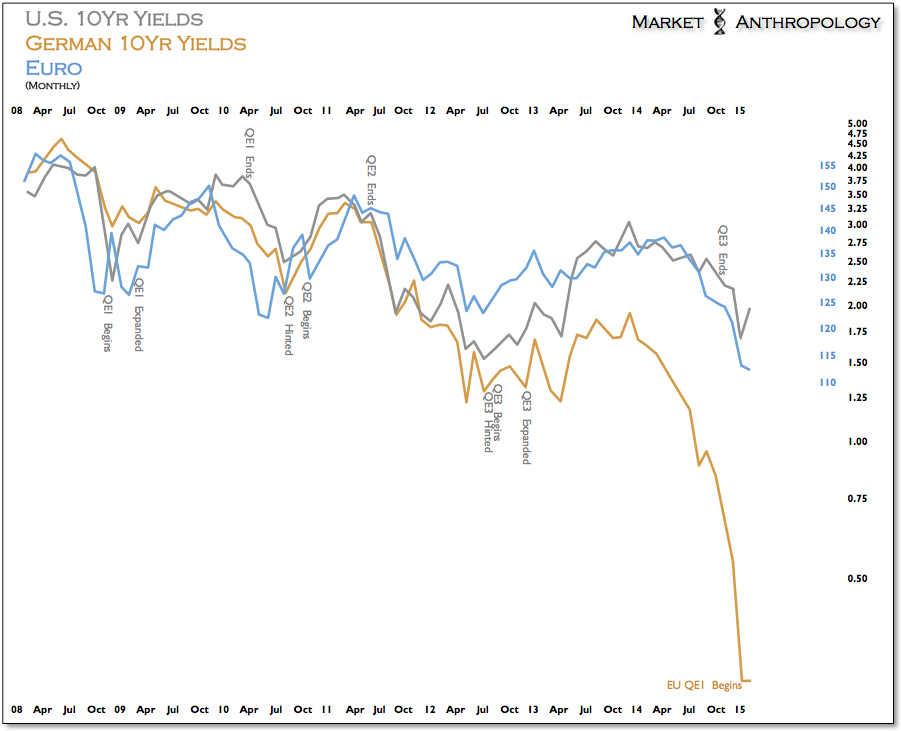

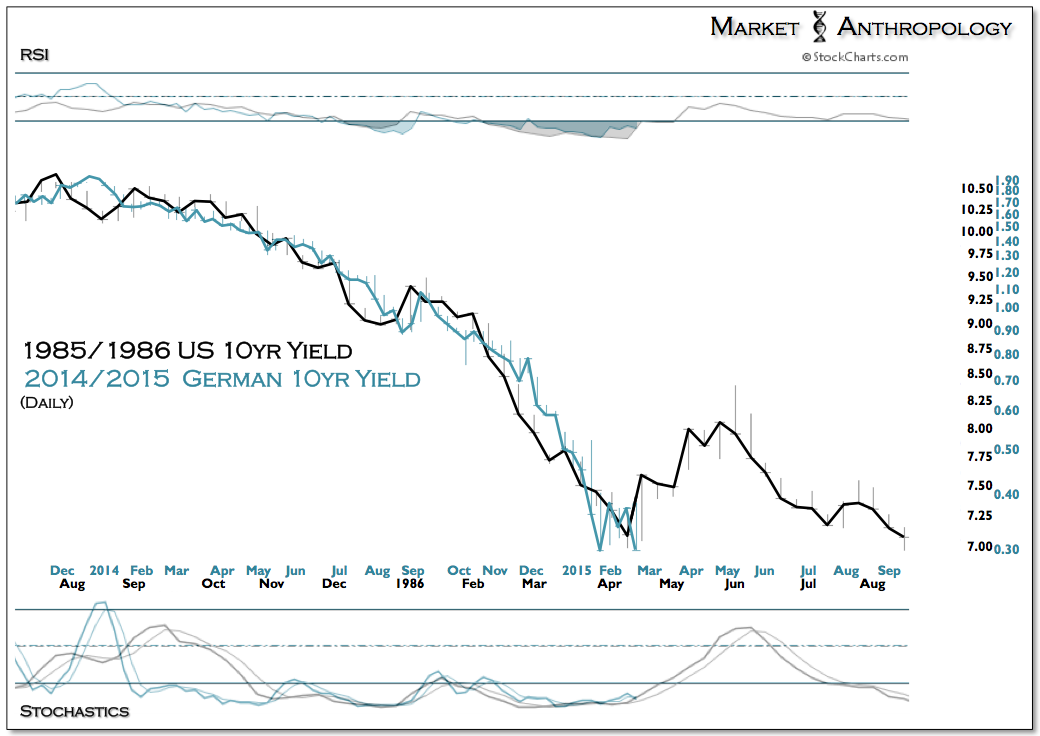

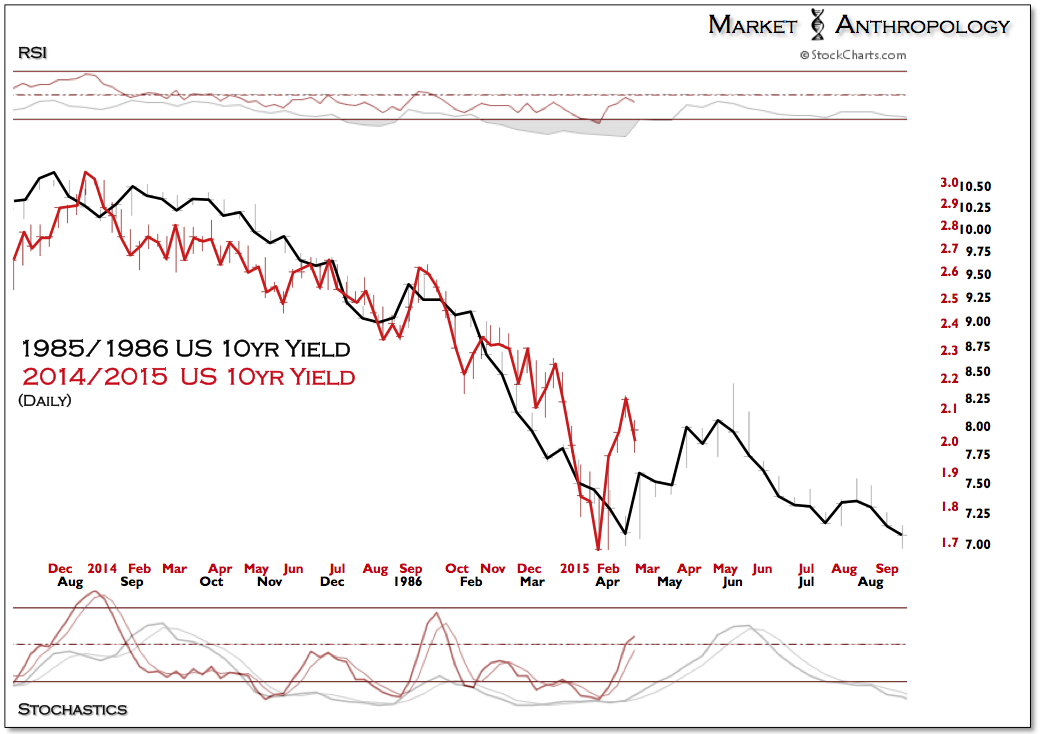

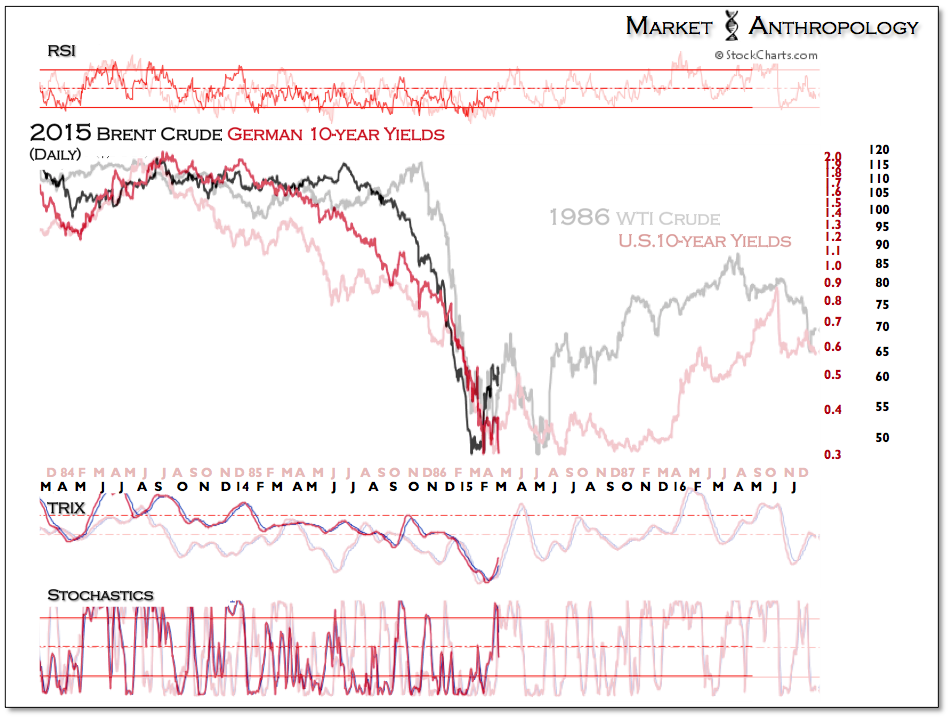

The euro, however, appears poised to follow the current uptrend in U.S. 10 year yields and out of a trough low that's been tested over the past month. Similar to the lagged affect on yields from QE in the U.S. in late 2008, we expect the measures introduced by the ECB last month to begin to buttress European yields and the euro in March.

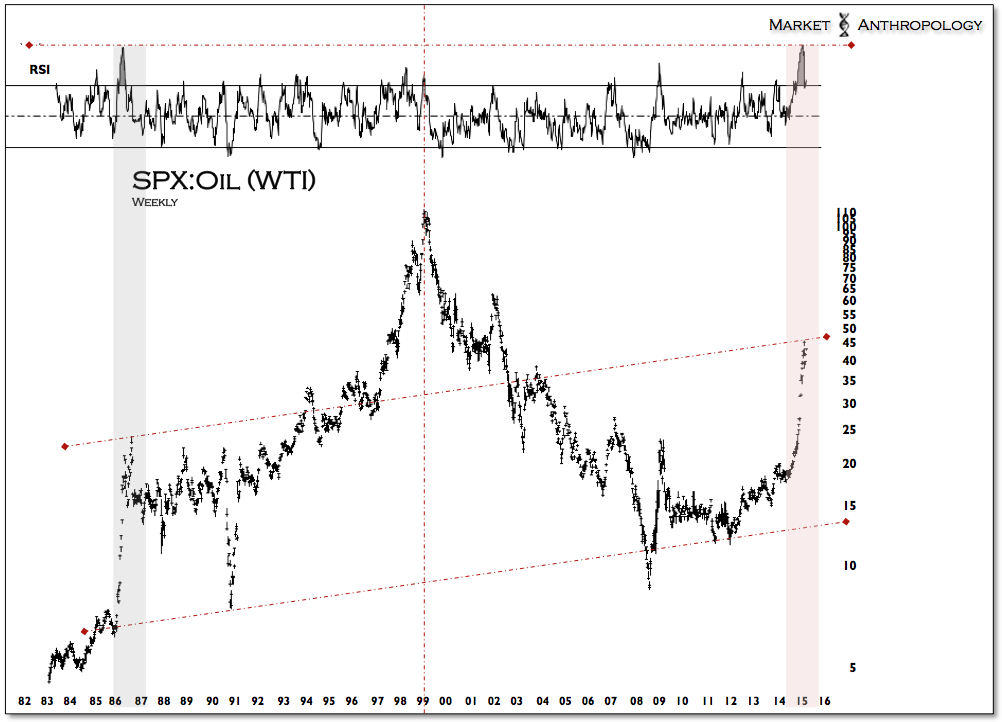

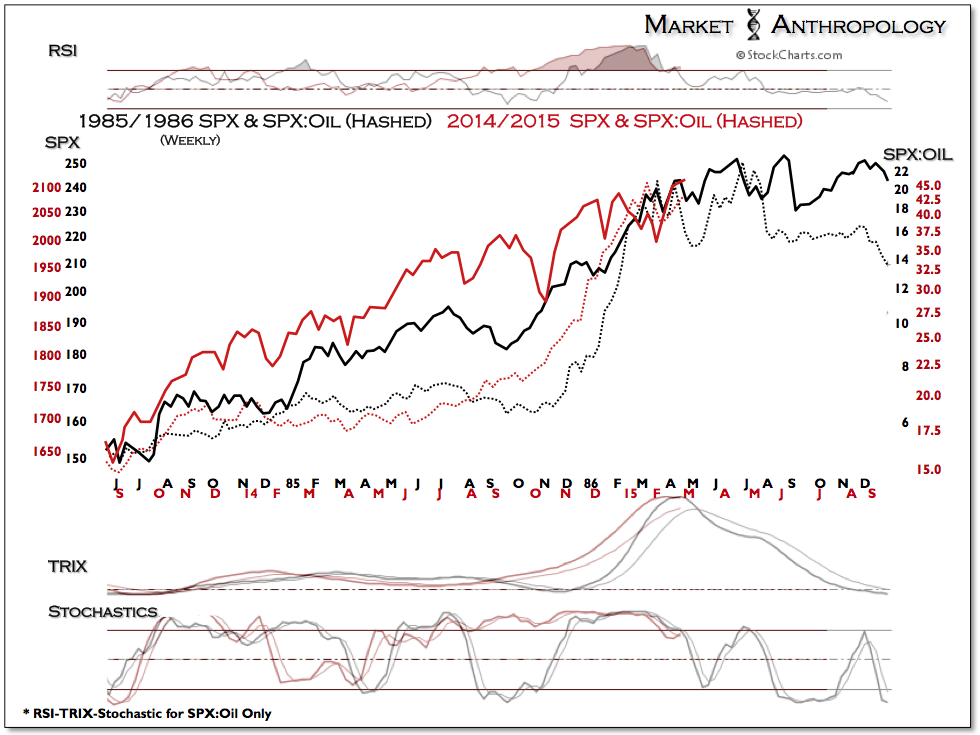

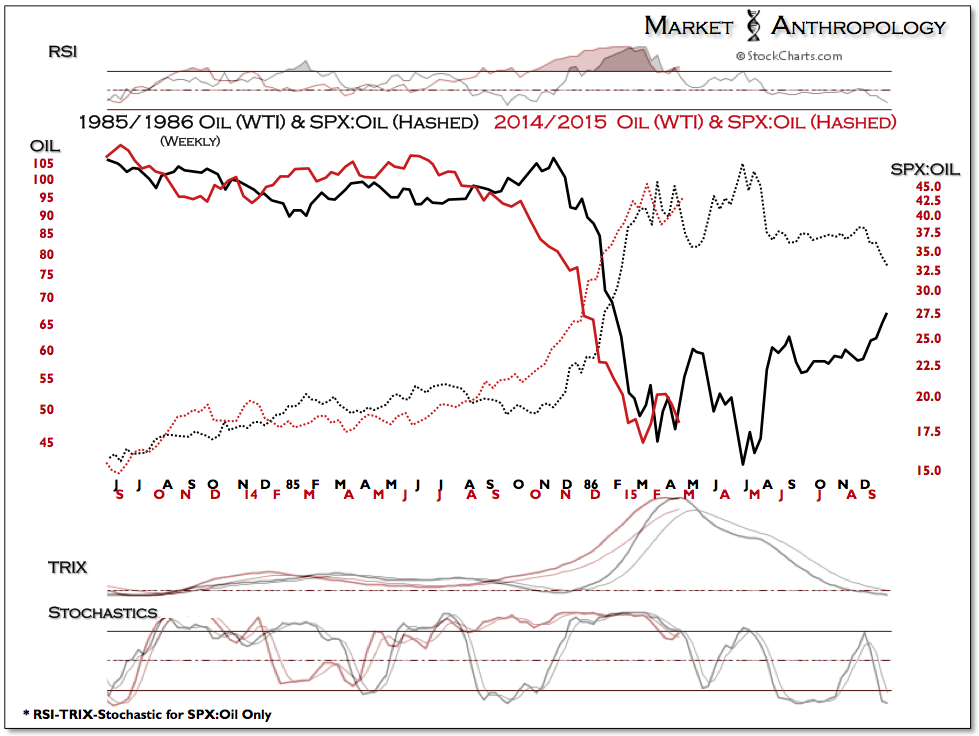

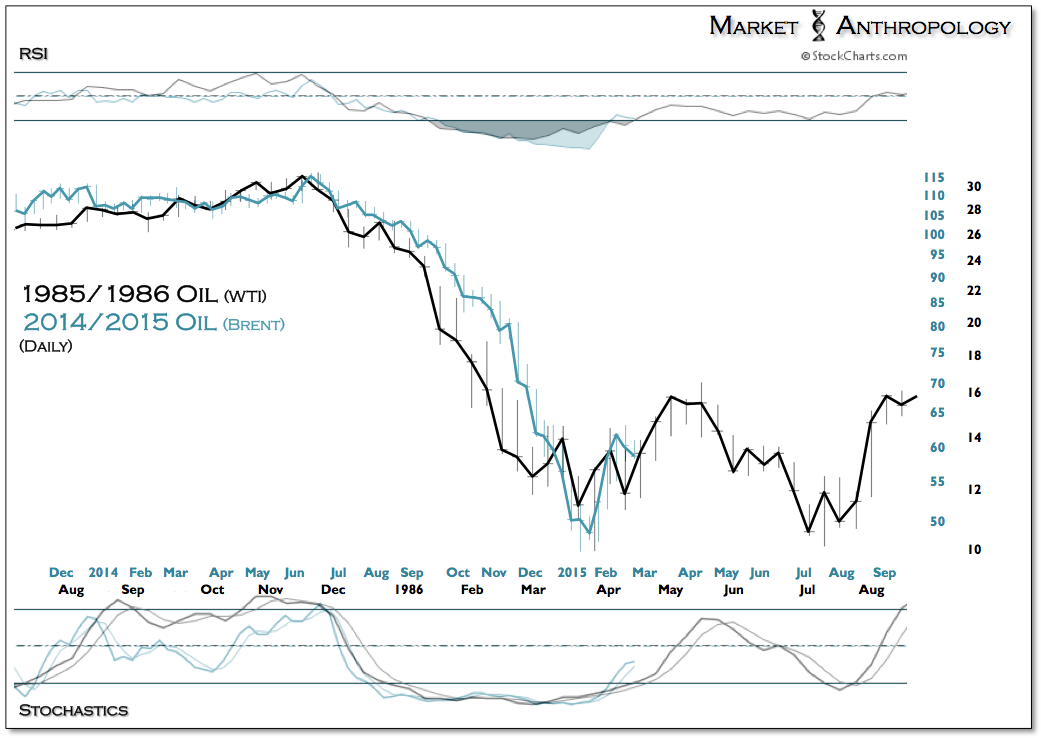

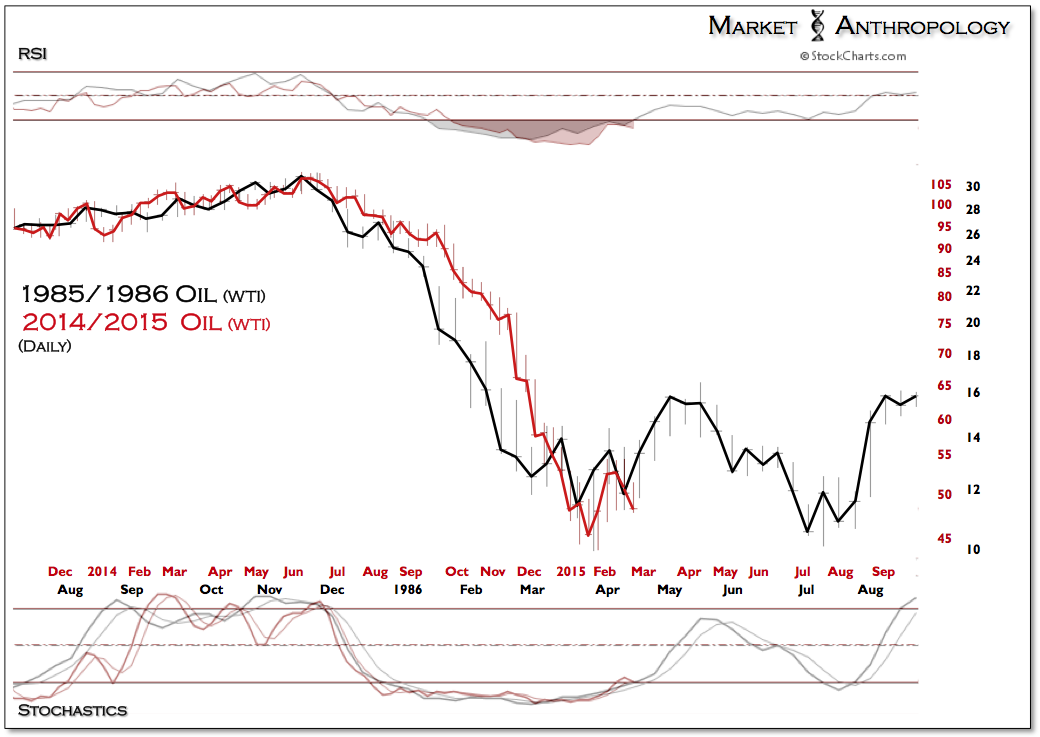

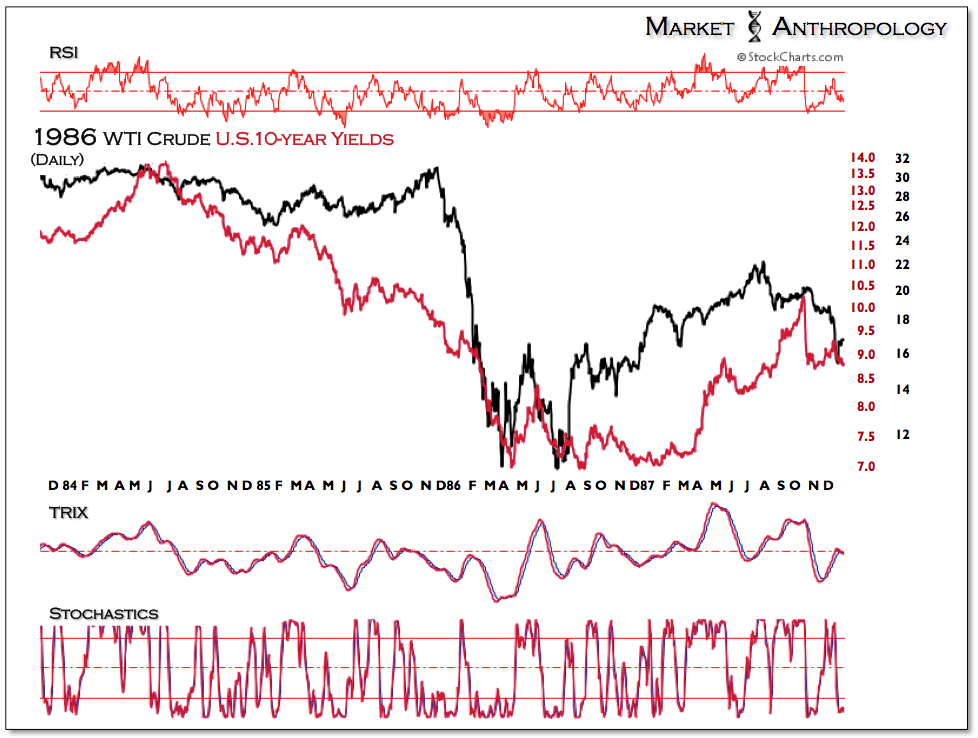

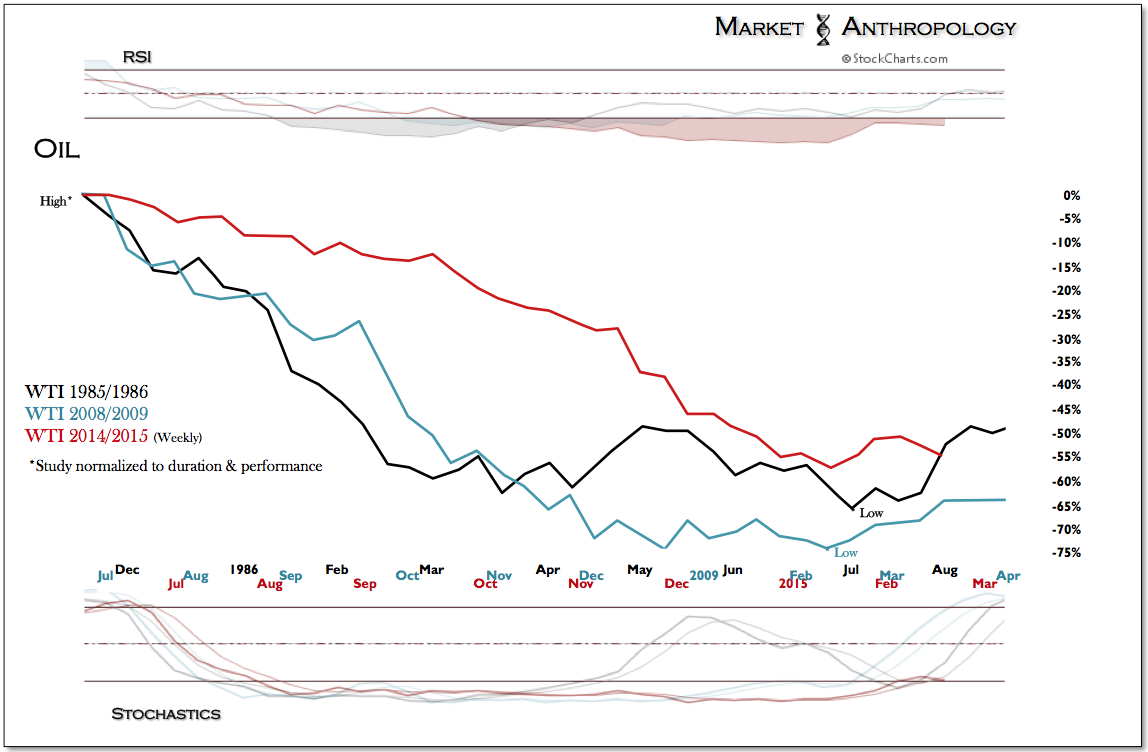

Outstanding of the oil crash in 2008, we have also closely followed the markets in relation to the supply driven decline in oil in late 1985 into 1986, which was primarily driven by a sluggish global economy while non-OPEC North Sea oil countries had increased production. Although there are similarities to what North American shale production has contributed to the global supply of oil, the 1985/1986 time period has been on our radar for years as a prospective mirrored shoulder in the

pattern below of the SPX:Oil ratio. Moreover - and quite dissimilar to 1985/1986, we feel the current move has been primarily driven by the currency markets, although there are similarities in underlying monetary policy that helped fuel a rebound in oil in the back half of 1986.

While it was the Fed that eased aggressively in the first half of 1986, today it's two of the other major players in the balance of the global economy (Europe, China) that are loosening policy that should support a rebound in oil - as well as those markets that have contributed and correlated with its decline. E.g. - the euro and European yields.