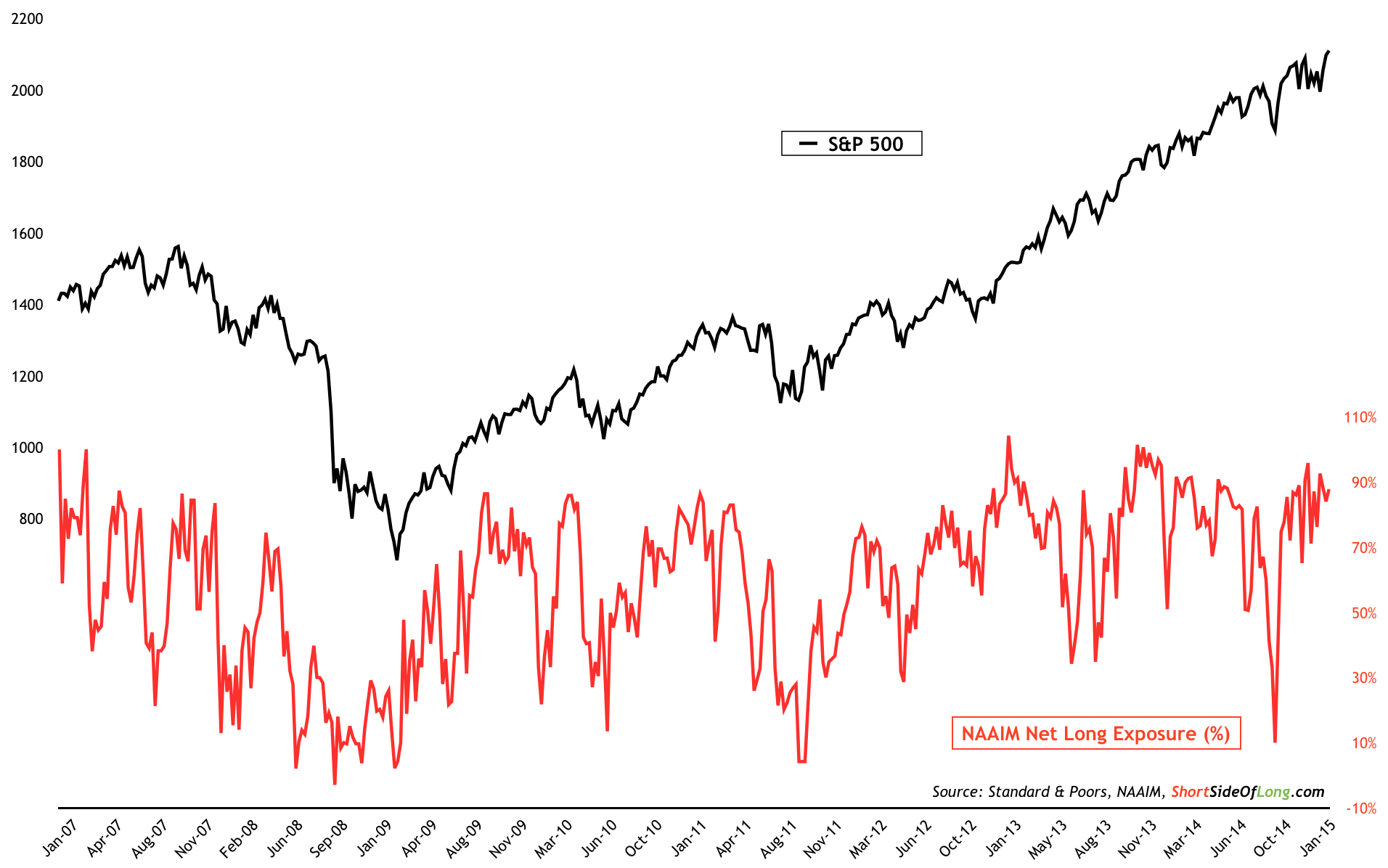

Chart 1: Recent fund manager long exposure has averaged above 80%

Source: Short Side of Long

Contrarian investors should start to pay attention. Over the last several months, NAAIM survey has been showing signs of extremely optimistic investor behaviour and it could be a dangerous signal. Since November of 2014, the average weekly reading for the survey was 83% net long, with the lowest level recorded at 65% (refer to Chart 1). This is a far cry from the levels seen during the recent intermediate bottom in October 2014, as exposure fell to only 10% net long.

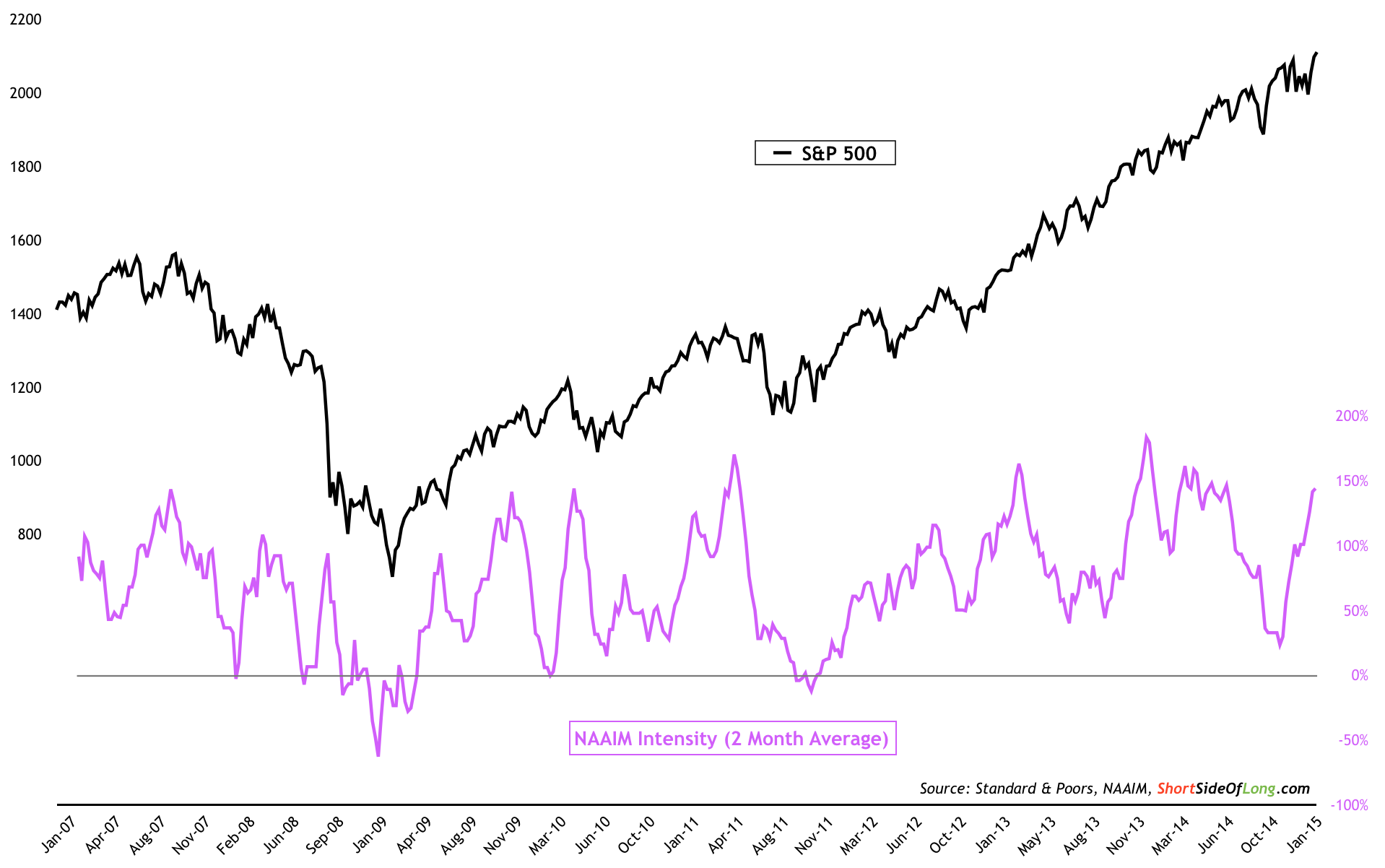

Furthermore, the difference between the net long managers relative to those who are net short, has been skewed more and more towards the bullish side. This is especially true over the last month, where the intensity has averaged 200% - a maximum reading possible - signalling outright greed. This kind of persistent bullishness, usually but not always, results in a sharp and fast shake out. For those who are net long equities as of today, caution is advised!

Chart 2: overall positioning is very skewed towards the bullish side...

Source: Short Side of Long

Copyright © The Short Side of Long