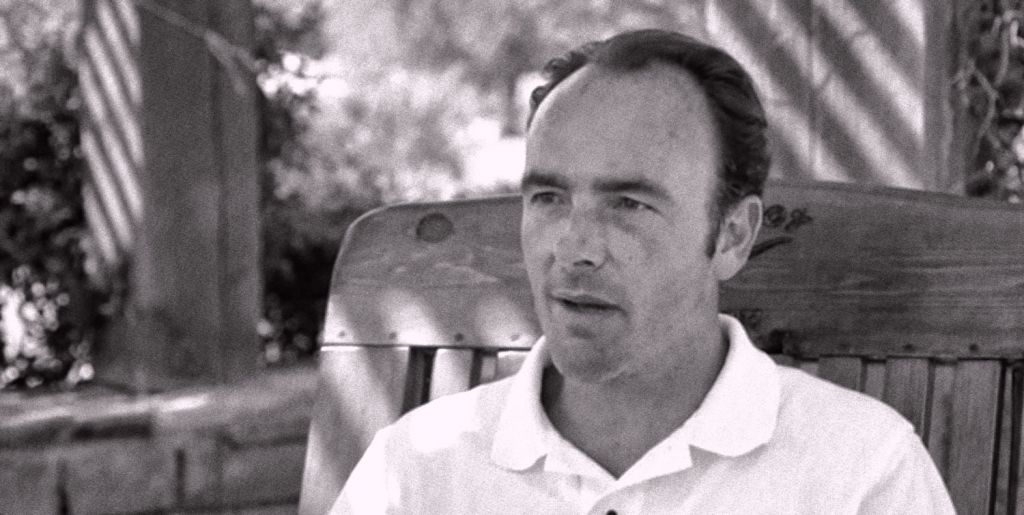

"I constantly feel inadequate, which may be what drives me," Kyle Bass tells Raoul Pal in this excellent discussion between two of the world's foremost (non-status-quo-hugging everything-will-be-fine) market practitioners. The interview with Bass, from the newly launched Real Vision TV, covers everything from how he got started in his career, what drives him, his process "it's an art - there is no science to it", and not only how we got here, but where we are going (inevitably)...

The Chain with Kyle Bass from Real Vision Television on Vimeo.

How do you find trades? "I wish I could tell you there was some magical screen but in fact "it's an art - there is no science to it"

For example...

"How did I get involved in Japan? When the bad assets were moving from private balance sheets to public balance sheets, I decided to look around the world to try to understand what the public balance sheets looked like (this is in late 2008)... and found them right at what I believe is an inflection point - when their population began to decline."

Bass also explains how he deals with the ubiquitous negativity that comes with being wrong on occasion as a fund manager...

"I think, as you know, the people who are really really good at this are ... how do I put it? They're not tremendous social people, right. They all have these crazy quirks and interesting lifestyles. They're generally all good people, the ones I've met ... I live in constant fear. Again, I live with this constant feeling of inadequacy that drives me so hard to succeed and be a proven fiduciary ... And that's what's always driven me. There are these two forces in life — positive reinforcement and negative reinforcement."

Humility appears to be key... Something we suspect more than a few other managers - guru-ised in this one-way street of a market - have yet to learn.

At 43:20, What really captivates Bass currently - and he explains he is working onm the exposition of this over the next few months - is the lack of liquidity:

"Forget equities, we saw the plumbing in the credit markets make moves that I thought we could never see... there is this confluences of events where the world has been driven to the daily liquidity of ETFs at the exact same time as broker-dealers are unable to take on risk [due to regulatory controls]... there aren't true circuit-breakers so we see gaps - and the gaps are huge - so we go from a no-vol world to a vol-world that goes off the charts because of the way the market is constructed today. What worries me is how the construct works across both equities and credit..."