Crude prices are falling, but whether WTI and Brent hit $40 or $60 doesn’t matter. What people should really be thinking about is how long prices could remain depressed.

The price of oil is at its lowest level in five years and the decline could very well continue. The question isn’t how low can it go, but rather, how long will it last.

It’s anyone’s guess as to exactly where oil prices are headed — some experts think they could fall further, others say they’re near the bottom. In some ways, where the price ends up isn’t the most important part of this story, what really matters is how long prices will stay low and, if there’s a strong argument for them to stay depressed for a prolonged period of time.

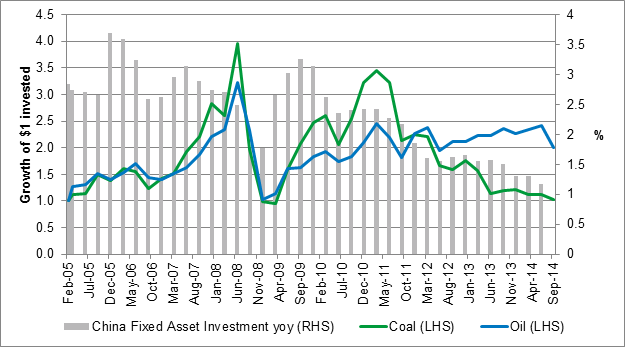

Why do we think prices aren’t rebounding anytime soon? It has to do with the price of coal. As you can see in the chart below, since 2003, coal and oil have essentially risen and fallen in lockstep with one another. That started to change in 2011, but it now appears that oil could be falling back in line with its commodity cousin.

Source: Bloomberg

Coal and oil are both energy inputs, so their strong correlation might suggest that prices rise and fall based on energy demand. But it’s not just energy demand in general. What was the one seminal event that linked these two commodities together? China’s investment boom.

You can see that in 2008, when oil and coal saw a severe correction because of the global financial crisis. Then, the Chinese came out with a strong stimulus plan and oil and coal took off again.

So what caused the divergence starting in 2011? The reason why prices didn’t drop together back then was in large part due to geopolitical risk. The Arab Spring started in December 2010 and ended in 2013. During that time people were worried about how protests would impact the Middle East’s oil supply. And while the U.S. began building up a major supply of shale oil and gas around this time, the concept of an energy-independent U.S. seemed remote. Peak oil, the theory that global oil production was in a terminal decline, was still an accepted dogma used to explain why a persistent supply/demand imbalance would ensure higher oil prices.

Tension in the Middle East is worse today than in recent history but, surprisingly, markets aren’t nearly as worried about a supply shutdown as they once were. That sense of calm, coupled with increasing supply from the U.S., has conspired to cast doubt about the concept of peak oil.

When most people talk about oil prices today, they frame it as a supply problem — that there’s too much product in the market — but, as the chart indicates, it’s also a demand issue. China’s investment boom began cooling around 2011 and this helps to explain the coincident decline in coal prices since China sources most of its energy from coal. However, the bigger story at play is that the marginal demand for energy has been contracting since 2011 and, absent a production cut, it was just a matter of time for a glut to drive prices to a lower equilibrium.

All of this leads me to believe that energy prices won’t be moving higher anytime soon. China’s deemphasizing investment and moving to more of a consumption driven economy. That means that China’s GDP should continue to cool as this growth rotation evolves — something we anticipate will take about five years to play out.

For oil prices to rise- assuming the OPEC cartel maintains current production – demand needs to come from somewhere else. The current shakeout in oil markets is effectively a wealth transfer from the producers to the importers. In time, low oil prices will result in more winners than losers as consumers from the importing nations will have more disposable income to income to spend. This demand pickup would manifest itself over time and would likely result in a creep in higher oil prices. An immediate catalyst could result from a cut in OPEC production, but the organization has said that it doesn’t plan to slash output. We see the current scenario similar to 1986 when OPEC gave up trying to support oil prices with a production cut causing oil prices to plunge from $30 to $10. And although the following decade witnessed an explosion in global growth, oil traded mostly between $10 and $20.

Wherever the price ends up, it’s likely it’ll stay there for a while. We don’t see demand increasing, especially with China cooling off. In the short-term that could be good news for our economy — lower gas prices mean people have more money to spend — but it remains to be seen just how our country will be impacted by a sub-$60 oil price. The longer it stays low, though, the more difficult things could get.

Aubrey Basdeo is a Managing Director and Head of Fixed Income for BlackRock Canada. He is a regular contributor to The Blog and you can find more of his posts here.

iSC-1507

Copyright © Blackrock Canada