by Ben Carlson, A Wealth of Common Sense

Since the financial crisis, investors are constantly on edge that we’ll see another melt-down in the stock market. On the other hand, there are investors such as Jeremy Grantham of GMO, that have been predicting the opposite — a melt-up in stocks before we see an eventual crash as investors notoriously take things too far.

But what if investors are looking for a melt-up in the wrong place? What if the real melt-up is already occuring in one the most boring asset class of all — long-term U.S. treasuries?

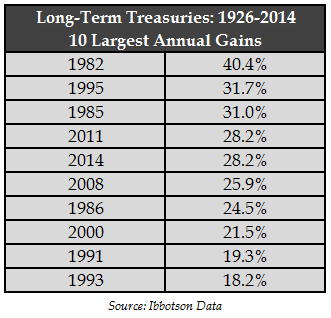

Long bonds have been on fire this year as they’re currently one of the best investments of any asset class. The iShares 20+ Year Treasury ETF (TLT) is up over 28%. From a historical standpoint, were that number to hold up through year end, it would be one of the best years ever for long bonds. Here are the top ten annual returns going back to 1926:

The performance in 2014 cracks the top five highest of all-time.You’ll notice that every single result in the top ten has occured since 1982 when interest rates started their steady decline from double digit levels. The average yield during these best performing periods was nearly 7%, juicing the total returns.

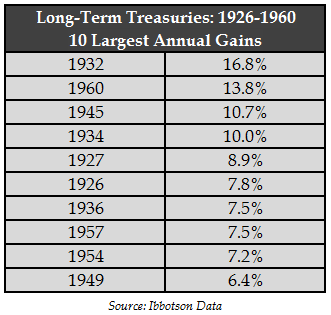

It seems everyone expects yields to shoot higher eventually, but I wanted to see what the performance numbers looked like in the past when rates stayed low for a long period. From 1926 to 1960, long bond yields were basically stuck in the 2-4% range. The current yield is in that range so historical returns could offer an idea about future performance. These were the ten best annual returns from that previous low yielding period:

This lower-for-longer period of interest rates led to a much more muted upside. The average return of the ten highest years in the 1926-1960 time frame was around 10% versus an average of 27% for the ten best in the 1926-2014 period.

Long bonds have shown fairly decent returns over the very long-term, going all the way back to 1926, of 5.7% annually (2.8% on an inflation-adjusted basis). But from 1926 to 1960 they only returned 3.2% a year (1.8% after inflation). This is not a prediction, just something to be aware of when setting return expectations.

People have been predicting the demise of bonds and a rise in interest rates for a number of years now. Anything is possible, but rates don’t have to go up just because they did in the past. There are legitimate reasons that we could see rates continue to fall in 2015 and beyond which could mean long bonds outperform once again. If we really were in the melt-up phase that’s exactly what would happen.

However, were this trend in rates to reverse, it’s worth noting that treasury bonds don’t see huge crashes like stocks do because of the way they’re structured (see: What Does the Bursting of a Bond “Bubble” Look Like). The largest annual loss in long bonds was only around 15% in nominal terms. Inflation is the real long-term killer of bonds.

So if you’re looking for a melt-up in 2015, it’s quite possible it could be in bonds and not stocks as most people assume.

Further Reading:

What’s an investor to do about bonds?

Looking beyond interest rate risk in bonds

Back-testing the Tony Robbins All-Weather Portfolio

Subscribe to receive email updates and my monthly newsletter by clicking here.

Follow me on Twitter: @awealthofcs

Copyright © A Wealth of Common Sense