It’s practically an investing axiom that government bonds are much less volatile than equities. But that depends on how you look at it. In fact, our research suggests that income streams from stocks are actually much less volatile than those of government bonds.

This counterintuitive point raises interesting observations for investors. Namely, the less sensitive you are to price volatility, the more attractive the yield from equities may become.

Over the long term, global equities have had an annualized volatility of nearly 17% versus about 8% for government bonds.1 This analysis is based on a century of data from 1900 to 2000 from the London Business School. By this measure, equities have clearly been riskier than bonds.

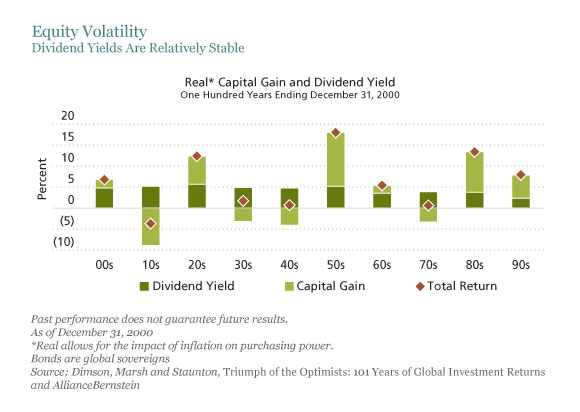

However, the picture looks very different looking at real returns, i.e., adjusted for inflation—especially if you decompose the total real return of equities into two components: the contribution from capital appreciation and the contribution from dividend yields. This analysis shows that share prices (capital appreciation) have been quite volatile over 10-year holding periods (Display). Dividend yields, though they have fallen somewhat over time, have been much more stable.

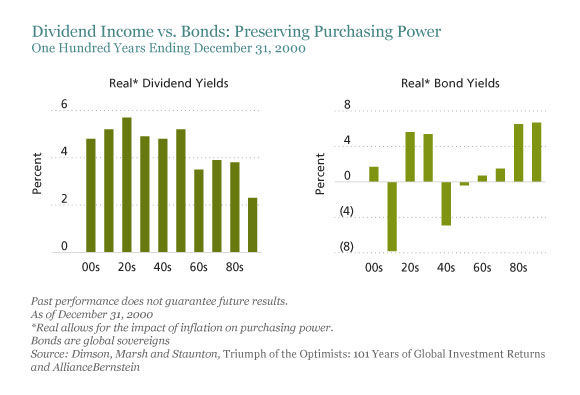

Comparing the real return of bonds over the same period with the dividend yield from equities also paints an interesting picture (Display). Bonds did very well in the 1980s and 1990s (and, for that matter, also over the most recent decade) as interest and inflation rates fell. However, bonds struggled during decades in which inflation and interest rates rose. In contrast, the real return from dividends was positive every decade. In other words, seen through the lens of producing an income stream to meet an investor’s purchasing needs, equities don’t look quite so risky after all.

Why might these observations matter? Most investors have assets because they have liabilities. Liabilities often take the form of a series of inflation-linked payments that need to be made over several years. So owning real income streams that meet those expected payments is the essence of asset-liability matching, in our view. And for investors without explicit liability matching needs, generating stable streams of real income is becoming increasingly important in a world of volatility. Yet the common perception that equities are more volatile than bonds often creates a barrier for investors to consider stocks as a reliable source of income.

In a recent blog, our colleagues pointed out that an equity income approach is probably more appropriate for investors with long-term goals. While the shares are likely to appreciate over time, stock price volatility means the value of the initial investment will fluctuate (see upper display). But of course, an investor doesn’t necessarily have to choose to be exposed to either equity or bond income.

In fact, there are good reasons to have a bit of both, in our view. Income streams between equities and bonds are not perfectly correlated. For example, we measured that the percentage yield from the Barclays Global Treasuries Index has had a negative correlation of –0.6 with the percentage yield from the MSCI World Equity Index since 2001. So by combining income streams from a range of asset classes, we think investors should be able to generate more consistent income and, importantly, income growth.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams. AllianceBernstein Limited is authorized and regulated by the Financial Conduct Authority in the United Kingdom.

Patrick Rudden is co-manager, Dynamic Diversified Portfolio at AllianceBernstein (NYSE:AB).

[1] Source: Dimson, Marsh and Staunton, Triumph of the Optimists: 101 Years of Global Investment Returns