by Michael Batnick, The Irrelevant Investor

We often spend far too much time worrying about things beyond our control; how will stocks do next year, will rates rise, etc. It’s easy to overlook one of the key elements to successful investing; setting realistic expectations.

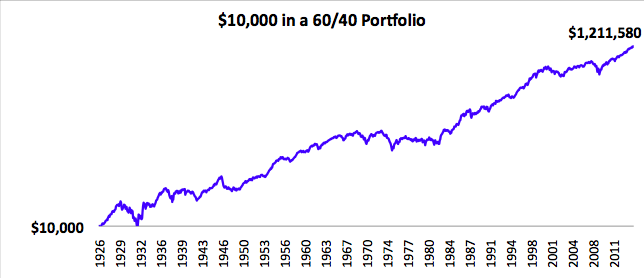

Looking at the chart above, you’ll see an investment of ten-thousand dollars in a traditional sixty/forty domestic portfolio ballooned into well over one million dollars net of inflation; a real return of over twelve-thousand percent. The message is clear; those able to insulate their emotions from the manias and the panics can their see money appreciate demonstrably. However looking at a ninety year chart is completely useless. We don’t see investments through a ninety year looking glass. To many of us, just one year feels long term.

The patient investor can hope to see their portfolio increase many times over throughout the course of their lifetime, however, it is critical to prepare for periods of disastrous returns. Intelligent investors can have no delusions of grandeur, they must be able to take the bitter with the better.

Consider a moderately conservative investor with this sixty/forty allocation- there were three separate decades of real annualized returns under two percent: the 1940s, 1970s and 2000s. Had an investor thrown in the towel after ten years of agonizing ups and downs with little to show for it, they would have missed extraordinary returns in the periods to follow. The 1950s delivered a one-hundred and forty percent total real return, the 1980s delivered a one-hundred and fifty percent real return and 2010-2014 has delivered real returns of over sixty percent.

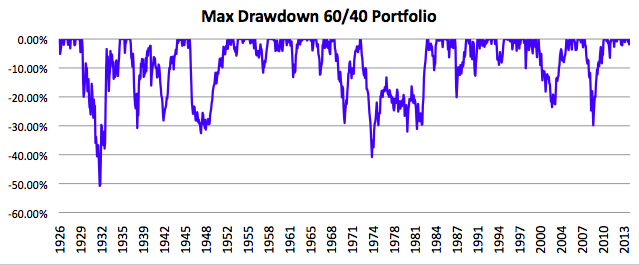

Looking more closely at this portfolio, going back to 1926, the median calendar year drawdown is negative five and a half percent. Thirty-six out of eighty-eight years, or forty percent of the time, this portfolio experienced at least a ten percent drawdown. In roughly one out of every twelve years, this portfolio experienced at least a twenty percent drawdown.

Invest over the your lifetime and you will learn that thirty plus percent drawdowns are the rule, not the exception. The bottom line is that investors can build great wealth in the market, but the price of admission can be gut wrenching. Avoid risk and you are all but doomed to inferior returns, there really can be no other way.

Copyright © The Irrelevant Investor