Thanksgiving Recipe

by Jeffrey Saut, Chief Investment Strategist, Raymond James

November 24, 2014

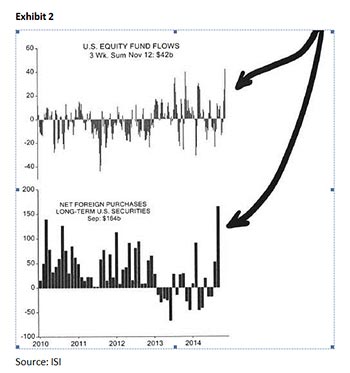

Begin with a turkey “chilling” in a sink for a few hours (see exhibit 1). Mix in the Bank of Japan’s “shock and awe” announcement of a week ago. Add the U.S. unemployment claims that are at a 14-year low and stir well, include housing prices that are better by +6%, fold in the Leading Economic Indicators advancing by 7%, the ECB announcement by Draghi about a “bazooka” of Quantitative Easing (QE), and the Thanksgiving dinner result . . . new highs for equity prices! I have hinted of this Thanksgiving “dinner recipe” rally since returning from a two-week trip to Europe where I spoke to many portfolio managers (PMs), although I did not think the rally would begin before this holiday-shortened week. Interestingly, all the PMs wanted to discuss was the U.S. equity markets and Emerging Markets (EMs). I told them I thought Draghi’s announcement of a trillion euro QE should have sparked “long” positions in the WisdomTree Hedged Equity Fund (HEDJ/$58.37), where the euro currency exposure is hedged out, but none of them wanted to listen to that idea. Accordingly, over the past three weeks there has been a record inflow into U.S. equity funds from foreign investors (see exhibit 2). Certainly the seasonality has a bullish tilt to it and I have learned the hard way that it is difficult to sell stocks off during the ebullient period between Thanksgiving and Christmas. Actually, that is not entirely true, because the first part of December has been subject to weakness. However, since 1950 the month of December has been an up month 48 times, and down only 15 times, with an average gain of 1.7% by the S&P 500 (SPX/2063.50). Thanksgiving week also has a bullish bias with a gain for the week of +0.64% two-thirds of the time.

Speaking to these points, last Friday I did a “hit” on CNBC with a gentleman who was in love with his own voice, because he over talked all of his points despite the sagacious Kelly Evans trying repeatedly to interrupt him. One point he kept trying to make was how the equity markets have been “financially engineered,” something termed “zaitech” by the Japanese in an era gone by. Ladies and gentlemen, we are not in an environment of zaitech, despite his claim. His words were reminiscent of another gentleman a few months ago that created quite a stir by suggesting the stock market is “rigged.” While last Friday’s CNBC guest sounded smart, he is totally wrong about zaitech. I do, however, think he is right about the secular bull market extending for many more years, but I do not think it is because of “financial engineering!”

Given last Friday’s surprising “two step,” many pundits are trying to spin Draghi’s statement into some ominous warning that Euroland is falling into a depression. I am not one of them, so here is what he said (as paraphrased):

There was no sign of economic improvement in the months ahead and the ECB would step up its program to pump more money into the currency bloc if its current measures fell short of lifting inflation.

While Draghi’s comments were a bullish surprise for world markets, the real surprise came from China. Indeed, the People’s Bank of China said it is cutting the one-year benchmark lending rate by 40 basis points to 5.6% and lowering the one-year benchmark deposit rate by 25 basis points. Hereto pundits attempted to infer this proves that China is in trouble. My comments to the media were not as dire. To wit, I think this may not have a large impact on China’s GDP growth, unless policymakers also let the rate of credit growth increase. I also think the REAL question is if this is a “one off” rate cut, or is it the beginning of a series of rate cuts? Only time will answer that question, but the world’s equity markets surely like it because early Friday morning markets exploded. This can be seen in the SPX’s early ~20-point pop. Of course, some of the upside fireworks were accentuated by last Friday’s option expiration, which was surprising in that the equity markets did not close at the session’s highs.

As most of you know, I watch Buying Climaxes and Selling Climaxes. A Selling Climax is when an individual stock trades to a new 52-week low, and then closes near/at that session’s intraday high, and that closing price needs to be above the previous Friday’s closing price. A Buying Climax is the exact reciprocal. Back at the October 15, 2014 lows, there were more than 600 Selling Climaxes, which was the most Selling Climaxes since the October 5, 2011 oversold low that led to a 26% rally. Likewise, the NYSE McClellan Oscillator was reflecting a deeply oversold condition at the time. Last week, despite the roughly 24-point gain for the SPX, there were only 126 Buying Climaxes and the NYSE McClellan Oscillator was not overbought. Meanwhile, my indicator that measures the equity markets’ internal energy has almost recovered a full charge of energy. As stated last Friday, while my model suggests that energy will be released on the downside, I just do not believe it given the bullish seasonality.

As for my sense that over the past two weeks crude oil is in a bottoming phase, I still feel this way and would note the January Crude Oil future’s contract closed above its 10-DMA last week for the first time in quite a while. Also of interest is that “smart money” Continental Resources (CLR/$56.90/Outperform) sold all of its downside futures’ contract hedges, for a $433 million dollar gain, betting that oil is in the process of bottoming. To this point, my colleague Andrew Adams has compiled a great “slide deck” discussing the current chart structure of the oil markets along with some individual names for your consideration, which can be retrieved on my RJNet page for subscribers. For non-subscribers, I suggest contacting the Equity Advisory Group (727.567.2520).

The call for this week: The biggest winning macro sectors last week, likely because of Draghi’s and China’s announcements, were Materials (+2.76%) and Energy (+2.50%). However, by far the biggest winner for the week was the economically sensitive metal Nickle (+7.38%)! I think this speaks volumes about the strength of the economic recovery and would remind investors that according to Goldman Sachs, for every 0.50% slowdown in the world’s economic growth, it only affects U.S. GDP growth by less than 0.13%! This week weather could again come into play as cold weather falls over the U.K. and Europe. Also Energy will be a topic as the stalled nuke talks with Iran capture the headlines. The Ferguson grand jury decision is due, Illinois is going to have to find a way to fix the worst pension shortage in the history of America, and OPEC meets to decide about production “cuts” in the light of declining oil prices (and please see our Energy team’s Oilfield Stat of the Week for more insight on oil prices). Meanwhile, traders are “long” the U.S. dollar in record amounts, and short the 10-year T’note contract (I think they are both wrong on a trading basis). Of interest is that Alerian Capital Management LLC, which manages indexes tracking energy and infrastructure companies (mainly MLPs), is in the early stages of exploring a sale of the company. Ladies and gentlemen, these are the kinds of headlines seen at major bottoms, and in this case, it would be a bottom in the Master Limited Partnerships (MLPs). I will be at FOF (Friends of Fermentation) next week with my friend Eric Kaufman, captain of VE Capital Management (http://www.vecapitalmanagementllc.com/), which manages money in MLPs, along with my friends the legendary Arthur Cashin and Bob Pisani, as well as a host of other dignitaries that happen to be in NYC. To my friend Doug Kass, who very kindly mentions me in his “best-selling” book A Life On Wall Street, I hope you are there! This morning German business morale is better, China stands ready to cut interest rates again, and Iran says its nuke talks will resume next month. All of this has the preopening SPX futures higher by 5-points at 5 a.m.