by Ben Carlson, A Wealth of Common Sense

“Financial advisors frame themselves as investment managers, providers of “beat-the-market” pills, when, in truth, they are mostly managers of investors.” – Meir Statman

In my opinion, managing your emotions is by far the most important aspect of managing money. For a number of reasons – time, lack of expertise or lack of willpower – it makes sense for many people to outsource the management of their emotions by hiring a financial advisor.

But figuring out the right financial professional to outsource to can be a challenge.

Meir Statman, in his terrific book What Investors Really Want, has one of the better descriptions I’ve come across on what makes a good financial advisor:

Good financial advisors are good financial physicians. Good advisors possess the knowledge of finance, as good physicians possess knowledge of medicine, and good advisors add to it the skills of good physicians: asking, listening, empathizing, educating and prescribing.

Statman’s research in the book focuses on behavioral finance, which is increasingly becoming an indispensable feature of the financial advice profession (although it always should have been). Natixis Asset Management recently performed a large-scale survey of financial advisors and their clients. The top three challenges laid out by the advisors really drives home the the importance of being a good financial physician:

Advisors say the top three challenges they face are clients’ emotional reactions to market movements, managing investor behavior and confidence, and persuading clients to stick with their financial plans.

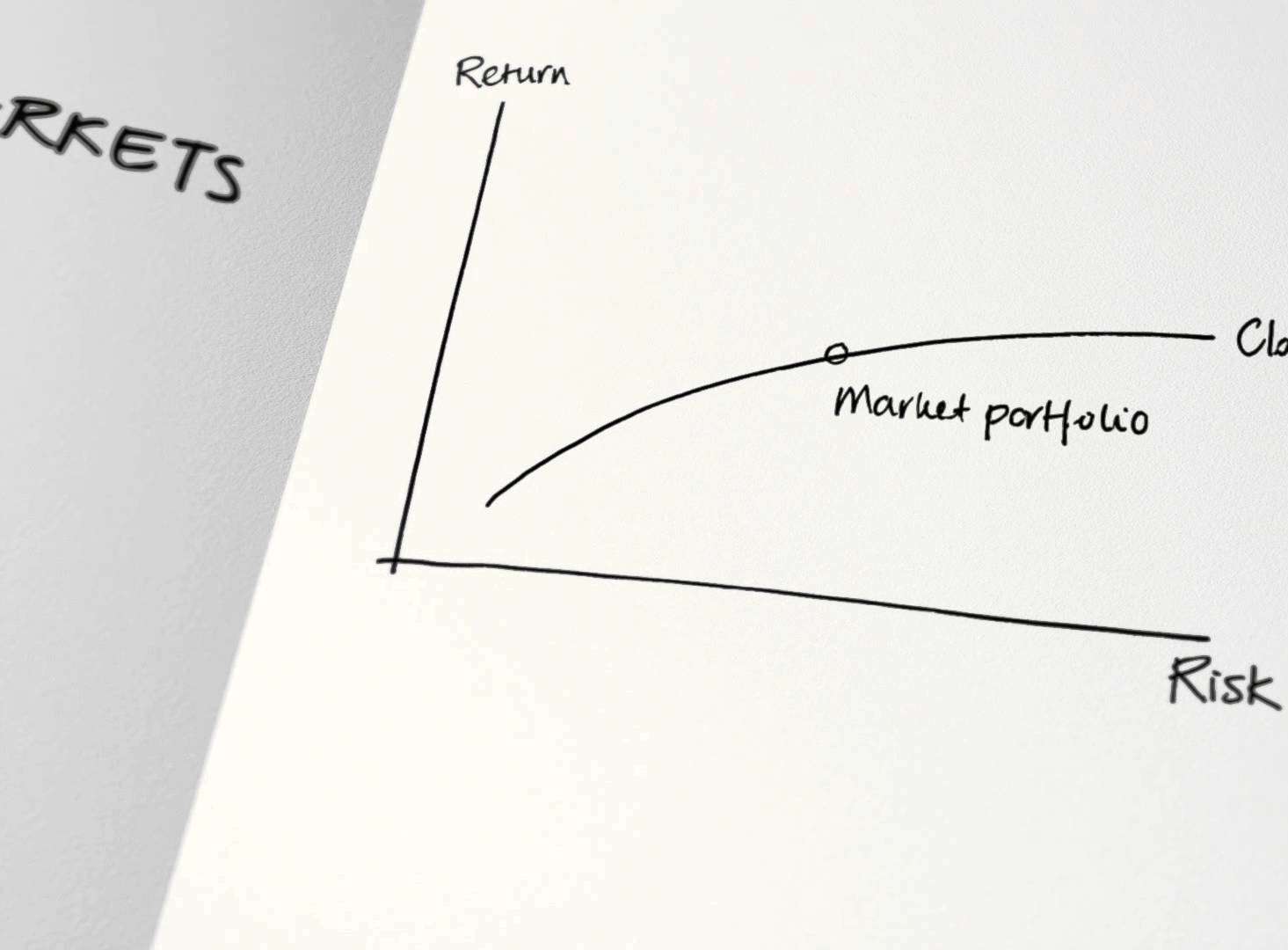

Every advisor can build a reasonable portfolio these days. It’s really not that all difficult and it’s becoming cheaper by the day. It’s the implementation of the portfolio strategy within a well-defined investment plan that’s the key.

Of the skills listed by Statman, I would rank educating and listening near the top. Without an understanding of what the client is looking for and an ability to communicate your process, it doesn’t matter what you prescribe. If they don’t get what it is you’re trying to do for them, all will be lost at the first sign of trouble. Which is why advisors are so nervous about volatility:

When asked directly what presented the greatest challenge to their success, eight out of ten advisors globally pointed to volatile markets.

The problem is that there appears to be a disconnect between the challenges faced by advisors and how they’re educating their clients. It makes sense that managing client emotions would be a challenge, but it’s a strategy that not many advisors have clearly communicated, based on this study:

Few investors acknowledged the relationship between emotions and investment success. When asked if putting their emotions aside could better enable them to meet their financial goals, only 8 percent of U.S. respondents answered “yes.”

I think a lot of this has to do with the fact that many financial professionals assume that impressing a client is job number one in order to get their business. It’s somewhat of a catch-22, because it’s easier to use certainty, cleverness and complexity to make the hard sell, but these tools are useless once it’s time to actually manage money.

This is why it’s so important for advisors to set reasonable expectations from the start. Then ongoing communication acts as a form of risk management for the client worries that inevitably come into play. In its most basic form, this is what that communication should look like:

- These are the things you need to focus on and pay attention to.

- These are the things you should ignore and not pay attention to.

That’s it from a high level perspective. Everything else branches off from there.

Volatile markets are never going away so risk management will always be an important part of the process. But risk is subjective. For most investors, risk comes down to making a huge mistake at the wrong time. That’s where the advisor earns their money.

When you really think about it, it’s an odd relationship to have to manage someone else’s emotions. It requires a deep understanding of psychology and human nature to be successful. Those that can do this well will have much better odds of running successful portfolios and client relationships. Those that can’t will likely have their advice ignored, no matter how sound it might be.

Subscribe to receive email updates and my monthly newsletter by clicking here.

Follow me on Twitter: @awealthofcs

Copyright © A Wealth of Common Sense