by Ben Carlson, A Wealth of Common Sense

Most investors spend their time worrying about the stock market, but the bond market is in a fascinating place right now. Interest rates are low, but retirees and risk averse investors need sources of income and a less volatile ride than the stock market provides.

Everyone seems to want rates to rise, but it’s just not happening. Talking to a number of different investors over the past few months has led to a realization — nobody has a clue about what to do about bonds.

There are many different strategies and income-producing assets out there, but nothing’s perfect. Some stick with high quality government bonds regardless of the level of rates. Others are happy to look for higher yields elsewhere, further out on the risk curve. There are a number of ways to add income exposure to a portfolio, but yield is only the starting point. Risks must be considered as well.

Here are a few options, sorted by risk:

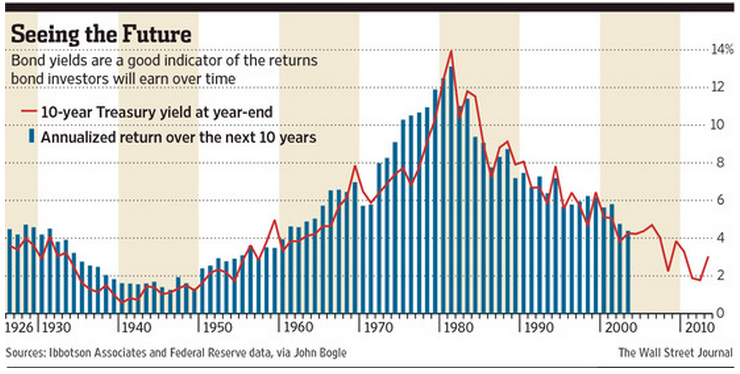

This is the biggest worry for bond investors right now, especially those holding high quality government issues such as treasuries. The correlation between current interest rates and future long-term returns is very high (around 0.90). This means lower performance can be expected in high quality bonds at these interest rate levels, something everyone has heard by now.

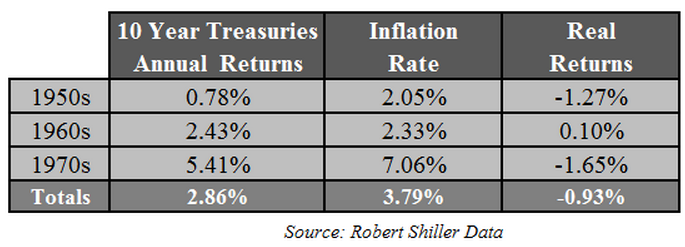

Inflation Risk. Inflation is the biggest risk to lower interest rates, as I’ve detailed in the past. There’s much less room for error. The historical record of bonds in rising interest rate and highly inflationary environment isn’t pretty:

It doesn’t look like much, but over 30 years that’s nearly a 40% loss in terms of purchasing power because of the effects of inflation.

Duration Risk. To combat interest rate risk and inflation risk, investors can choose to either lengthen or shorten the maturities of their bond holdings. Each option comes with potential problems.

Using longer bond maturities can increase your yield but also increases your chances of getting slaughtered in a rising rate environment. Higher rates and longer maturities are at higher risk of volatility and losses in a rising rate environment.

Or you could stick to the short end of marturities to decrease the effect of rising rates based on the theory that you could rollover your short-term bonds into longer-term holdings if and when rates ever rise in a material way. The risk here is that you could lose out on total return from lower yields. Many investors have been waiting for a number of years now in short duration bonds, anticipating a rising rate environment that just hasn’t materialized.

As usual, trade offs abound.

Sovereign Risk. Emerging market bonds offer higher interest rates, but they come with potential country-specific risks. Bond investors are usually more concerned with return of capital than return on capital.

Emerging market countries are no strangers to a crisis, but even when a minor flare-up occurs, there can be issues. In 2013, EM bonds were down 8%, supposedly on worries of how the Federal Reserve’s policy decisions would affect many EM countries. They’ve basically made back the losses in 2014, but provide a much wilder ride than most developed country sovereign bonds.

Asset Risk. There are a host of higher yielding investments that many view as bond substitutes, but most fail in the one area high quality bonds usually shine — preserving capital during stock market losses.

When the S&P 500 was down almost 20% in the summer of 2011, these were the drawdowns for some of the various higher-yielding investment options (along with their corresponding ETF tickers):

- Dividend Stocks (SDY) -16%

- Preferred Stocks (PFF) -8%

- Convertibles (CWB) -15%

- Bank Loans (BKLN) -8%

- Master Limited Partnerships or MLPs (AMLP) -13%

- REITs (VNQ) -14%

- High Yield Bonds (JNK) -7%

Portfolio Risk. This is probably the most important one. Investors searching for income have to be willing to make certain trade-offs or sacrifices in a low rate world. Investors have to figure out the purpose of bonds or income streams in a portfolio. Every asset class or holding within a portfolio should have a reason for inclusion.

For bonds it could be:

- Reliable income?

- A higher yield?

- Performance over inflation?

- A shock absorber during a stock market crash?

- Diversification benefits?

Figure out this question and hopefully the fixed income portion of a portfolio becomes easier to define. I also think that creating a bond ladder is a straight forward way to manage risk in fixed income assets, as well.

But there really are no easy answers right now.

Sign up for email updates and my monthly newsletter by clicking here.

Follow me on Twitter: @awealthofcs

Copyright © A Wealth of Common Sense