by Don Vialoux, EquityClock.com

Pre-opening Comments for Thursday October 30th

U.S. equity index futures were lower this morning. S&P 500 futures fell 4 points in pre-opening trade.

Index futures recovered following release of economic news at 8:30 AM EDT. Consensus for preliminary third quarter annualized real GDP was growth at 3.0% versus 4.2% in the second quarter. Actual was growth at a 3.5%. Consensus for Weekly Jobless Claims was an unchanged at 284,000. Actual was an increase to 287,000.

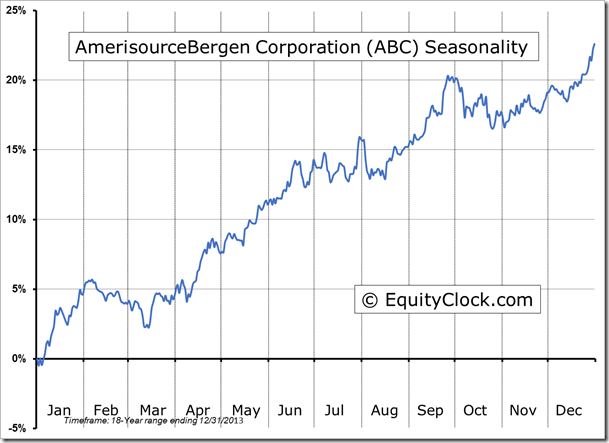

Third quarter earnings reports continue to flood in. Companies that reported since the close yesterday included Altria, AmerisourceBergen, Apollo, Avon Products, Bombardier, Johnson Controls, Kellogg, L3, MasterCard, Mosaic, Shell, Suncor, Teva, Time Warner Cable, Thomson Reuters, Vale and Visa.

Visa gained $9.36 to $224.02 after reporting higher than consensus third quarter earnings. The stock also was upgraded by FBR Capital. Target is $260.

Lowes added $0.58 to $56.39 after Goldman Sachs upgraded the stock from Neutral to Buy. Target is $63.

Kraft Foods fell $1.66 to $55.75 after Credit Suisse downgraded the stock from Outperform to Neutral. Target is $58.

Cott Corp (COT US$6.25) is expected to open higher after Stifel Nicolaus re-iterated its Buy rating with a target price of $8.00

EquityClock.com’s Daily Market Comment

Following is a link:

http://www.equityclock.com/2014/10/29/stock-market-outlook-for-october-30-2014/

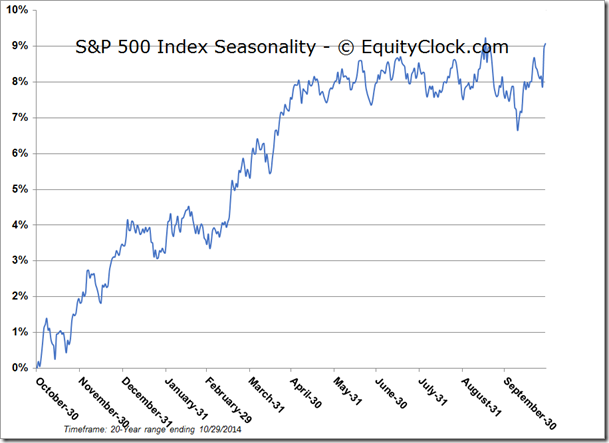

Note comment on S&P Index Returns Around Mid-Term Elections

Interesting Charts

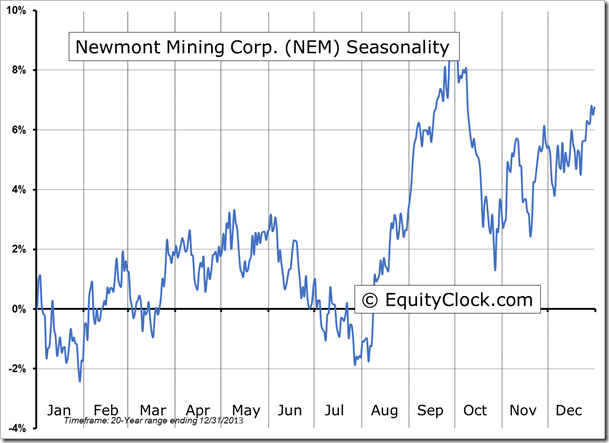

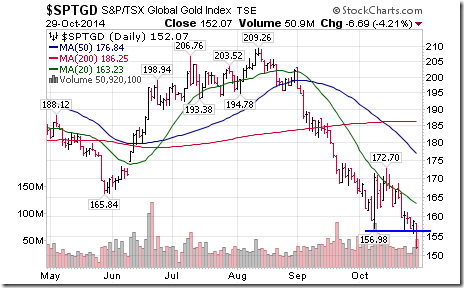

Response to the FOMC minutes news was surprisingly muted. U.S. equity markets initially moved lower but were virtually unchanged at the close. Strongest sector was Financials. Weakest sector was gold. Several Canadian gold stocks broke support including Agnico-Eagle, Eldorado Gold and Semafo. Gold equity ETFs on both sides of the border broke to new lows. Ditto for the S&P/TSX Gold Index!

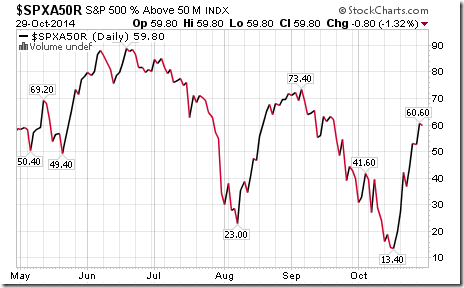

Percent of S&P 500 stocks trading above their 50 day moving average continues to trend higher, but already is approaching an intermediate overbought level.

StockTwits Yesterday@equityclock

Editor’s Note: Please join Equityclock’s Twitter community and receive inter-day tweets. Over 1,500 people already are connected.

More bullish action by S&P stocks to 10:30. 18 stocks broke resistance. Notable: Health Care and Technology stocks. None broke support.

Surprising little technical action following the FOMC announcement! No S&P 500 stocks broke support or resistance.

Technical Action by Individual Stocks Yesterday

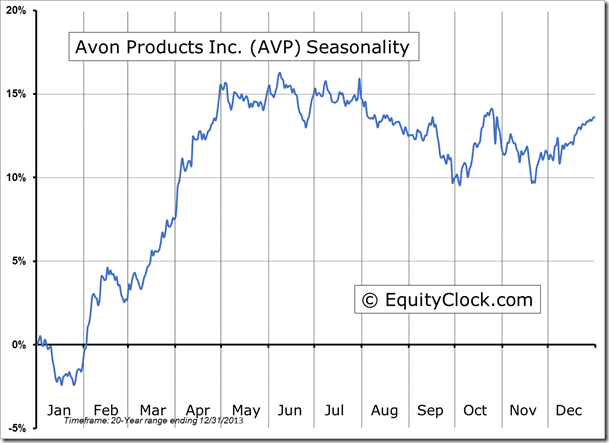

By the close, twenty S&P 500 stocks broke resistance and two stocks broke support (Owens Illinois and Avon Products).

Among TSX 60 stocks, Thomson Reuters touched a 13 year high and Agnico Eagle and Eldorado Gold broke support.

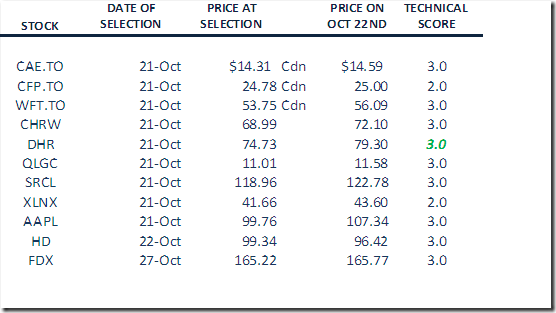

Monitored List of Technical/Seasonal Ideas

Green: Increased score

Red: Decreased score

Special Free Services available through www.equityclock.com

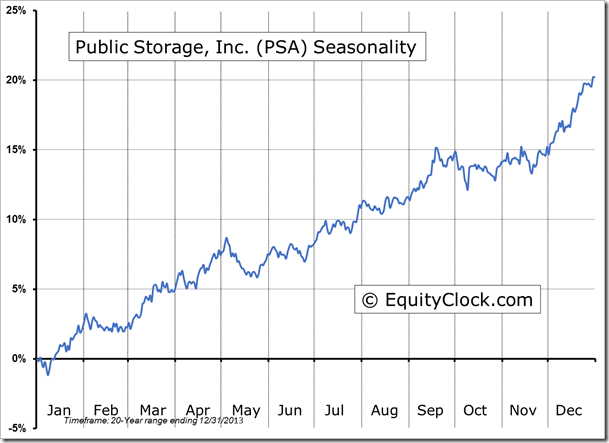

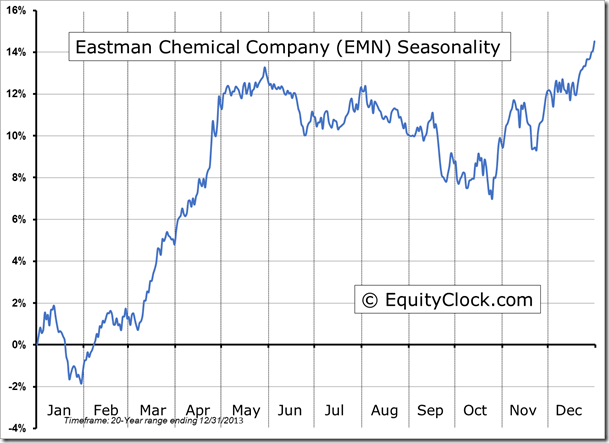

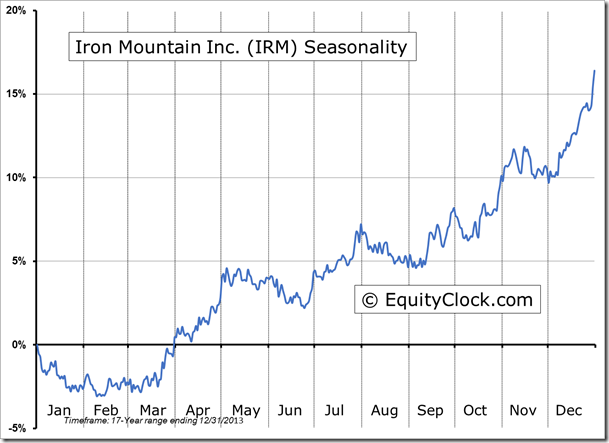

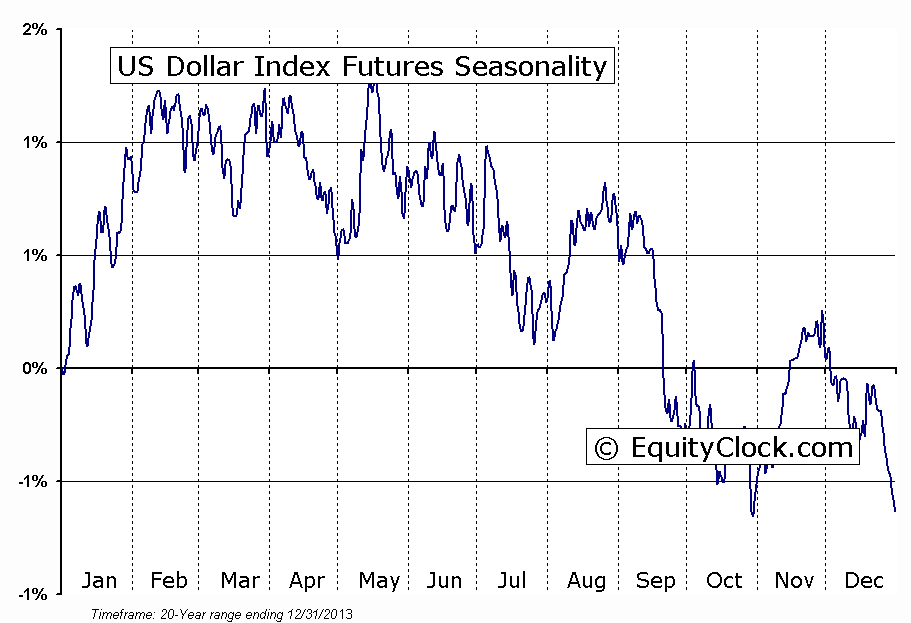

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/

Following is an example:

Disclaimer: Comments, charts and opinions offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed. Don and Jon Vialoux are Research Analysts with Horizons ETFs Management (Canada) Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons ETFs Management (Canada) Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons ETFs Management (Canada) Inc.

Individual equities mentioned in StockTwits are not held personally or in HAC.

Horizons Seasonal Rotation ETF HAC October 29th 2014

**NEW** As part of the ongoing process to offer new and up-to-date information regarding seasonal and technical investing, we are adding a section to the daily reports that details the stocks that are entering their period of seasonal strength, based on average historical start dates. Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

- No stocks identified for October 30th

The Markets

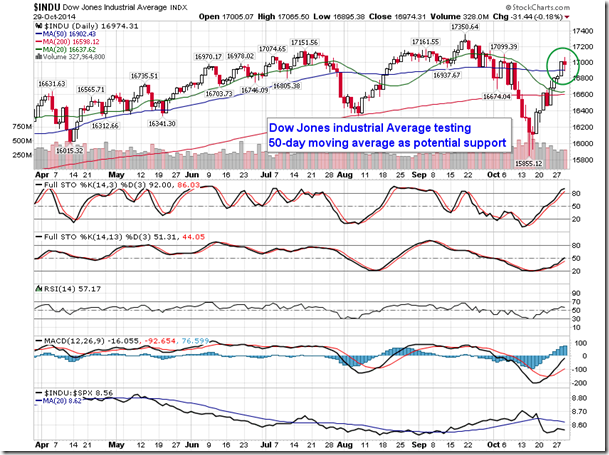

Stocks held around the flatline on Wednesday as investors showed a rather muted reaction to the FOMC announcement, which confirmed the conclusion to QE3. The Fed reiterated that it would hold its benchmark rate near zero for an extended period of time as the committee allows the market to gain a footing prior to the tightening process. Equities in the US will now have the opportunity to prove that they can remain supported based upon fundamentals alone, rather than the trillions of dollars worth of asset purchases that has created the motto “Don’t fight the Fed.” Following the statement release, the S&P 500 Index, Nasdaq Composite, and Dow Jones Industrial Average traded lower to test yesterday’s breakout level at the 50-day moving average, a level that is now implied to become support. The full extent of the reaction to the hawkish Fed statement may not be realized for another couple of days as investors mull the implications of the conclusion of quantitative easing in the midst of a still struggling global economy.

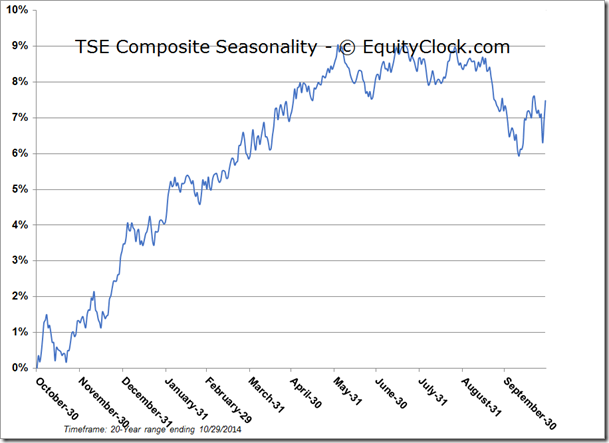

Although reaction in the equity market may have been muted, reaction in the currency market was obvious. The US Dollar Index jumped by three-quarters of one percent, reaching back towards the highs charted earlier this month. A short-term reverse head-and-shoulder pattern is apparent on the chart of the US Dollar Index ETF (UUP), suggesting further upside potential and the resumption of the positive trend that began in July. Although the gains in the currency over the past few months have not been typical, the currency index is now entering into a period when gains are the norm. The month of November tends to be one of the strongest months of the year for the currency on a frequency basis with gains realized in 65% of periods over the past 20 years. Average gain for the 11th month of the year is 0.6%, followed only by January as the second strongest monthly performance during the year. Corporations will tend to repatriate foreign profits back into the domestic currency both before and after the close of the year, leading to increased demand to buy dollars. Commodity and commodity sensitive equities are most at risk given the near parabolic rise in the US Dollar Index since the start of the last quarter; the materials sector was by far the weakest performer during Wednesday’s session, declining by 1.24% and maintaining a sharp trend of underperformance.

With the FOMC Announcement now behind us, investors will be looking towards the next major market moving catalyst, which looks to be the mid-term elections next week. As of present, the consensus is that the Republicans will gain control of the Senate, alleviating a bottleneck that has been holding back progress in passing legislation, potentially a bullish scenario for equity markets. Historically, the week of mid-term elections has been bullish for stocks with the S&P 500 Index averaging a gain of 1.61% since 1950. Gains were recorded in 88% of the periods as investors reacted positively to the election results. Best day of the election week was the session immediately following the election result; gains averaged 0.84% with a similar frequency of success of 88%. Gains of this magnitude would be enough to propel many of the major equity benchmarks in the US above resistance of the September highs, which would clear the way to new highs through the end of the year. A breakout above the previous high for a number of benchmarks, including the S&P 500, remains a requirement to confirm the conclusion to the recently formed negative trend that was derived following a break of the multi-year positive trendline at the end of last month.

| S&P 500 Index Returns Around Mid-Term Elections | ||

| Mid-Term Election Day | Day Following Election | Week Of Election |

| 11/02/10 | 0.37% | 3.60% |

| 11/07/06 | 0.21% | 1.22% |

| 11/05/02 | 0.91% | -0.69% |

| 11/03/98 | 0.70% | 3.85% |

| 11/08/94 | -0.05% | 0.02% |

| 11/06/90 | -1.80% | 0.61% |

| 11/04/86 | 0.15% | 0.73% |

| 11/02/82 | 3.91% | 6.31% |

| 11/07/78 | 0.64% | -1.47% |

| 11/04/74 | 2.78% | 1.77% |

| 11/03/70 | 0.20% | 1.17% |

| 11/08/66 | 0.81% | 1.40% |

| 11/06/62 | 0.62% | 1.78% |

| 11/04/58 | 0.91% | 1.81% |

| 11/02/54 | 2.04% | 3.25% |

| 11/07/50 | 1.03% | 0.45% |

| Average Return | 0.84% | 1.61% |

| Frequency of Success | 88% | 88% |

Sentiment on Wednesday, as gauged by the put-call ratio, ended bearish at 1.03.

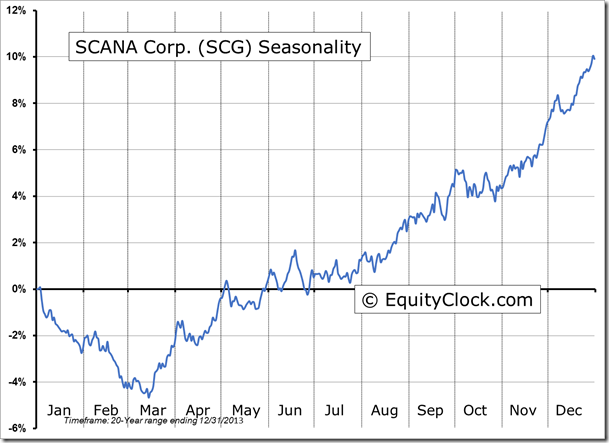

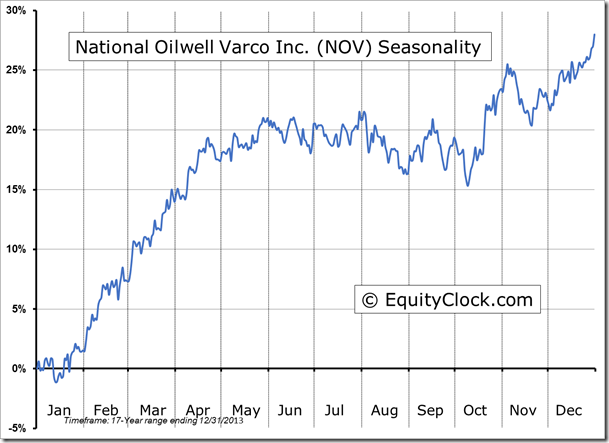

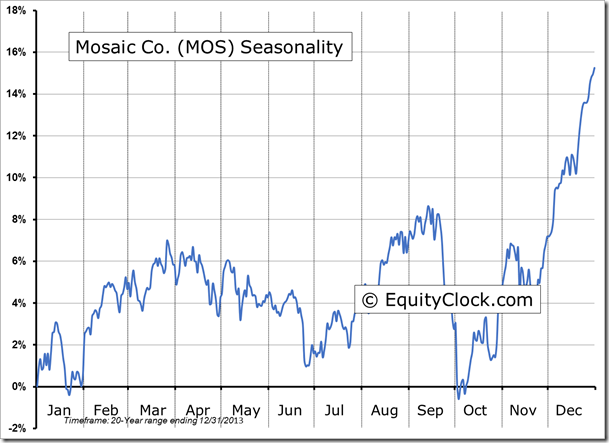

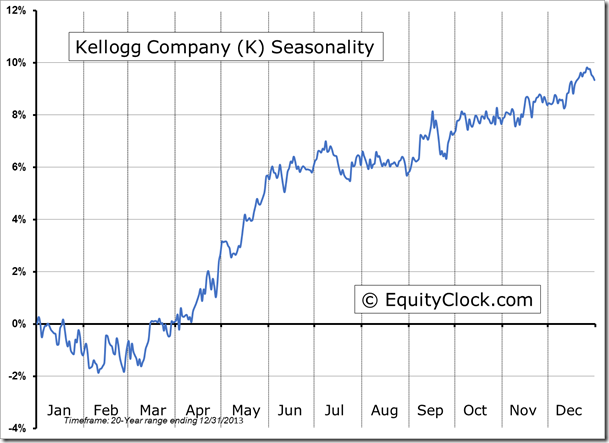

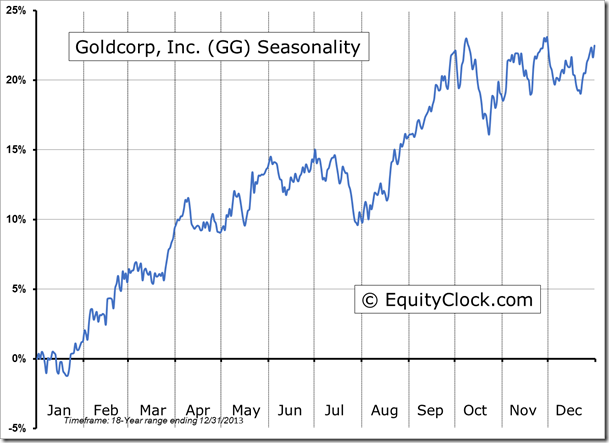

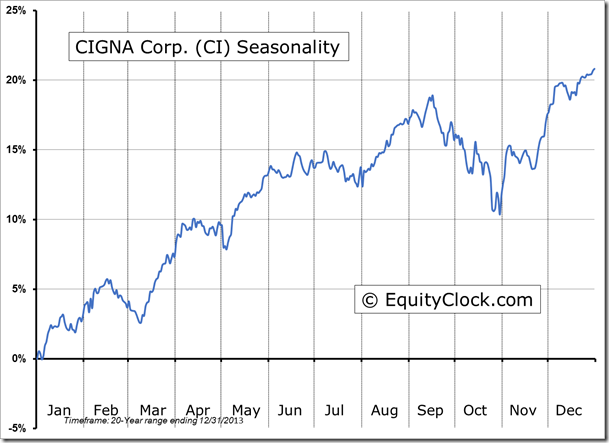

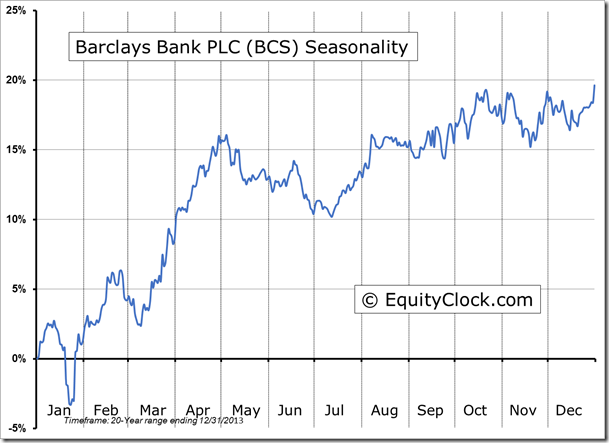

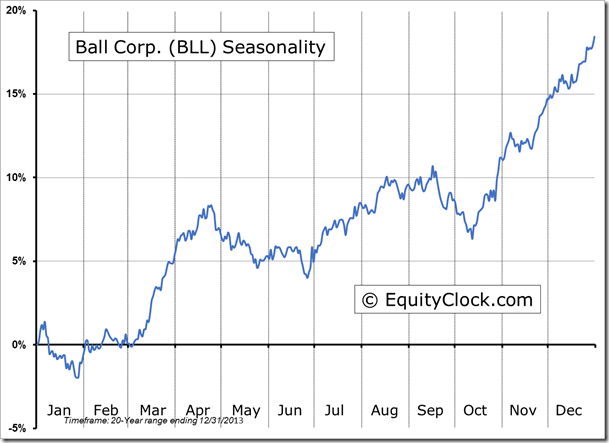

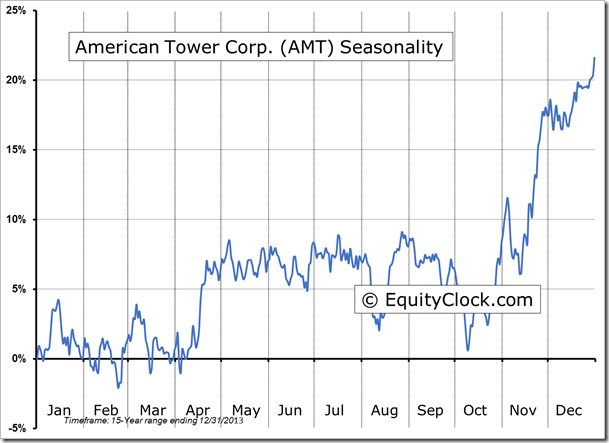

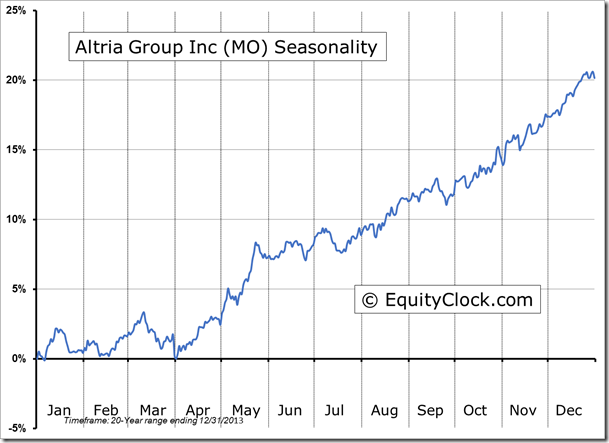

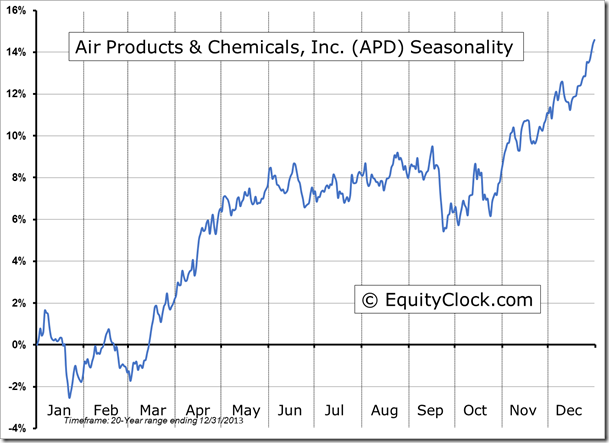

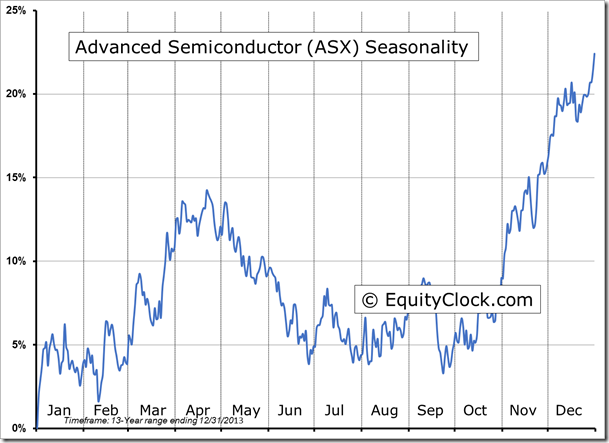

Seasonal charts of companies reporting earnings today:

S&P 500 Index

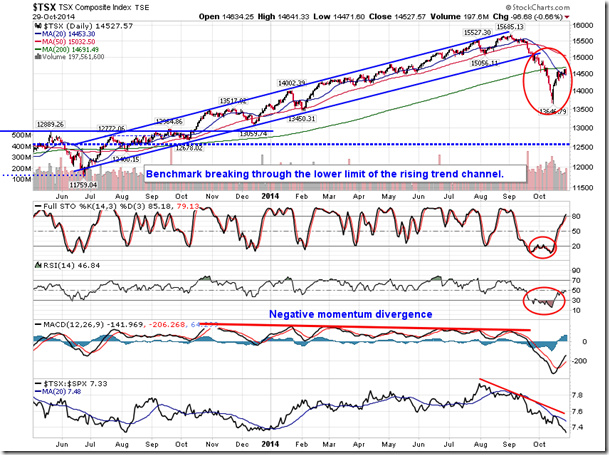

TSE Composite

Horizons Seasonal Rotation ETF (TSX:HAC)

- Closing Market Value: $14.28 (down 0.70%)

- Closing NAV/Unit: $14.32 (down 0.42%)

Performance*

| 2014 Year-to-Date | Since Inception (Nov 19, 2009) | |

| HAC.TO | 0.14% | 43.2% |

* performance calculated on Closing NAV/Unit as provided by custodian

Click Here to learn more about the proprietary, seasonal rotation investment strategy developed by research analysts Don Vialoux, Brooke Thackray, and Jon Vialoux.

Copyright © Don Vialoux, EquityClock.com

![clip_image002[5] clip_image002[5]](https://advisoranalyst.com/wp-content/uploads/HLIC/cf2e734a5aa417b78819b974b208b1c9.png)