by Cam Hui, Humble Student of the Markets

The parents fight and the kids hear everything. The younger, more naive ones, think that the parents are on the verge of a divorce, but nothing could be further from the truth. That`s the picture of Europe today. The outsiders are the young kids listening to the fights between European leaders.

Grand Plan 1.0

Recently, Mario Draghi outlined Version 2.0 of his Grand Plan for Europe. I have written about the first version before (see Mario Draghi reveals the Grand Plan and Draghi`s "growth pact" = Internal devaluation). To recap, Grand Plan 1.0 involves:

- The ECB taking steps to temporarily hold things together and buy time so that member eurozone governments enact reforms.

- The reforms include:

- Good austerity: Budget reduction through lower taxes and less government

- Structural labor market reforms to encourage labor flexibility and breaking the social compact of lifetime employment for entrenched older workers.

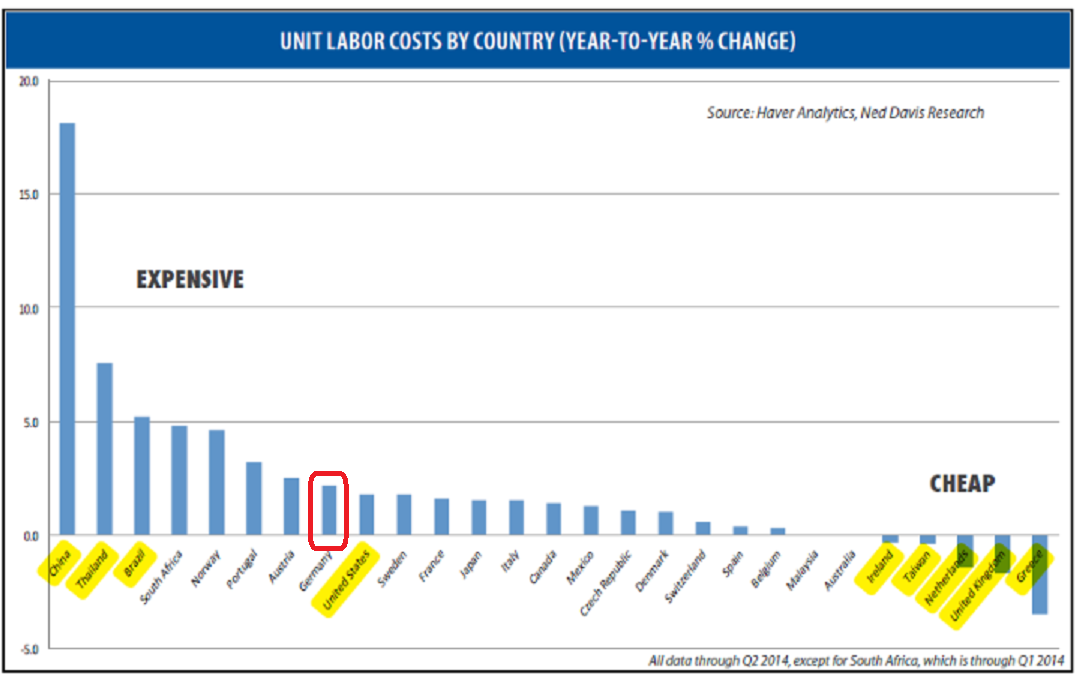

In a currency union, the peripheral countries cannot devalue their currency to become more competitive. They have to enact painful reforms that amount to internal devaluation. In effect, German wages go up and PIIGS wages go down. Despite the pain, those initiatives have largely pushed the eurozone in the right direction. As the chart from Ned Davis Research shows, progress continues as unit labor costs of most eurozone countries have declined YTD relative to Germany and indeed, EM manufacturing powerhouses like China.

Grand Plan 2.0

Now Mario Draghi has revealed his Grand Plan 2.0, which he outlined in a speech at the Brookings Institute while sharing the stage with the Fed`s Stanley Fischer (use this link if the video doesn`t work):

In his speech, Draghi outlined the third leg of Grand Plan. In addition to the components of Grand Plan 1.0, Grand Plan 2.0 includes infrastructure spending for member states that have the fiscal flexibility to do so. In practical terms, it's an infrastructure fiscal spending for structural reforms bargain within the eurozone.

"Infrastructure spending", them`s fighting words as they are evocative of the Keynesian solution of government make-work fiscal stimulus. The criticism of Jeremy Warner of The Telegraph is typical of the objection to such an initiative, which was also a growth strategy advocated by the IMF:

Infrastructure spending is a bit like motherhood and apple pie. Everyone can agree that it’s basically a good thing, serving the dual purpose of providing both a short-term boost to employment and, assuming it’s wisely allocated, a long-term increase in the economy’s productive potential.

But to think that in itself such spending provides a solution is a complete misdiagnosis of the problem.

Warner explained that many European countries don`t need more infrastructure, so why build more bridges to nowhere?

Nor, in any case, is it always worthwhile. No one would think that the economic stagnation which has settled on France is for want of infrastructure spending – it has some of the best infrastructure anywhere in the world.

Similarly, some of the other troubled economies of the eurozone – Spain, with its empty regional airports, and Portugal and Ireland with their traffic-free highways – hardly need more such spending. As in China, the problem in these countries has if anything been one of over-investment, rather than lack of it.

There is also a basic problem that afflicts all publicly initiated infrastructure spending – much of the time, it is guided by government vanity and pork barrel politics. Glamour projects, such as high speed rail, tend to assume precedence over more mundane, but perhaps better targeted, spending on improving the existing transport network.

A different kind of infrastructure

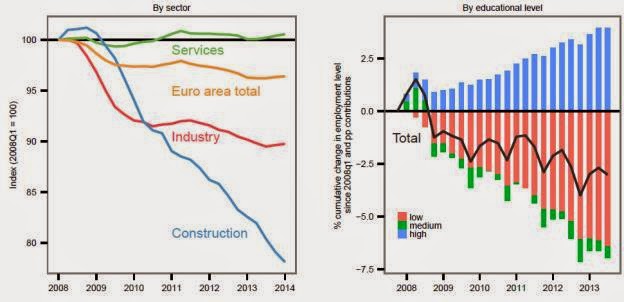

As you watched the video, Draghi proposed a more subtle approach to infrastructure spending that just building highways and bridges. He referenced digital infrastructure and categorized spending on education as infrastructure spending. He said that it is not a coincidence that underperforming countries also scored badly on global education standards (presumably like PISA tests). Draghi referenced the benefits of education in a Jackson Hole speech that he made this year:

Perhaps Draghi was thinking about the kinds of apprenticeship programs implemented in Germany as a model for the rest of Europe. Consider this Quartz story about these programs. While the focus of the article was transplanting apprenticeships to the US, the comments could be applied to other parts of Europe as well:

This doesn’t mean the system can’t be adapted if we start with our eyes open and a full understanding of the differences between the two countries. What’s likely to drive programs, in the US as in Germany, is the need for talent. “German companies want to train,” one trade association executive told us, “because they know the schools can’t do it. Especially in today’s tech economy, vocational schools alone can’t prepare the workers we need.”

As with the kind of reforms undertaken with Grand Plan 1.0, these kinds of initiatives are much harder to achieve than politicians deciding to write a cheque for more roads, railways and airports. These kinds of changes are hard and take a lot of work. Draghi was probably thinking of the kinds of achievements outlined in this Project Syndicate essay (Make your own Silicon Valley), where Finland created a cluster of gaming startups that export 90% of their products and the Dutch started a big-data hub that resulted in the Netherlands Institute for Radio Astronomy.

Looking through the Sturm und Drang

No one said that these changes are going to be easy, but my guess that Europe will eventually move in that direction.

Currently, there are numerous German objections to the plan for more fiscal spending, but the Germans will eventually waver. That`s because France is becoming the new sick man of Europe. The French-German alliance represents the heart of Europe. No doubt we will see lots of German protest and likely 2011-style emergency-summits-every-other-week before this is over, but everyone involved understands that France is too big to save.

In addition, German growth is starting to tank and that will create internal pressure for Berlin to act:

The German government on Tuesday slashed its growth outlook, saying the country's economy was navigating "difficult waters" because of worsening conditions around the world.

German Economics Minister Sigmar Gabriel said Berlin expected gross domestic product (GDP) to expand by only 1.2 percent in 2014, down from an earlier estimate of 1.8 percent. He also revised projections for next year to 1.3 percent annual growth from 2 percent.

"Geopolitical crises have also increased uncertainty in Germany with the only moderate global economic development acting as a drag on the economy," Gabriel added.

Even German states are pleading for the central government to take action in the face of slowing growth (via Bloomberg):

Germany’s state governments stepped up calls for infrastructure spending, adding another source of pressure on Chancellor Angela Merkel to boost investment as economic growth falters.

Much like Merkel’s national government, the states are caught between a deteriorating growth outlook and the balanced-budget drive that Germany started in response to the euro area’s debt crisis. It’s making the 16 regions set aside political differences to challenge the status quo, from rich Bavaria to rural Mecklenburg-Western Pomerania in the east, home to Merkel’s electoral district.

A day after the German government lowered its growth outlook, proposals to spend more on projects such as highways in Europe’s biggest economy are on the table at a retreat of state premiers starting today that Merkel plans to attend.

“To unleash growth impulses, additional investment is needed in infrastructure and other future-oriented sectors,” according to a summary of the states’ negotiating position in fiscal talks with the federal government that was prepared for the meeting in Potsdam and obtained by Bloomberg News. The states want a “lasting” funding boost, saying a lack of spending is holding back economic development nationwide.

The struggle in Germany parallels the international conflict pitting Merkel and Finance Minister Wolfgang Schaeuble against the International Monetary Fund and countries such as France and Italy that advocate spending to stimulate growth.

The theatre may be upsetting for some, but Europe is a place where the elite makes deals behind closed doors. Watch for Merkel et al to relent and effect a fiscal stimulus for structural reform bargain, but not before a lot of Sturm und Drang to show the hardliners that they tried but compromised for the sake of European unity. José Manuel Barroso wrote that unity is the "is a condition sine qua non of the EU’s economic prosperity and political relevance" and it is a quality that embedded in the DNA of every member of the European elite. Everyone understands those core values.

Watch for the endpoint. The Draghi Grand Plan 2.0 will implemented in some fashion.

Copyright © Cam Hui, Humble Student of the Markets