by Don Vialoux, EquityClock.com

Pre-opening Comments for Wednesday October 22nd

U.S. equity index futures were lower this morning. S&P 500 futures were down 2 points in pre-opening trade.

Index futures were virtually unchanged following release of the September Consumer Price report. Consensus was unchanged versus a decline of 0.2% in August. Actual was a gain of 0.1%. Excluding food and energy, consensus was an increase of 0.2% versus no change in August. Actual was an increase of 0.1%.

Third quarter reports continue to pour in. Companies that reported this morning included Abbott Labs, Biogen Idec, Boeing, Dow Chemical, EMC, Glaxo Smith Kline, Ingersoll-Rand, Northrop, Stanley Black & Decker, Xerox and Yahoo.

Coca Cola fell $0.28 to $40.40 after Societe Generale downgraded the stock from Hold to Sell.

OMC (OMC $69.01) is expected to open lower after Goldman Sachs downgraded the stock from Neutral to Sell. Target is $64.

Texas Instruments added $0.48 to $47.25 after Bernstein upgraded the stock from Market Perform to Outperform. Target is $54.

Yahoo added $2.12 to $42.30 after Bank of America/Merrill upgraded the stock from Market Perform to Outperform. Target is $50.

EquityClock.com’s Daily Market Comment

Following is a link:

http://www.equityclock.com/2014/10/22/stock-market-outlook-for-october-22-2014/

Note the list of individual equities that are entering their period of seasonal strength

StockTwits released yesterday @equityclock

Technicals for S&P 500 stocks at 10:45 AM: Bullish. 13 stocks broke resistance including 5 consumer discretionary stocks.

S&P 500 stocks breaking resistance: $AZO, $DHI, $DLTR, $GPC, $TWX, $RAI, $TSO, $WAT, $CHRW, $AAPL, $BLL, $SHW, $SRCL

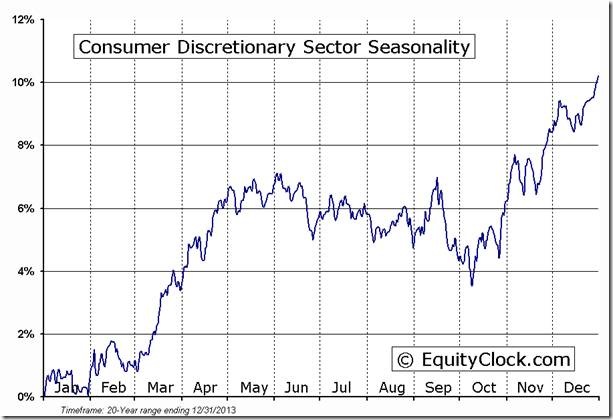

Consumer Discretionary stocks that broke resistance were $AZO, $DHI, $DLTR, $GPC, $TWX. ‘Tis the season!

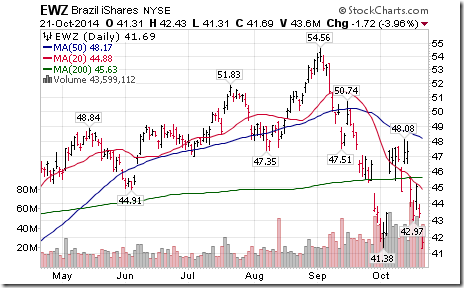

Brazil iShares break support on election polls favouring current President. Election this weekend.

Technical Action by Individual Equities

By the close, 23 S&P 500 stocks had broken resistance and none had broken support.

No TSX 60 stocks broke intermediate support or resistance.

Interesting Charts

More technical evidence that the S&P 500 Index reached an intermediate low last Thursday! The Index recovered above its 20 and 200 day moving averages and its short term momentum indicators continue to trend higher.

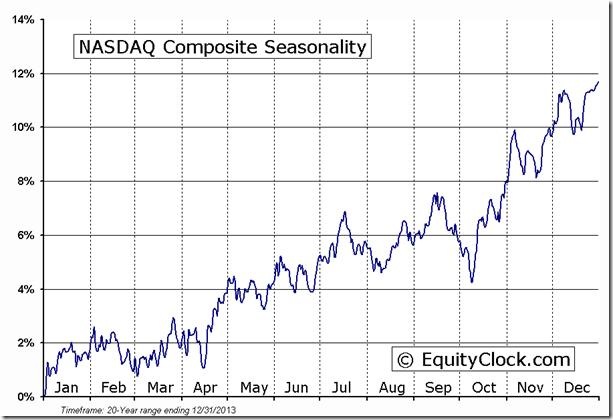

Ditto for the NASDAQ Composite Index! It also has started to outperform the S&P 500 Index. ‘Tis the season!

Update on the Monitored List of Technical/Seasonal Ideas

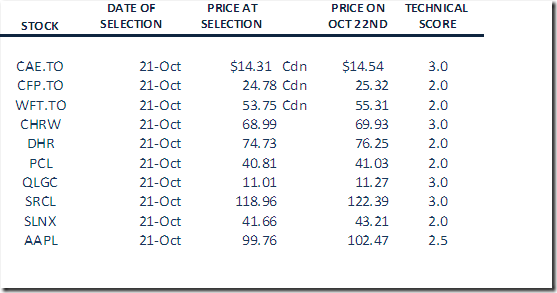

Yesterday’s Tech Talk added 11 individual equities to the Monitored List. Requirements for the 11 stocks were that they had to have a technical score of 2.0 or higher out of 3.0, they had to have entered their period of seasonal strength recently and they had to be economic sensitive. (i.e in the materials, technology, industrials or consumer discretionary sectors). Following is an update:

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/

Following is an example:

FP Trading Desk Headline

FP Trading Desk headline reads, “David Rosenberg sounds pretty bearish on oil”. Following is a link:

Disclaimer: Comments, charts and opinions offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed. Don and Jon Vialoux are Research Analysts with Horizons ETFs Management (Canada) Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons ETFs Management (Canada) Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons ETFs Management (Canada) Inc.

Individual equities mentioned in StockTwits are not held personally or in HAC.

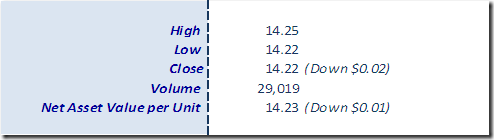

Horizons Seasonal Rotation ETF HAC October 21st 2014

Copyright © Don Vialoux, EquityClock.com