by Eddy Elfenbein, Crossing Wall Street

Last quarter was another strong quarter for dividends. For the first time ever, the S&P 500 paid out more than $10 per share in dividends. (That’s the dividend-adjusted number; every $1 on the index is worth about $8.88 billion.)

Dividends for Q3 were $10.02 per share which is an increase of 12.50% over last year’s Q3. Note that over the same time, the index has increased its price by 17.29%. So in terms of dividend yield, the S&P 500 has a slightly higher valuation but both dividends and stock prices are growing roughly inline with each other. That’s why I think much of this “bubble” talk is very premature.

Dividends have grown by more than 10% for 14 of the last 15 quarters. The only exception was the fourth quarter of last year, and that’s because the fourth quarter of 2012 had been unusually strong (+22.77%) so investors could take advantage of the new tax laws. Dividends for Q3 are up more than 77% from the third quarter of 2010 while the index is up by 73%. Yes, the dividend yield is slightly higher than what it was four years ago. Some bubble.

Over the last four quarters, the S&P 500 has paid out $38.49 in dividends. Going by the index’s close on Tuesday (1,972.29) that comes to trailing dividend yield of 1.95%.

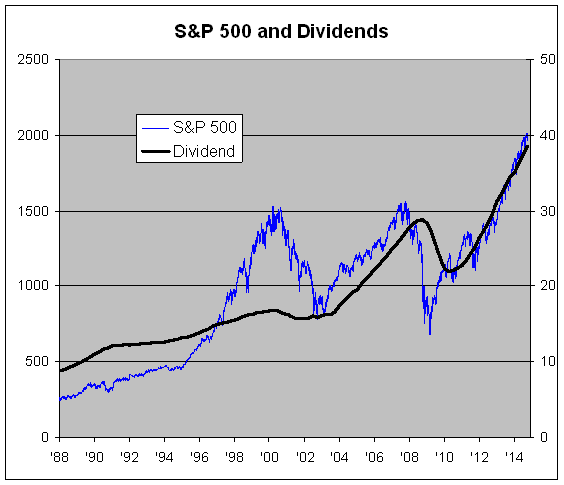

Here’s a chart showing the S&P 500 (in blue, left scale) along with dividends (in black, right scale). The two lines are scaled at a ratio of 50-to-1 which means that whenever the lines cross, the trailing yield is exactly 2%. For the last three years, both lines have stuck by each other pretty closely. You can also see how cheap the market was in early 2009.

Eddy Elfenbein

Copyright © Crossing Wall Street