by Don Vialoux, Timing the Market

Pre-opening Comments for Thursday September 18th

U.S. equity index futures were higher this morning. S&P 500 futures were up 5 points in pre-opening trade.

Index futures eased slightly following release of economic news at 8:30 AM EDT. Consensus for Weekly Jobless claims was a decline to 305,000 from 316,000 last week. Actual was a decline to 280,000. Consensus for August Housing Starts was 1,045,000 versus 1,120,000 in July. Actual was 956,000.

Peabody dropped $0.39 to $13.80 after Goldman Sachs downgraded the stock from Neutral to Sell. Target price is $13.

Dupont added $0.49 to $69.74 after JP Morgan upgraded the stock from Neutral to Overweight. Target is $75.

Monsanto gained $0.96 to $114.65 after Stiffel Nicolaus upgraded the stock from Hold to Buy. Target is $135.

Owens Illinois (OI $28.58) is expected to open lower after Macquarie downgraded the stock from Outperform to Neutral. Target is $32.

EquityClock.com’s Daily Comment

Following is a link:

http://www.equityclock.com/2014/09/18/stock-market-outlook-for-september-18-2014/

Responses to Yellen’s Press Conference

Several initial mild reactions!

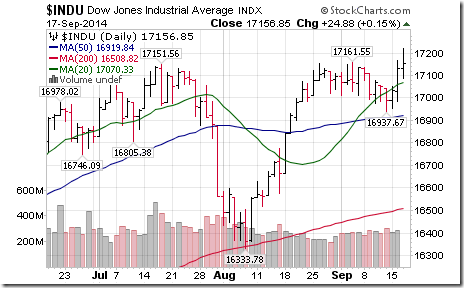

· U.S. equity indices moved higher. The Dow Jones Industrial Average and the Dow Jones Transportation Average moved to new all-time highs. However, most of the gain was erased by the close.

· Treasury bond yields moved higher

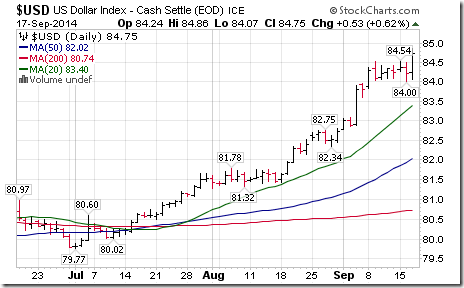

· The U.S. Dollar moved higher

· Commodity prices moved lower (crude oil, gold, silver, copper, aluminum)

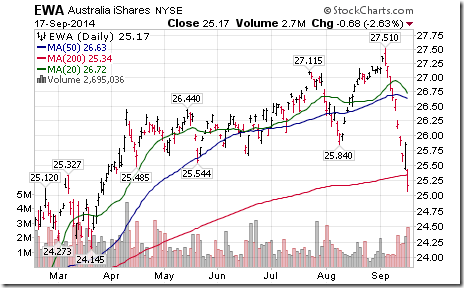

· Equity indices outside of the U.S. and their related ETFs moved lower in response to strength in the U.S. Dollar and weakness in commodity prices (e.g. TSX Composite, Australia All Ordinaries)

StockTwits Yesterday

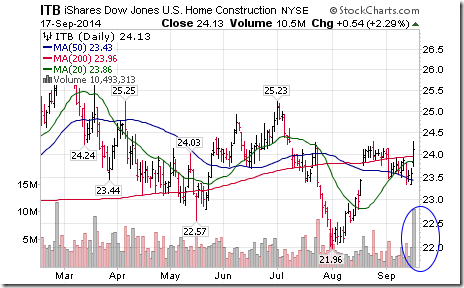

U.S. Homebuilders ETF ($ITB) moving higher after $LEN reported higher than consensus results. Breakouts by $DHI, $PHM

Bullish technical action by S&P stocks to 11:00. 10 stocks broke resistance and two broke support.

Technical Action by Individual Equities

By the close, 13 S&P 500 stocks broke resistance and three stocks broke support. Only one stock broke resistance following Yellen’s press conference, Wells Fargo.

No TSX 60 stock broke support or resistance.

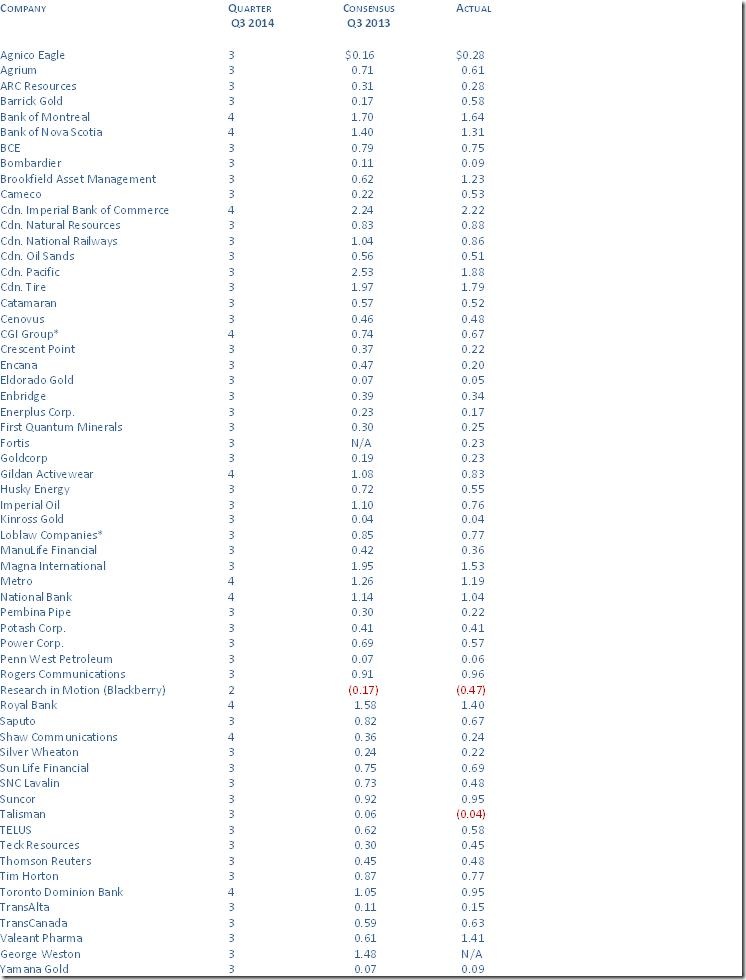

Third Quarter Consensus Earnings per Share Estimates for TSX 60 Companies

Canada’s top 6o companies are scheduled to report a healthy year-over-year gains in the third quarter. Average (median) increase is 10.4%. Forty three companies are expected to report higher results, fifteen companies are expected to report lower results and two companies lack sufficient data. Companies expected to report the highest percent increase are Shaw Communications, SNC Lavalin, Canadian Pacific, Encana and Crescent Point.

Yamana Gold 3 0.07 0.09

*Median companies

Estimates from Zacks Investment Research

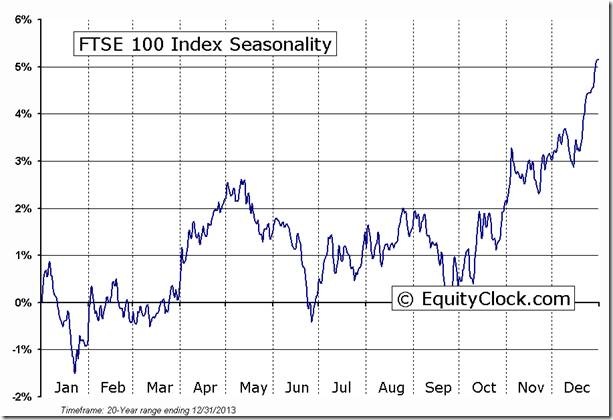

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/

Following is an example:

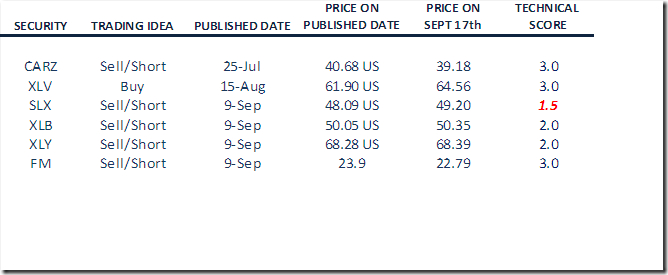

Monitored Technical/Seasonal Trade Ideas

$CEX was deleted at a loss of 0.90% after its technical score fell below 1.5.

A security must have a Technical Score of 1.5 – 3.0 to be on this list.

Green: Increased Technical Score

Red: Reduced Technical Score

Disclaimer: Comments, charts and opinions offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed. Don and Jon Vialoux are Research Analysts with Horizons ETFs Management (Canada) Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons ETFs Management (Canada) Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons ETFs Management (Canada) Inc.

Individual equities mentioned in StockTwits are not held personally or in HAC.

Horizons Seasonal Rotation ETF HAC September 17th 2014

Copyright © Don Vialoux, Jon Vialoux, Brooke Thackray

![clip_image002[5] clip_image002[5]](https://advisoranalyst.com/wp-content/uploads/HLIC/fe2659287bead4442077a582f73e14eb.png)