by Don Vialoux, Timing the Market

Interesting Charts

More technical evidence that crude oil prices have bottomed! Yesterday, crude moved above its 20 day moving average, started to show improving short term momentum indicators and showed early signs of outperformance relative to the S&P 500 Index.

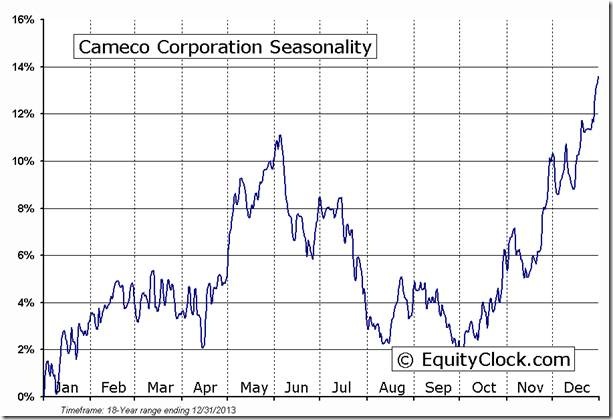

Oil prices are not the only energy prices to move higher. The spot price for uranium increased another $1.25 to $34.00 U.S. per lb. last week. Spot uranium prices have increased 22.5% during the past two months. Uranium stock prices are showing early signs of bottoming.

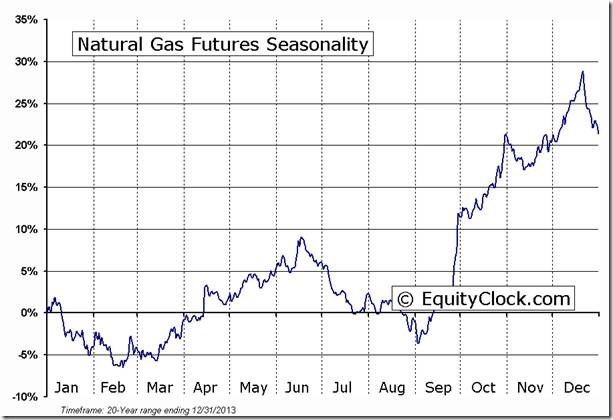

Natural gas prices also are showing early signs of bottoming. ‘Tis the season! A break above $4.10 will complete a base building pattern.

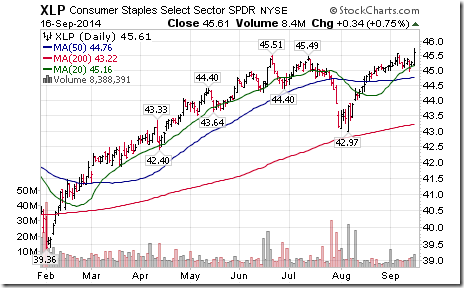

Defensive stocks are leading U.S. equity indices on the upside. Strongest SPDRs yesterday were Utilities, Health Care and Consumer Staples. XLP and XLV reached all-time highs. ‘Tis the season! Weakest sectors yesterday relative to the S&P 500 Index were Materials, Consumer Discretionary and Industrials.

Not all equity markets were moving higher yesterday. Watch out for developments in Greece!

StockTwits Yesterday @equityclock

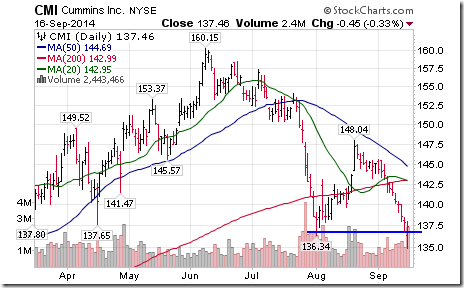

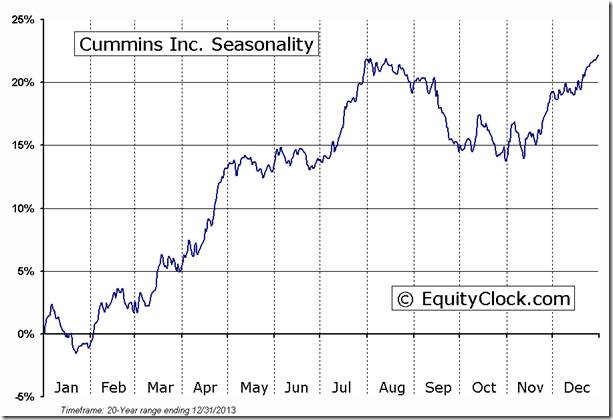

Quiet technical action by S&P stocks to 11:00 AM. $CMI and $WU broke support. None broke resistance.

‘Tis the season for weakness in Cummins ($CMI) and related auto sector stocks ($CARZ)

With the DJIA at an all-time high this afternoon, only three S&P stocks broke resistance:

$BK, $PRU, $DHR

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/

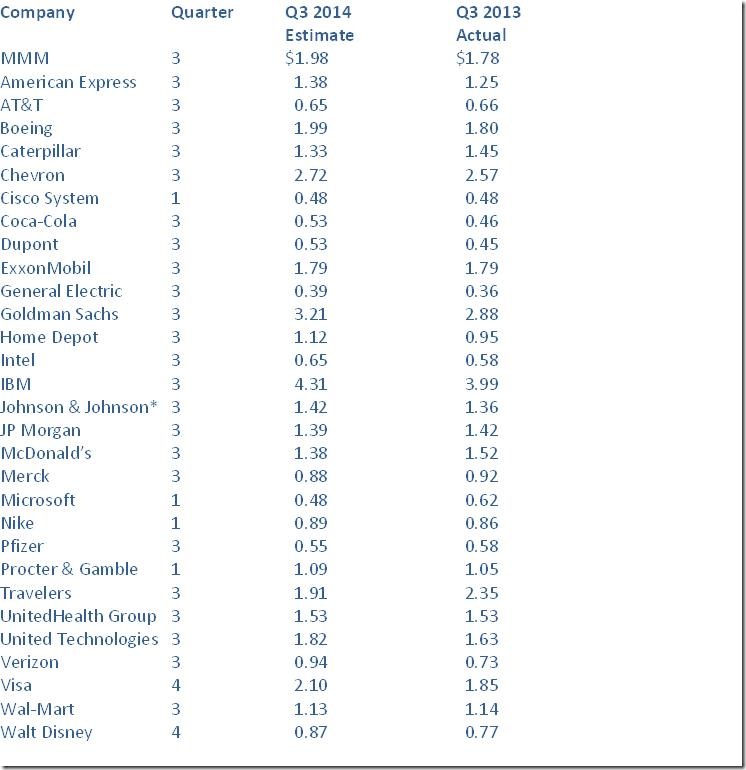

Third Quarter Earnings Expectations for Dow Jones Industrial Average Companies

Consensus third quarter earnings per share estimates show only modest gains relative to results in the same quarter last year. Average (median) gain is only 4.4%. Nine companies are expected to report lower year-over-year earnings, three companies are expected to report no change and 18 companies are expected to show gains. Companies expected to report the highest percent gains are Verizon, Home Depot and Coca Cola.

A word of caution! With a few exceptions where guidance recently was lowered (e.g. McDonalds and Wal-Mart), consensus estimates likely are high. Analysts have yet to adjust revenues and earnings to reflect recent strength in the U.S. Dollar.

Following is the data

*Median company

Estimates from Zacks Investment Research

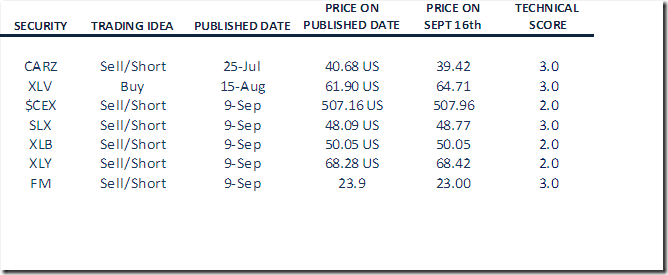

Monitored Technical/Seasonal Trade Ideas

A security must have a Technical Score of 1.5 – 3.0 to be on this list.

Green: Increased Technical Score

Red: Reduced Technical Score

Disclaimer: Comments, charts and opinions offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed. Don and Jon Vialoux are Research Analysts with Horizons ETFs Management (Canada) Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons ETFs Management (Canada) Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons ETFs Management (Canada) Inc.

Individual equities mentioned in StockTwits are not held personally or in HAC.

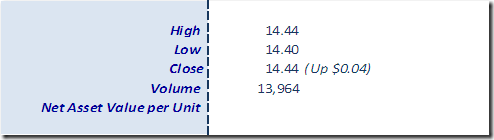

Horizons Seasonal Rotation ETF HAC September 16th 2014

Copyright © Don Vialoux, Jon Vialoux, Brooke Thackray