by Don Vialoux, Timing the Market

Pre-opening Comments for Tuesday September 16th

U.S. equity index futures were lower this morning. S&P 500 futures were down 3 points in pre-opening trade.

Index futures were virtually unchanged following release of the August Producer Prices report. Consensus was unchanged from July. Actual was unchanged. Excluding food and energy, consensus was an increase of 0.1% from July. Actual was an increase of 0.2%.

Microsoft added $0.16 to $46.40 after Royal Bank Capital initiated coverage with an Outperform rating.

Peabody Energy fell $0.22 to $13.90 after Northland Securities downgraded the stock from Neutral to Reduce.

Lions Gate Entertainment (LGF $33.80) is expected to open higher after ISI Group initiated coverage with a Buy rating. Target is $41.

Pepsico (PEP $91.20) is expected to open higher after Cowen initiated coverage with an Outperform rating. Target is $106.

Molson Coors (TAP $76.00) is expected to open higher after Cowen initiated coverage with an Outperform rating.

MasterCard gained $0.56 to $75.80 and Visa increased $0.84 to $215.48 after Bernstein and Sterne Agee initiated coverage with Outperform/Buy ratings

EquityClock.com’s Daily Market Comment

Following is a link:

http://www.equityclock.com/2014/09/16/stock-market-outlook-for-september-16-2014/

Jon Vialoux on BNN’s “Market Call Tonight” Yesterday

Following are links:

http://www.bnn.ca/Video/player.aspx?vid=441146

http://www.bnn.ca/Video/player.aspx?vid=441149

http://www.bnn.ca/Video/player.aspx?vid=441156

http://www.bnn.ca/Video/player.aspx?vid=441160

http://www.bnn.ca/Video/player.aspx?vid=441173

http://www.bnn.ca/Video/player.aspx?vid=441175

http://www.bnn.ca/Video/player.aspx?vid=441188

http://www.bnn.ca/Video/player.aspx?vid=441179

Interesting Charts

Weakest sector yesterday was the Technology sector. XLK fell below its 20 day moving average and short term momentum indicators are trending down. Institutional investors are raising funds to purchase Alibaba by taking profits in the technology sector.

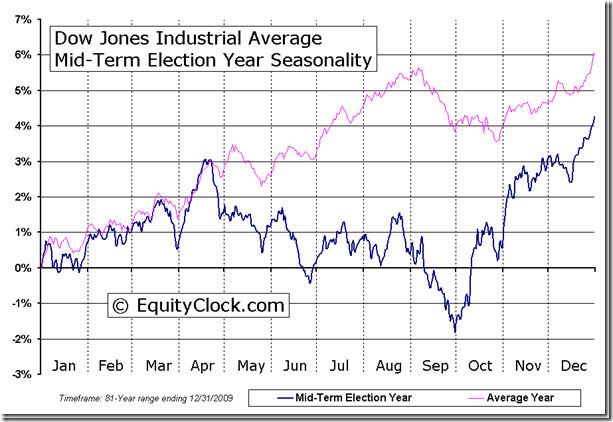

More signs that U.S. equity markets have entered a corrective phase! VIX Index spiked again.

StockTwits released yesterday @equityclock

Technicals on S&P stocks to 10:30: bearish. 2 stocks broke resistance: $TAP, $PBCT. 9 broke support: $JCI, $APC, $NE, $BCR, $STJ, $ETN, $JOY, $JNPR, $RHT.

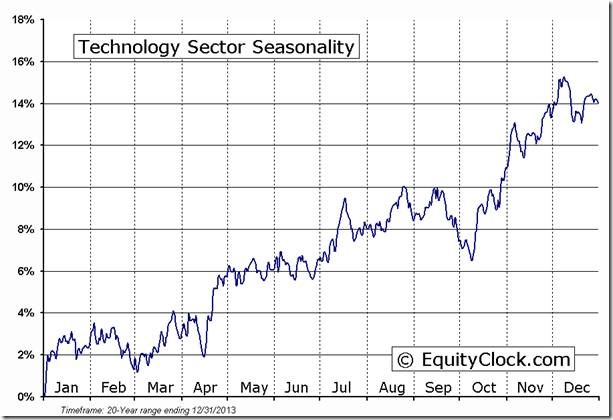

Two more technology stocks broke support: $CRM, $WDC. ‘Tis the season for weakness in Technology!

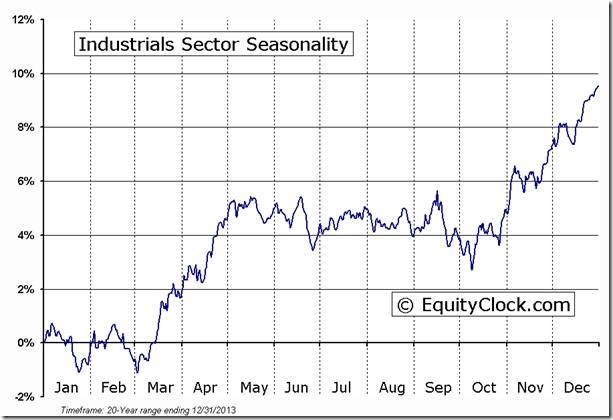

$XLI broke support at $53.80. ‘Tis the season for weakness in the Industrial sector!

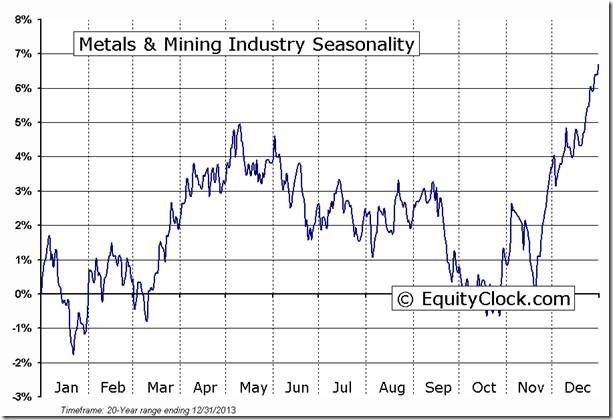

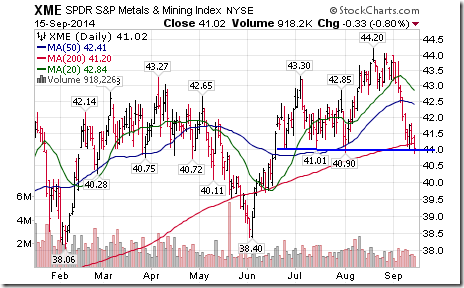

$XME broke support at $40.90. ‘Tis the season for weakness in the Metals & Mining sector!

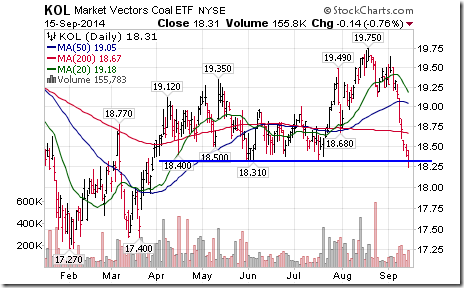

A major reason for weakness in $XME is a breakdown by $KOL below support at $18.31. Coal stocks lower.

Base metal prices are under pressure following China slowdown (e.g. $JJU )

Technical Action by Individual Equities

By the close, two S&P 500 stocks had broken resistance and 13 had broken support.

FP Trading Desk Headline

FP Trading Desk headline reads, “Why the S&P 500 is struggling to get past 2,000”. Following is a link:

http://business.financialpost.com/2014/09/15/why-the-sp-500-is-struggling-to-get-past-2000/

Weekly Tech Talk/Horizons Seasonal/Technical Sector Report

Following is a link:

http://www.horizonsetfs.com/campaigns/TechnicalReport/index.html

Note the change in format (Includes technical scores)

Adrienne Toghraie’s “Trader’s Coach” Column

|

Dream Trading Success

By Adrienne Toghraie, Trader’s Success Coach

In order to reach a dream there must be pictures and dialogue. The more vivid the pictures and detailed dialogue, the more you impress upon your mind’s eye that you are serious about heading in the direction of your dream.

Ground Hog day

Every year for the last eleven years I hear from a trader who explains to me in detail why he cannot work with me privately. It is important to note that he contacts me without my reaching out to him.

I looked back at the letters he has written me over the years and they are basically the same in content. What this tells me about this trader is that the pictures that he has created are not compelling enough to justify making the kind of changes that he thinks he wants, or he just feels he should be able to do it without any assistance.

I asked him to email me a letter where he saw himself as already achieving his dreams for being a profitable trader. Here is some of what he wrote:

“I see myself as being a philanthropist to children. If only I could stick with my strategy, and overcome the fear that holds me back from making the profits I know I can make. In this picture I’m happy and my family is very encouraging. It is unlikely that my family could ever be encouraging, because it is not in their nature to be so.”

The superfluous dialogue needs to be removed from his dialogue and so do the conflicting pictures that he gives himself.

Dreaming the positive dream

Contrast the above trader with a trader who sent me this letter a few years ago:

“I have been through your Home Study Course 5 times while getting myself ready to be a successful trader. In 3 years I should be ready to launch my career with enough money, and a good strategy that is part of my business plan. My family is almost as excited as I am and supports me towards my goal. I see myself giving them a good life.”

I am happy to report that this trader is now living his dream.

Strategy for dreaming

Make sure that negative dialog and pictures are not a part of your dream. You do this by:

· Creating a dialog about how you want your life to be in a year and then in five years

· Be succinct with the words you use, example:

I am happy, wealthy, and healthy, and know and follow a good strategy

· Make sure that every part of that dialog is positive by having a friend or spouse check out your words

· Create a picture of yourself as if you have already achieved that dream

· Detail what you see to your friend or spouse and make sure that they listen for anything that might sound like something that could keep you from this picture

· Dream this dream repeatedly adding detail to the picture, example:

I see myself with a big smile looking at a summary of all of my bank accounts; there are worn golf clubs in the background. It is a sunny day and my family and friends can be seen outside the window preparing a feast to celebrate our success.

Conclusion

The dreams that you dream are the future that you prepare your mind to receive. When you dream about being a successful trader, make a conscious choice detailing what that looks like until your emotions compel you towards the right choices.

Adrienne’s Free Webinars

Adrienne presents free webinars on the psychology of trading

Email Adrienne@TradingOnTarget.com

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/

Following is an example

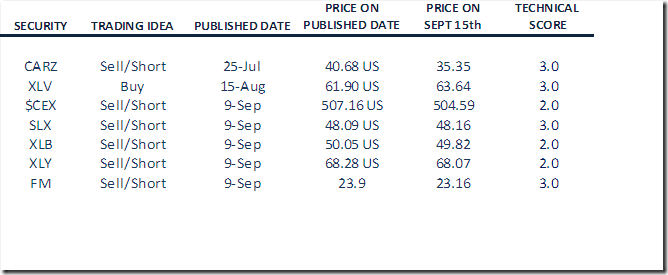

Monitored Technical/Seasonal Trade Ideas

IBB was deleted for a profit of 1.9% after its technical score fell below a technical score of 1.5.

A security must have a Technical Score of 1.5 – 3.0 to be on this list.

Green: Increased Technical Score

Red: Reduced Technical Score

Disclaimer: Comments, charts and opinions offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed. Don and Jon Vialoux are Research Analysts with Horizons ETFs Management (Canada) Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons ETFs Management (Canada) Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons ETFs Management (Canada) Inc.

Individual equities mentioned in StockTwits are not held personally or in HAC.

Horizons Seasonal Rotation ETF HAC September 15th 2014

Copyright © Don Vialoux, Jon Vialoux, Brooke Thackray

![clip_image002[5] clip_image002[5]](https://advisoranalyst.com/wp-content/uploads/HLIC/22f8a176f93ef5d6477c079593bd09de.png)