by Ben Carlson, A Wealth of Common Sense

“The wonderful thing about emerging markets is that they can get terribly cheap from time to time.” – William Bernstein

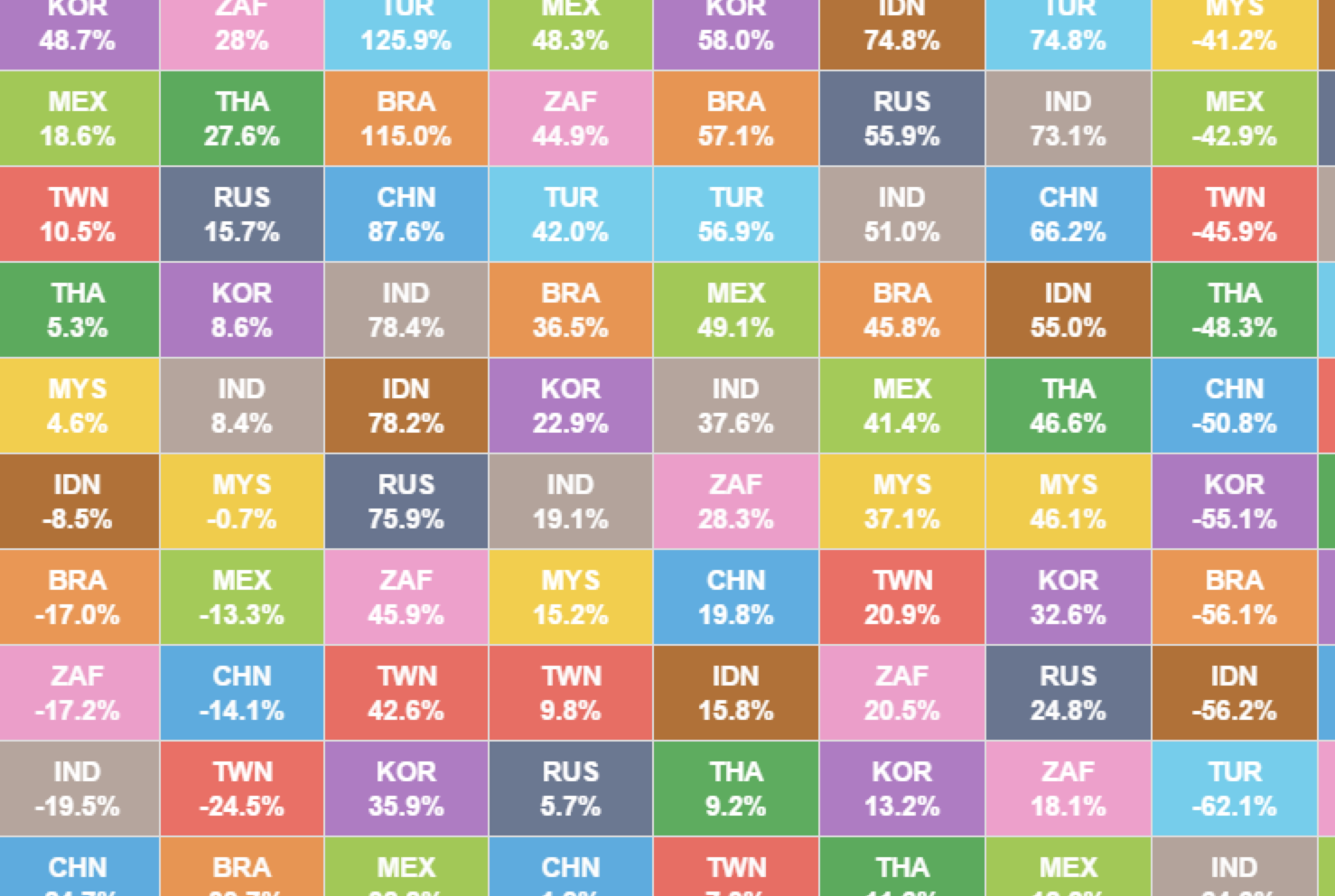

The quilt above, courtesy of the Novel Investor, shows the annual performance numbers for the largest emerging market countries going back to the year 2000. Like any asset allocation quilt, it looks like complete chaos from year to year as there’s no consistency in the best or worst performers.

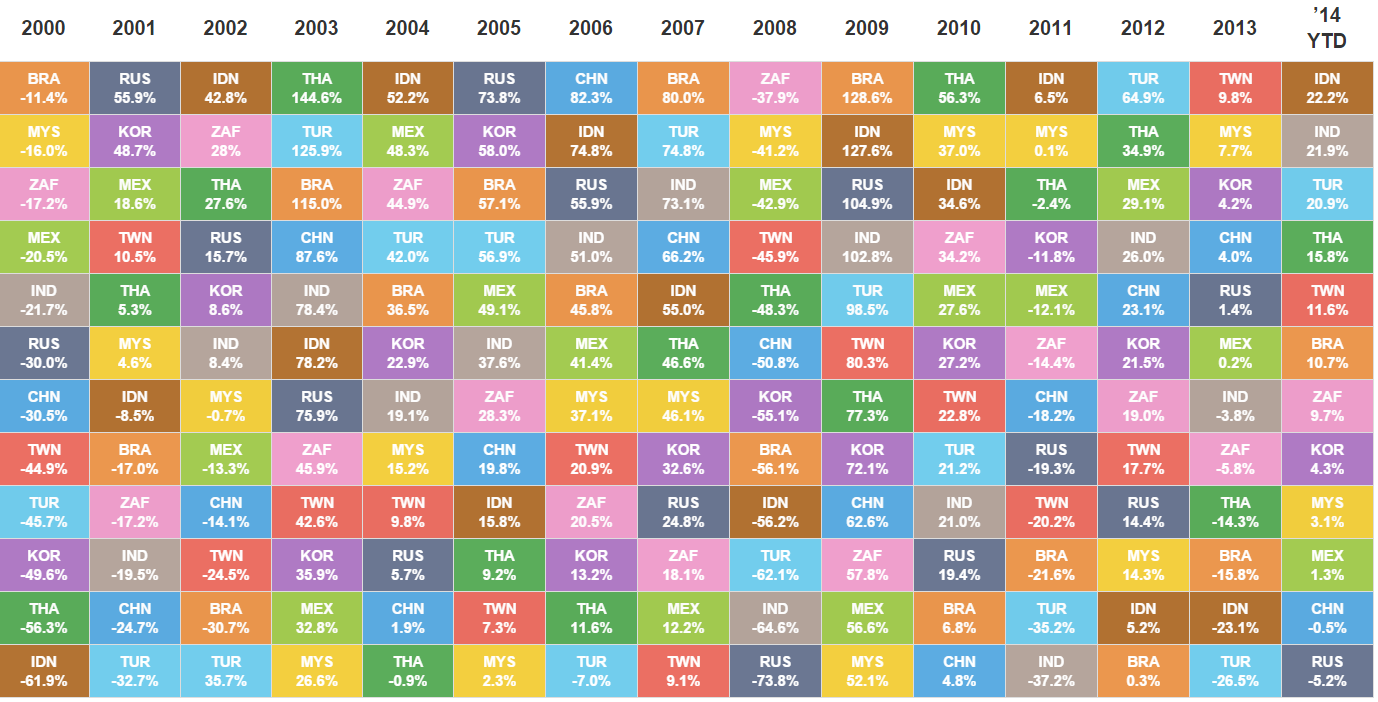

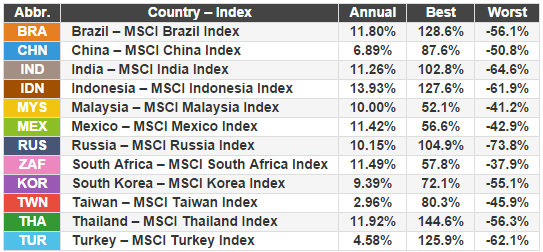

These markets also offer a wide range of returns over the years as you can see from the cumulative results:

The best thing about investing in emerging market stocks is also the worst thing about investing in emerging market stocks – they are extremely volatile. Investors get their patience tested, but also have ample opportunities to buy, sell or rebalance when volatility strikes.

In fact, six of these countries (Indonesia, Thailand, Turkey, Russia, India and Brazil) had a standard deviation, or variation in returns, of over 45% since 2000. You can see that many of these countries also provided excellent performance. There were 8 of the 12 countries with double digit annual returns while 10 out of the 12 actually outperformed the S&P 500.

Yet even the worst performing markets were all over the place as Turkey and Taiwan had the lowest returns, but still experienced huge swings from year to year.

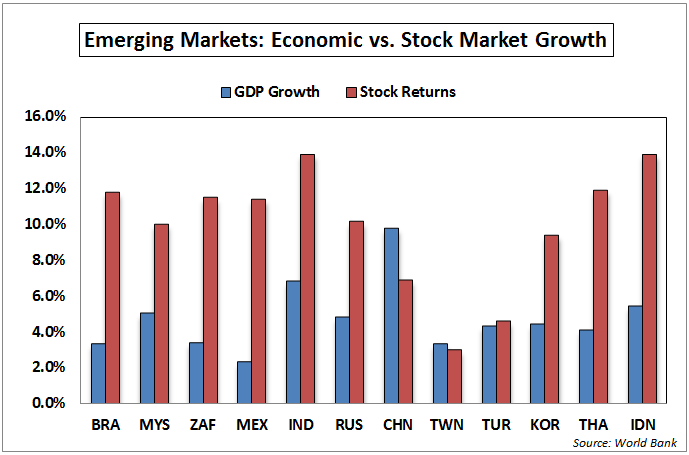

The standard rallying cry for investing in emerging markets always seems to rely on the promise of higher economic growth in these developing countries. When we look at GDP growth in relation to stock market returns over this time period we fail to find a reasonable pattern to follow:

China had by far the highest economic growth rate but also had one of the worst performing stock markets. Mexico, Brazil and South Africa all showed excellent stock returns with only decent economic growth. Other counties, including Turkey and Taiwan, actually showed economic and market performance that were in line with one another.

Now that these countries are becoming more stable and easier to invest in on a standalone basis, many investors are trying to weed out the best performers from the rest of the group.

These results show that this will be no easy task.

Further reading:

The S&P 500 Sector Quilt

Putting Emerging Stock Market Losses in Perspective

Subscribe to receive email updates and my monthly newsletter by clicking here.

Follow me on Twitter: @awealthofcs

Copyright © A Wealth of Common Sense