by Don Vialoux, Timing the Market

Pre-opening Comments for Tuesday September 9th

U.S. equity index futures were mixed this morning. S&P 500 futures were down 1 point in pre-opening trade.

Alcoa added $0.10 to $17.11 after Bernstein initiated coverage with an Outperform rating. Target is $22.

RBC Capital adjusted its recommendations on fertilizer stocks. CF Industries (CF $253.08) was raised from Sector Perform to Outperform. Mosaic was downgraded to Sector Perform from Outperform. Mosaic slipped $0.39 to $46.75.

Chevron slipped $0.81 to $125.40 after Bank of America/Merrill downgraded the stock from Neutral to Underperform. Target is $133.

JP Morgan upgraded the U.S. home building sector. DR Horton (DHI $21.88) was raised to Overweight from Neutral. Lennar (LEN $39.05) was increased to Overweight from Neutral. Pulte Homes was upgraded to Neutral from Underweight.

Molson Coors (TAP $72.15) is expected to open lower after BTIG Research downgraded the stock from Buy to Neutral.

Potash Corp fell $0.34 to $34.02 after Cowen downgraded the stock from Market Perform to Underperform.

EquityClock.com’s Daily Market Comment

Following is a link:

http://www.equityclock.com/2014/09/08/stock-market-outlook-for-september-9-2014/

Note comments on performance of the S&P 500 Index during periods of strength in the U.S. Dollar. Also, not comments on the VIX Index.

Interesting Charts

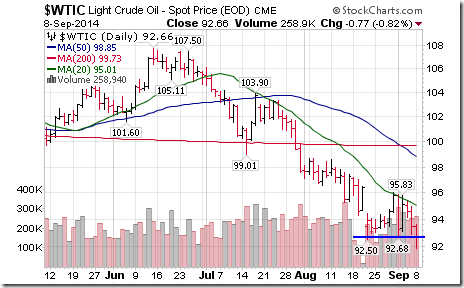

The spike in the U.S. Dollar continues to dominate action in equity and bond markets around the world. Note that the U.S. Dollar Index already is significantly higher in the third quarter of 2014 than the same period last year. Look for analysts to respond between now and mid-October by reducing third quarter estimates for international companies based in the U.S. Earnings from operations outside of the U.S. will be consolidated at a lower than previously expected level, particularly earnings from European operations.

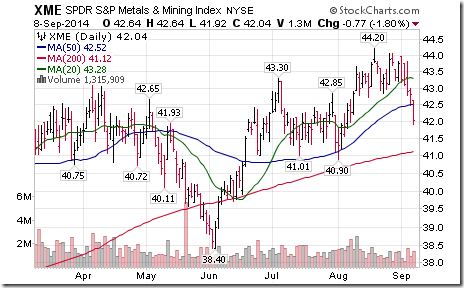

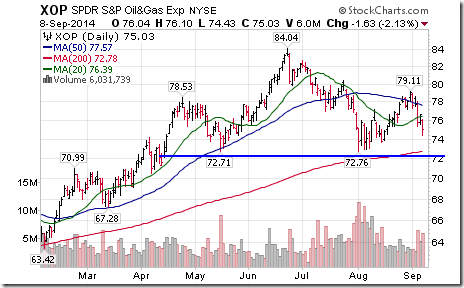

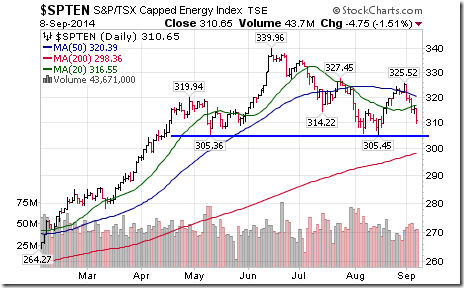

Impact is greatest on commodity sensitive stocks and ETFs. Metals & Mining was the weakest sector. Energy equities and ETFs are forming potential Head & Shoulders patterns.

Momentum indicators for commodity sensitive indices (e.g. TSX Composite, Australia All Ordinaries) are rolling over from overbought levels.

Strength in the U.S. Dollar, or conversely, weakness in the Euro continues to have an impact on European equity prices in terms of U.S. Dollars. Their momentum indicators have rolled over once again.

Horizons/Tech Talk Weekly Seasonal/Technical Sector Report

Following is a link:

http://www.horizonsetfs.com/campaigns/TechnicalReport/index.html

StockTwits Released Yesterday @EquityClock

Quiet technical action by S&P stocks to 10:45 AM. Two stocks broke resistance: $CAG, $MHFI. Two energy stocks broke support:$APA, $DVN.

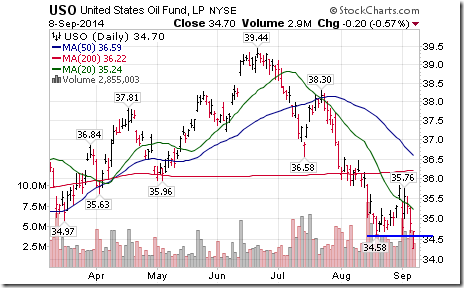

$USO broke support at $34.58 to extend an intermediate downtrend.

Editor’s Note: Ditto for spot WTI crude!

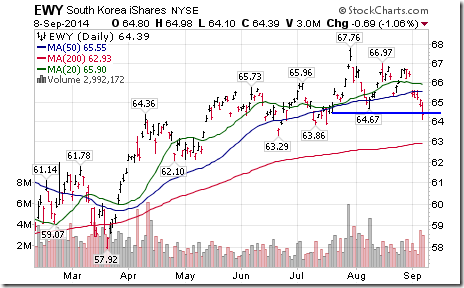

$EWY (Korean ETF) completed a double top pattern on a break below support at $64.67.

Notable weakness in S&P stocks to 1:45 PM! Breakdowns included three more energy stocks: $RIG, $CHK, $COP.

Ford broke support at $16.72 following a downgrade to set a downtrend. ‘Tis the season for weakness!

FP Trading Desk Headline

FP Trading Desk headline reads, “Canadian bank returns to slow over the next year” Following is a link:

http://business.financialpost.com/2014/09/08/canadian-bank-returns-to-slow-over-the-next-year/

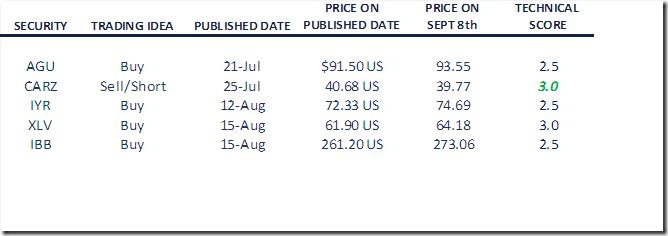

Monitored Technical/Seasonal Trade Ideas

A security must have a Technical Score of 1.5 – 3.0 to be on this list.

Green: Increased Technical Score

Red: Reduced Technical Score

Disclaimer: Comments, charts and opinions offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed. Don and Jon Vialoux are Research Analysts with Horizons ETFs Management (Canada) Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons ETFs Management (Canada) Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons ETFs Management (Canada) Inc.

Individual equities mentioned in StockTwits are not held personally or in HAC.

Horizons Seasonal Rotation ETF HAC September 8th 2014

Copyright © Don Vialoux, Jon Vialoux, Brooke Thackray

![clip_image002[5] clip_image002[5]](https://advisoranalyst.com/wp-content/uploads/HLIC/642a42244c86b6902fab26eca5d1df75.png)