The Unintended Consequence of Risk Avoidance

by Ben Carlson, A Wealth of Common Sense

“Risk control is the best route to loss avoidance. Risk avoidance, on the other hand, is likely to lead to return avoidance as well.” – Howard Marks

The investment fee wars continue to heat up as scale becomes more important than the actual size of the expenses. Here’s the latest from Investment News:

TD Ameritrade Inc.’s retail advisory service this week received a green light from securities regulators to offer a full refund of fees to customers whose investment portfolios decline in value.

The brokerage plans to offer the rebate to new clients of its Amerivest managed-accounts service, which currently costs between 0.3% and 1.25% of assets annually, if their investments post negative returns in two consecutive quarters.

TD Ameritrade professionals will manage your portfolio based on a risk tolerance questionnaire. The deal is that if you use this service and see two down quarters in a row you get to recoup your advisory fees.

As with most sales pitches in the finance industry, this sounds great in theory, but leaves much to be desired in reality. Unfortunately, these types of offers always come with unintended consequences because we humans are guided by incentives above all else.

If earning positive returns over any six month period is one of the main goals for these managed funds there could be a huge misalignment of risks. Certain clients could have a high tolerance for risk and be able to withstand periodic losses but the portfolio managers would be incentivized to dampen volatility to avoid drawdowns and fee rebates.

Many investors have learned the hard way that trying to beat the market over shorter time frames can be more trouble than it’s worth. A singular mission to outperform can actually lead to underperformance. The same logic applies when trying to minimize losses. A sole focus on downside protection usually leads to the opportunity cost of no upside participation.

An illusion of safety in the short-term can lead to problems in the long-term. Judging your portfolio or your financial advisor over a six month period is a recipe for failure. No strategy can be assessed over that short of a time frame.

Also, while fees are important over the long haul, investor behavior is much more important. Investors need to make sure they aren’t sacrificing other areas of portfolio management in a push to only reduce fees. Lower investment fees are only one of the many risk management techniques needed for a successful portfolio.

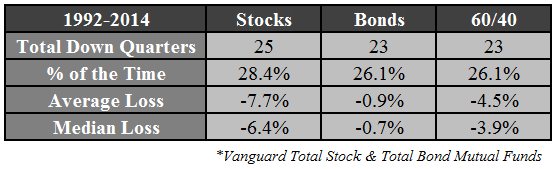

It’s also true that historically, a diversified portfolio doesn’t lose money two quarters in a row that often. It happens, but it’s fairly rare. Here’s some quarterly data using the Vanguard Total Stock Market Fund and the Vanguard Total Bond Market Fund as well as a 60/40 portfolio of the two going back to 1992:

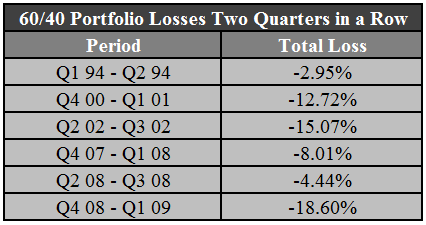

Quarterly losses in stocks, bonds or even a diversified portfolio happen about once every four quarters. On the flip side, these funds have been positive roughly 70-75% of the time. But two down quarters in a row for the 60/40 portfolio has been rare:

It’s happened six different times since 1992 if you count the six quarterly losses in a row from 2007 to 2009 as three different instances. So around 14% of the time or just under once every two years.

Losses are inevitable in the markets, but most of the time stocks and bonds have gone up historically. The problem with a complete aversion to risk is that it can lead to a lack of rewards. Risk management is prudent while risk avoidance can lead to unintended consequences.

Source:

TD offers refunds to managed-accounts customers with losses (Investment News)

Subscribe to receive email updates and my monthly newsletter by clicking here.

Follow me on Twitter: @awealthofcs

Copyright © A Wealth of Common Sense