by Patrick O'Shaughnessy, Millenial Invest

Jack Bogle and Vanguard have been incredibly good for the investing business. They’ve made equity markets more accessible to investors and have minimized the cost of investing to the point that it is almost free. As a result, the market share of index funds has risen from the low single digits in 1990 to nearly 30% today. While I believe (vehemently) that some investors can earn returns superior to market-cap weighted index, I still often recommend index funds to friends and family. I do so because picking active managers is very hard, and, as Bogle says, in investing “you get what you don’t pay for;” the lower your costs (fees, transactions costs, taxes), the better your long term returns will be. Index funds quite brilliantly sidestep what Bogle refers to as the “tyranny of compounding costs”…man is Bogle quotable! These costs can be up to 2% per year, which compound to a huge disadvantage over time. This interview with Bogle is a great read.

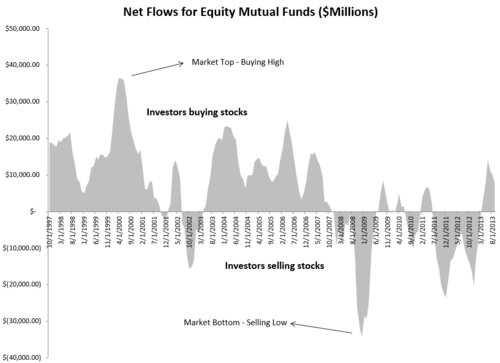

But even index funds cannot solve the number one problem for investors: their consistently putrid, almost-always-perfectly-mistimed, buy-high-sell-low, self-defeating behavior. The Vanguard 500 index fund (VFINX) should be THE beacon to long-term investing. It is designed to be purchased and held forever. But in the past 15-years (as will likely be the case in the next 15) the “investor return” (dollar weighted, what the actual investors earn) in VFINX has significantly lagged the “total return” (time weighted, what the fund itself earns). The 15 year return for the fund itself is 4.25% per year, which for 15 years compounds to 86.7%. But the “investor return,” as calculated by Morningstar, was just 2.29% per year, for a total return of 40.4%. That means that because investors have entered and exited the fund at the wrong times collectively, they’ve missed out on more than half of the total return earned by the fund.

Now that investing is almost free, this is the final frontier: how to effectively protect investors from themselves. The best financial advisors earn their keep by doing just this: keeping clients oriented towards the long-term during times of greed/euphoria and during times of fear/panic. Still, as a group, we are terrible decision makers. Look at this chart below of all fund flows into/out of equity mutual funds during the same rough 15 year period referenced above. Inflows peak at the exact market top, outflows peak at the exact market bottom. The return gap between 4.25% and 2.29% is huge. At 1.96% per year this gap, or “human tax” as I like to call it, is roughly the same as the 2% cost gap that Bogle uses to criticize non-index investment strategies.

Investing arguments are always about strategy, but most investors would be better off spending their energy on improving their own behavior. It is a tall order, because human nature isn’t changing anytime soon. But by reading a lot (market history, investor psychology, and even some philosophy) and working with financial advisors/friends/family who can help you weather the storms of greed and fear, you can overcome some of your own investing self-flagellation. As Nick Murray says, “You can’t, as we’ve seen, build and hold wealth without equities. But the converse is even more importantly true: equities can’t do it without you.”

Photo: Sweetie187

Copyright © Millenial Invest