There was a 6.1% drop in the Emerging Markets MSCI stock price index (in dollars) at the beginning of this year, from January 22 to February 5, on fears of another emerging markets crisis. I didn’t buy this latest “endgame” scenario. On the other hand, I didn’t expect that the index would rebound by 17.5% through yesterday’s close. It has been highly correlated with the CRB raw industrials spot price index, which I use as a sensitive indicator of global economic growth. I don’t see enough of it to drive EM stock prices higher on a sustainable basis. The CRB index is back down to its lowest reading since February 13 after a brief and small rally.

There have been impressive rebounds in lots of EM stock price indexes since February 5. Among the so-called “Fragile Five,” there are ytd gains in the MSCI indexes (in dollars) for Indonesia (29.8%), India (24.2), Turkey (14.2), Brazil (13.1), and South Africa (11.0). The China MSCI (in dollars) has also rallied sharply by 20.0% since March 20, with a ytd gain of 6.4%. However, this rally hasn’t been confirmed by the price of copper, which has become a sensitive indicator of China’s economy in recent years.

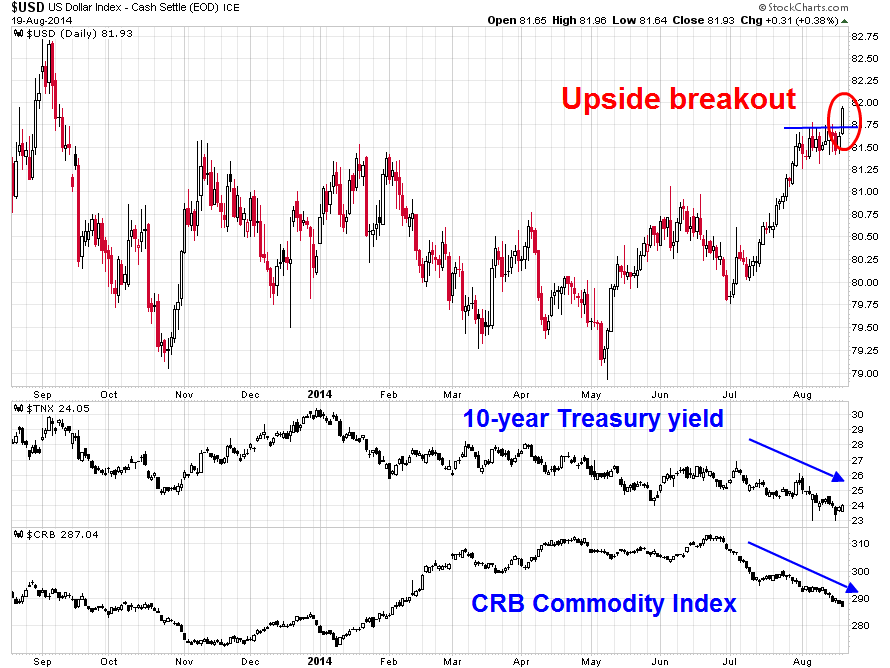

By the way, there has also been a high inverse correlation between the EM MSCI and the trade-weighted dollar. Maybe that’s because the dollar tends to be strong when the global economy is relatively weak compared to the US. A strong dollar tends to depress commodity prices, confirming the relative weakness in the global economy. Weak commodity prices aren’t good for EMs that produce them. The trade-weighted dollar has been strong recently, and relatively flat since the start of the year. It hasn’t confirmed the rally in EM stocks.

The attraction of EM stocks has been their relatively low valuation. They are currently trading at a forward P/E of 11.0, which is up from the year’s low of 9.7 during the week of February 6. That’s still below the forward P/E of the MSCIs for the US (15.6), Japan (13.5), UK (13.3), and EMU (13.0).

Today's Morning Briefing: Staying Close To Home. (1) All the comforts of home are at home. (2) Eurozone may still have some upside. (3) Missing out on Abenomics, which may be striking out. (4) Emerging markets rally not confirmed by weak industrial commodity prices and strong dollar. (5) Nevertheless, EMs are still relatively cheap. (6) US MSCI still leading the pack this year, and since March 9, 2009. (7) Might easy money be deflationary? (8) Low inflation allows central banks to delay normalizing their ultra-easy policies. (9) US CPI gives Yellen more time to create more jobs. (More for subscribers.)

Copyright © Dr. Ed Yardeni