Why does value investing work? One of the reasons is that value factors like price-to-cash flow or price-to-earnings identify companies with very low market expectations. They tend to be boring companies, have negative news, poor outlooks, and so on. Value works because the market leaves these stockstoocheap, and when perception is ultimately adjusted to reality,value stocks outperform the broad market.

But there is a second reason that value investing works. Some of the outperformance of the value strategy comes because it forces you to never own the really expensive, popular stuff which tends to do terribly in the market. Sometimes, what you don’t own is as important as what you own. Take Apple at the start of 2012. As I noted in a recent piece, Apple was very expensive, and value strategies would have avoided it. Not owning Apple was a huge boon to any strategy being compared to the S&P 500 in 2013, because Apple’s relatively weak year was a large drag on market returns for the year. Regardless of what you owned in 2013, your relative performance would have been boosted by not owning Apple.

I was amused when I came across a story posted by Business Insider, saying they were hiring someone to cover exciting stocks like “Tesla, Netflix, Facebook, Twitter, and the biotechs.” Can you imagine seeing a similar position posted to cover “potentially great investments like DirecTV, Marathon Petroleum, and Northrop Grumman.” I can’t see people lining up for that job.

Measuring Popularity

Tesla, Netflix, and Twitter are all very popular stocks. They are also expensive: they are in the 99th, 89th, and 100th percentile by value, respectively—meaning they are some of the most expensive stocks in the market in July, 2014.

Valuation is just one way of measuring popularity, but it is a bit indirect. One more direct way is to look at something called share turnover, which measures what percentage of a company’s total shares are trading hands every day. The higher the share turnover, the more action there is in the stock. Sometimes this is because of really bad news, but more often it’s because the stock is exciting.

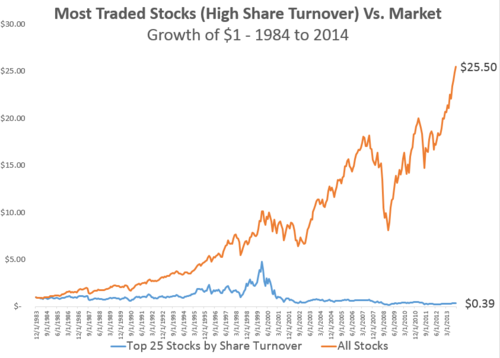

Among the larger stocks in the U.S. today, Netflix, Tesla and Twitter are all in the top five by share turnover. On average over the past month, between 4-5% of the shares of each stock has changed hands every day. With that in mind, check out this figure below. These are the historical results of a strategy that buys the top 25 stocks in the market based on their share turnover (rebalanced every year). This group of the most highly traded stocks has delivered an annual return of -3.1% since 1984. That is putrid compared to the equal weighted basket of all stocks, which has delivered an 11.4% return in the same period.

Today’s portfolio of highest share turnover stocks would include Netflix, Tesla, Plug Power and GoPro, among others. (Note: don’t just take my word on share turnover, Roger Ibbotson has a great paper—and firm—devoted to this factor. His findings mirror mine: high share turnover stocks lag, and less loved & low share turnover stocks outperform).

I think share turnover is a nice alternative to value to identify extremely popular stocks that you may want to avoid. The success of value strategies and the lack of success for high share turnover stocks teach us that investing success is as much in the avoiding as it is in the choosing. There will always be exceptions: Twitter has been very expensive, but was still up huge yesterday. Some popular names will do well. But as a group, they’ve been toxic.