Scott Krisiloff, Avondale Asset Management

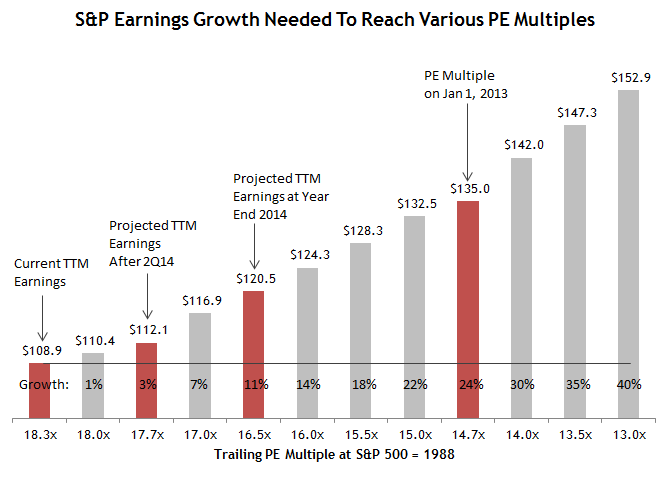

So far Corporate America has surprised me this earnings season and appears to be generating profit growth that is stronger than I expected. Stock multiples are still high, but if earnings continue to grow, multiples can contract through earnings expansion rather than falling prices. Below is a chart of how much trailing earnings need to grow (holding the S&P 500 flat) for multiples to contract to less expensive levels.

Multiples have expanded dramatically in the past year and a half, so to get back to cheaper levels, earnings need to grow by quite a bit. If companies continue to meet analyst’s expectations we would end the year at a 16.5x PE ratio as long as the market doesn’t move from its current level. That’s still not exactly a cheap multiple though.

In order for the PE multiple to return to the level it was at the start of 2013, earnings need to grow by 24% from here. That’s roughly what analysts are projecting earnings to be for 2015, so it would take meeting those expectations and the market staying flat until the end of 2015 for multiples to get back to the level that they were at before this phase of the bull market rally began.

Source: Standard and Poors, Avondale

Copyright © Avondale Asset Management