by Don Vialoux, Timing the Market

Interesting Charts

More technical evidence that U.S. equity indices (notably the S&P 500 Index) effectively peaked on July 3rd:

· Equity markets are responding to uncertain international events.

· Volatility spiked again

· Percent of S&P 500 stocks trading above their 50 day moving average resumed its intermediate downtrend.

· Investors are “selling on news” when second quarter results are released (Exceptions exist if results are “blowout” )

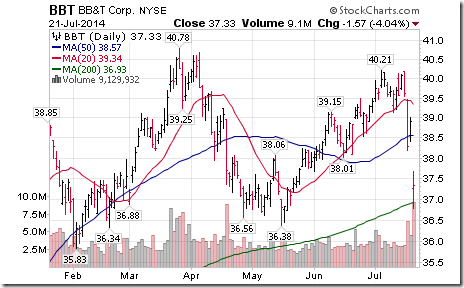

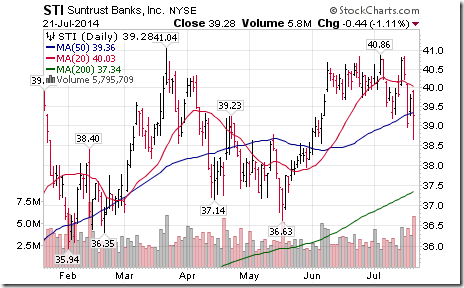

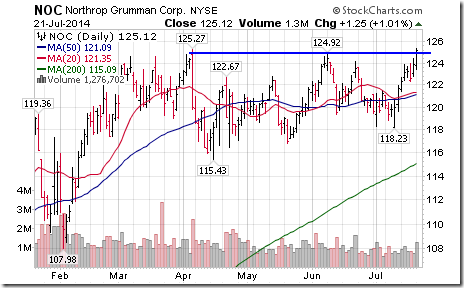

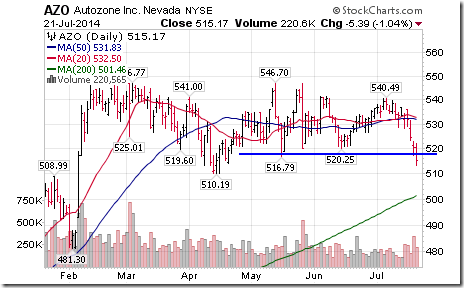

Technical Action by Individual Equities

Technical action (intermediate break outs and break downs) by S&P 500 stocks was extraordinarily quiet yesterday. Three stocks broke resistance (Interpublic, Coca Cola, Northrop) and two stocks broke support (Autozone and General Electric)

No TSX 60 stocks broke support or resistance.

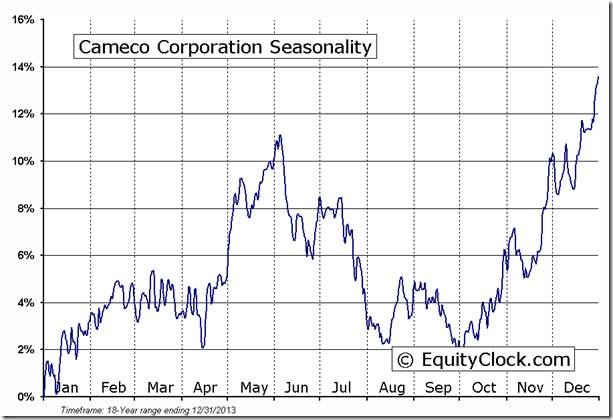

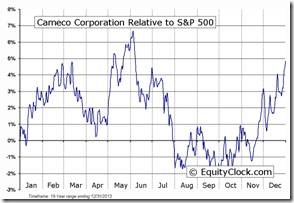

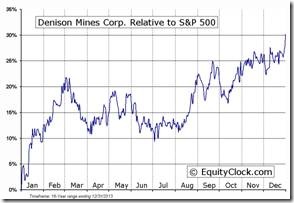

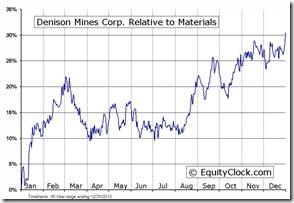

Uranium Stocks Come Alive

Nice breakout on increasing volume by the Uranium equity ETF! Cameco and Denison led the advance.

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/

Following are examples

Tech Talk/Horizons Weekly Seasonal/Technical Sector Update

Following is a link:

http://www.horizonsetfs.com/campaigns/TechnicalReport/index.html

Adrienne Toghraie’s “Trader’s Coach” Column

|

|

Focusing on the Process

By Adrienne Toghraie, Trader’s Success Coach

While it is important to have a goal for becoming a top trader,

you should focus your efforts on the process of attaining your

goal rather than on the goal itself.

A goal gives you a picture of where you want to go and activates the assistance of universal consciousness towards getting you there. After you direct your mind towards that goal, you must create a series of actions towards attaining the picture that you created. These actions will lead to lessons, opportunities and additional actions that you did not consider.

The process of becoming a top trader can be challenging, but the overall journey for the top traders I have met have said to me that those memories were the best part of getting there.

Confusing the process

Darrell became interested in becoming a trader as a result of experiencing his best friend’s family enjoying a rich lifestyle. He appreciated his friend’s hand-me-downs of electronic devices, clothes and other status symbols, but he wanted to be the person who could be generous to someone else.

All Darrell could see was being a trader. What he did not see was the 15-year struggle it took to get there. He asked his friend’s father, Tom, to show him how to trade. Tom gave Darrell 10 books to read and said that he could look over his shoulder, but not ask questions until he finished reading the books.

Darrell started reading the books over and over again. He lied to Tom about his progress and tried to simulate trades on his own even though Tom told him not to. When Tom asked him some relatively simple questions, he knew that Darrell was not taking the process seriously and told him that he did not want him to watch him trade any more.

Darrell is still trying to become a trader after 10 years. He still has not read the books Tom gave him and is repairing telephone equipment as his profession.

Sticking with the process

Lori attended one of my webinars a few years ago and wrote to me that she was a student in a business program. She explained that she did not have any money, but knew that someday we would work together. Lori’s goal was to be a Master Trader. Even though Lori was sure about what she wanted, she asked me if she was naive to think that a student with a lot of debt could reach that grand goal. I told her that if she was willing to start with one step and put one foot in front of the other, I knew she would get there.

I suggested that Lori read a few books. Within a month she wrote back to me that she found the books very helpful and in the process she learned about other books that she should be reading. What she wanted to know was if these books were the best ones to move forward with or were there others that were better. I said yes to a few and suggested others that I thought would be better.

A few months later it was June and Lori was graduating from College. She had finished reading and studying all of the books and knew that she wanted to be a futures trader. I had asked one of my clients who ran a room of gas traders to consider the possibility of hiring her into his firm. My client hired her as a bonus to the traders to be an assistant to help them with their backroom work. When he experienced her work ethic, he told her that the company would pay for all of her trading education. Just as an aside, what I did not know was that my client was going through a divorce.

After 3 years Lori became the head trader and married my client. Lori said to me that while she loves her present life, she loved the process of getting there.

Conclusion

If a trader has a goal and focuses on the process while taking the necessary steps to move towards his goal, then no matter what a trader’s circumstances are, he will eventually feel the wind on his back. Trust in yourself and universal consciousness will take care of the rest.

Adrienne’s Free Webinars

Adrienne presents free webinars on the psychology of trading

Email Adrienne@TradingOnTarget.com

Disclaimer: Comments, charts and opinions offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed. Don and Jon Vialoux are Research Analysts with Horizons ETFs Management (Canada) Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons ETFs Management (Canada) Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons ETFs Management (Canada) Inc.

Individual equities mentioned in StockTwits are not held personally or in HAC.

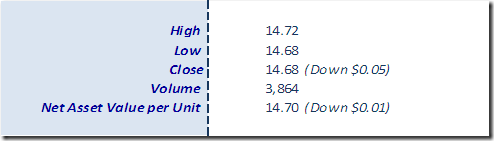

Horizons Seasonal Rotation ETF HAC July 21st 2014

Copyright © Don Vialoux, Jon Vialoux, Brooke Thackray