by Don Vialoux, Timing the Market

Interesting Charts

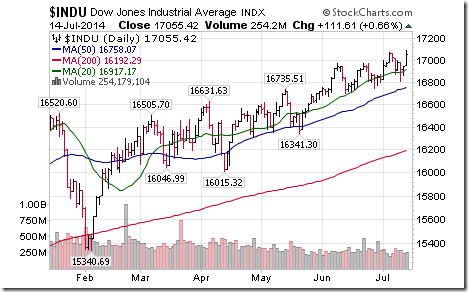

The Dow Jones Industrial Average and the Dow Jones Transportation Average managed to touch all-time highs while other broadly based U.S. equity indices remained below all-time highs. Equity markets moved higher in anticipation of bullish comments from Federal Reserve Chairman Janet Yellen’s testimony this morning before the Senate Finance Committee. A better than expected second quarter report by Citigroup also contributed.

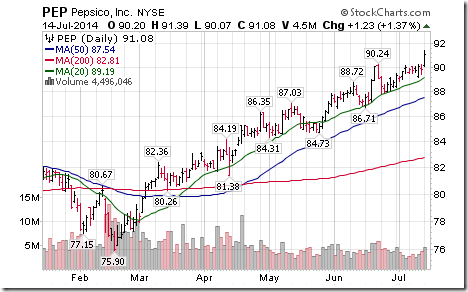

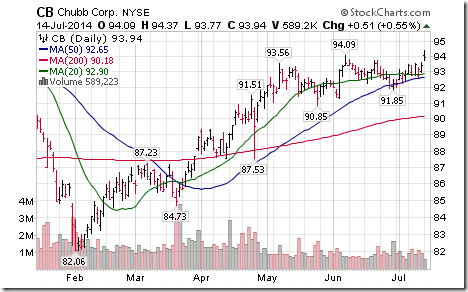

Technical Action by Individual Equities Yesterday

Technical action by S&P 500 stocks was quietly bullish despite all-time highs set by the Dow Industrials and Transports. Eight S&P 500 stocks broke resistance (PEP, CB, MSFT, PRGO, NSC, CLX, REGN and PBI) and three broke support (KORS, ROST, HSY).

Among TSX 60 stocks, Penn West Petroleum broke support.

Horizons/Tech Talk Weekly Sector Seasonal/Technical Report

Following is a link:

http://www.horizonsetfs.com/campaigns/TechnicalReport/index.html

Adrienne Toghraie’s “Trader’s Coach” Column

Saving, Risking, Spending for a Trader

By Adrienne Toghraie, Trader’s Success Coach

How you deal with money can give you a clue as to how you will profit in trading and in life. Here are three tendencies of handling money:

· Savers

· Risk takers

· Spenders

Savers

Those who are interested in only saving will have a tendency of being very conservative in how they risk and fear losing. This is very often because it took them so long to earn their money and they are not willing to take any risk to expand that money. They view spending outside of necessities, or risking as a threat to their financial security. If they do enter the markets, they are more likely to be very conservative investors.

Sandy the saver

Sandy’s parents were very conservative about spending money. The family always had the necessities, but rarely enjoyed frivolity. Sandy became very much like her family. She saved from when she was a child and nested away over seventy thousand dollars by the time she was thirty years old.

Sandy learned investing from her parents. They believed in the fundamental rules of trading and that was to buy good companies and hold on to them forever. When Sandy’s parents passed on she discovered that the family nest egg was well over a million dollars. She continued to live her conservative spending life and felt safe until the Enron scandal.

Risk Takers

Calculated risk takers are the entrepreneurs of the world who live beyond the norm because they are more likely to face and conquer their fears. They are the individuals that are not satisfied with mediocrity. These types of risk takers will usually try out every type of time frame and every type of instrument.

Those who risk without considerable calculation are the gamblers of the world who most likely will wind up not having anything. They tend to want to day trade.

Robert the calculated risk taker

Robert’s parents worked hard at their tailoring business. Robert’s father took a risk and hired an employee, which he could not afford, but knew that he could not grow his business if he did not have more hands to do the work. He repeated taking this kind of risk until he owned a large company that manufactured and distributed clothing all over the world. The only problem was that the family always lived on the edge of bankruptcy.

Robert went into the family business and realized the family’s vulnerability, so he learned how to be a trader. This was fortunate for his family because when clothing started to be manufactured overseas, the family eventually had to sell the business at a fraction of what it was worth. Robert’s ingenuity in investing kept the family going, but their lives were only about work. Even when the family took that rare vacation, they would always be thinking about was happening in the business.

Spenders

These are the people who spend money as fast as they earn it. They generally do not have a long-range picture of the consequences of not having anything. If they invest in the markets they usually make every mistake in the book. These people are more likely going to be attracted to day trading. That is, if they ever have enough money to invest.

Sam the spender

Sam learned to be a spender just like his dad. He never went beyond the 8th grade because he had to help out at home. One day Sam won a jackpot of over a million dollars. He decided that he would learn to invest money. It did not take long before he went through half of his winnings. This is when he met Sandy the saver. Between their two extremes they learned to enjoy their lives by saving, risking and spending.

Conclusion

The ideal for becoming successful in life while enjoying the process is to be balanced. When you mix being a saver to have security, with taking calculated risk for expanding your life style and spending so you can enjoy the process you have achieved that balance. With this balance you are more likely to have a good mindset for being a profitable trader.

Adrienne’s Free Webinars

Adrienne presents free webinars on the psychology of trading

Email Adrienne@TradingOnTarget.com

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/

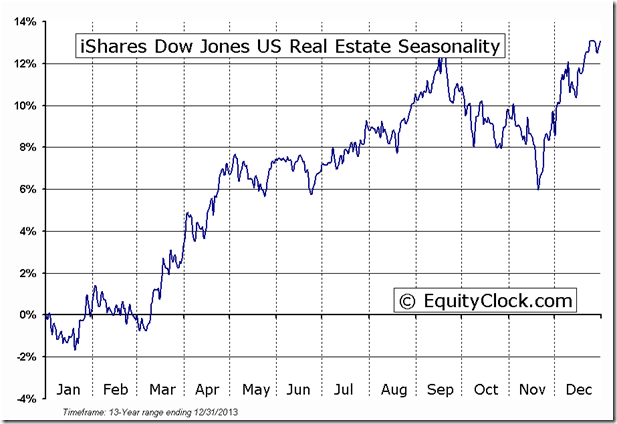

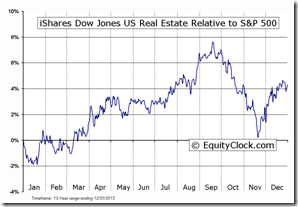

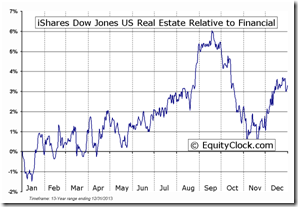

Following is an example:

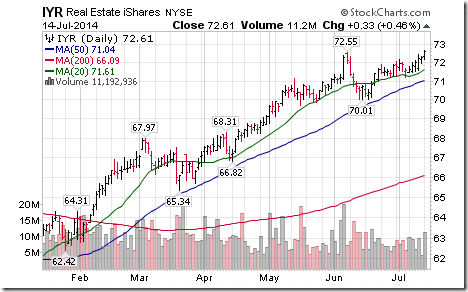

Editor’s Note: Nice breakout yesterday by the ETF!

Disclaimer: Comments, charts and opinions offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed. Don and Jon Vialoux are Research Analysts with Horizons ETFs Management (Canada) Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons ETFs Management (Canada) Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons ETFs Management (Canada) Inc.

Individual equities mentioned in StockTwits are not held personally or in HAC.

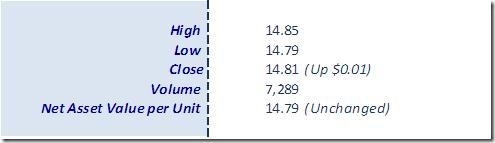

Horizons Seasonal Rotation ETF HAC July 14th 2014

Copyright © Don Vialoux, Jon Vialoux, Brooke Thackray