Halftime Hunches??

by James Paulsen, Chief Investment Strategist, Wells Capital Management

We are pleased to bring you the latest edition of Economic and Market Perspective, written by James Paulsen, Ph.D., Wells Capital Management’s chief investment strategist. In this edition, Jim offers his analyses of current economic trends. For mobile users, we have included the first paragraph of the latest piece:

It’s mid-year and both stocks and bonds are sporting solid returns. Officially, due to a bizarre first-quarter real GDP report (suggesting the economy collapsed at almost a 3% annualized pace), the economy supposedly has not grown so far this year despite the fact that almost 1.4 million jobs were created!

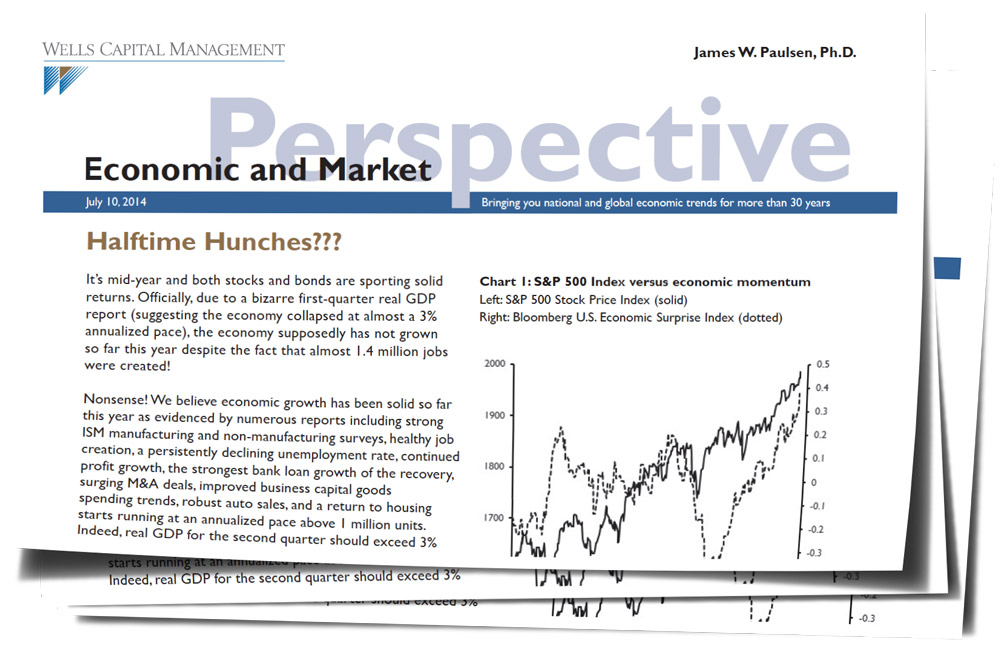

Nonsense! We believe economic growth has been solid so far this year as evidenced by numerous reports including strong ISM manufacturing and non-manufacturing surveys, healthy job creation, a persistently declining unemployment rate, continued profit growth, the strongest bank loan growth of the recovery, surging M&A deals, improved business capital goods spending trends, robust auto sales, and a return to housing starts running at an annualized pace above 1 million units. Indeed, real GDP for the second quarter should exceed 3% and we expect growth to remain north of 3% during the second half of this year. With the S&P 500 near an all-time record high of almost 2000, cash yields still near zero and with a 10-year Treasury bond yield recently falling back to only about 2.5% (even though the core consumer inflation rate has risen to 2%), how should investors now be positioned? Here are some “halftime hunches” for the second half.

Read/Download the entire report below:

Copyright © Wells Capital Management