by Ben Carlson, A Wealth of Common Sense

“This is one of the most important rules of investing. If you never peek from the age of 20 to the age of 70, you’ll rip that first 401(k) statement open at age 70, and I recommend you have a doctor on hand because you’ll go into a dead faint. Your heart might even stop. You’re going to have an amount of money you can’t even imagine.” – John Bogle

I spend plenty of time writing about bad investor behavior and controlling unforced errors to improve portfolio performance. Everyone makes mistakes with their investments, myself included, so it makes sense to focus on utilizing an addition by subtraction method.

So it’s only fair to point out good investor behavior when I come across it. A recent Vanguard study restored my faith in investor behavior. Vanguard looked at a number of statistics for over 3 million participants in their 401(k) retirement plans for a study called How America Saves 2014.

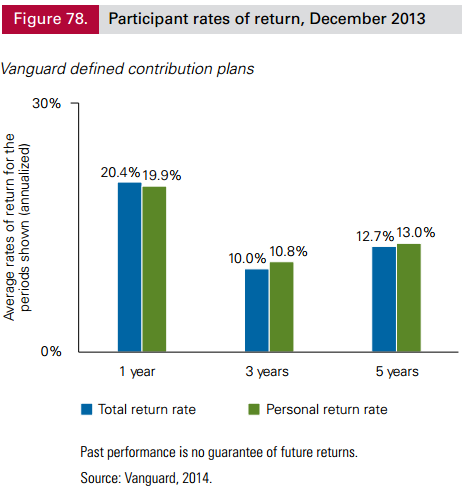

A few stats from the report caught my eye. The first was the 5 year performance numbers:

The performance on a simple 60/40 portfolio made up of the total stock market and total bond market funds was 13.1% per year over the 5 years ending in 2013, nearly identical to the plan results from this study. These numbers are pretty decent when you consider the usual studies on actual investor returns.

Could investors have done better than thee numbers in other vehicles? Of course. But could they have done much much worse? Definitely and many investors did perform much worse than this 60/40 portfolio, including some of the largest professionally managed funds.

Next, the majority of Vanguard investors didn’t make any changes to their portfolio in 2013, a wise move in a market that exploded higher (emphasis mine):

Despite the ongoing market volatility of 2013, only 13% of participants made one or more portfolio trades or exchanges during the year, down from 16% in 2008. When participants using the managed account program are excluded, only 10% of participants initiated an exchange. As in prior years, most participants did not trade. Not only did participant trading activity remain at lower levels during 2013, but trading activity between 2009 and 2013 was lower than the trading activity during 2004–2005, when markets were more benign.

Obviously, as I’ve said before, it’s much easier to be a long-term investor in a bull market. But in the last period of substantial market volatility in the summer of 2011 during the European debt crisis when the S&P 500 lost nearly 20% Vanguard investors didn’t panic (the correct move in hindsight). This comes from a previous study:

In the first eight trading days of August [2011], including two of the most volatile days since 2008, just under 2% of 401(k) participants at Vanguard made a change to their portfolios. In other words, over 98% stayed the course. Ninety-eight percent took no action. Ninety-eight percent took the long-term view.

Finally, the last stat that I found interesting from this report was the fact that a large number of investors mostly ignore their portfolio balances even though they have the option of checking them online on a daily basis:

In 2013, 40% of plan participants never contacted Vanguard regarding their plan account. […] For participants who did not contact Vanguard, their sole method for reviewing plan balances was quarterly account statements.

This seems like an antiquated form of doing business in the information age of being able to access everything anytime we want it, but it seems to be working.

Vanguard is pegged by most in the industry as strictly an index fund provider, but interestingly enough they have more active funds in their line-up than index funds (52% active versus 48% indexed – I don’t have the breakdown for these numbers by assets, this is simply the number of funds).

So it’s not just index fund investing that Vanguard does well. It’s low cost, low activity investing that’s beneficial to long-term investors that mainly act passively. Of course costs don’t matter at all if you don’t behave, but it appears Vanguard’s investors have found a way to minimize both costs and mistakes.

Summing it all up, here are the lessons we can learn from Vanguard investors:

- Investing in simple fund structures can work if you have a long-term mindset and are able to stay out of your own way.

- Doing nothing is a perfectly reasonable course of action most of the time with your portfolio if you have a plan in place. Sometimes I think it’s much harder to not do something, which is where many investors run into trouble.

- You don’t have to look at your performance numbers all the time to succeed. Not looking can actually be beneficial because of a tendency to allow loss aversion to affect investing decisions since the probability for gains increases as the time horizon in the market lengthens.

Sources:

How America Saves 2014 (Vanguard)

98% stayed the course (Vanguard)

Thanks to Harry Sit at The Finance Buff for pointing out this study to me.

And this is the stuff I’ve been reading lately:

- Investor behavior: the final frontier (Millennial Invest)

- The 12 types of people on Wall Street (Turney Duff)

- There’s more to your risk tolerance than just your age (Oblivious Investor)

- On the importance of proper fund evaluation & benchmarking (Prag Cap)

- Markets or economies can’t be explained by just one thing (Big Picture)

- Insights from how America saves (The Finance Buff)

- The unpopularity of patience (Clear Eyes Investing)

- 10 things people don’t like about their financial advisor (Alpha Architect)

- Everything wrong with investor behavior in one article (Reformed Broker)

- Can we talk about process first? (Seth Godin)

- How to win by doing less (Motley Fool)

Subscribe to receive email updates and my monthly newsletter by clicking here.

Follow me on Twitter: @awealthofcs

Copyright © A Wealth of Common Sense