by Don Vialoux, Timing the Market

Apr 22

Jon Vialoux on BNN last night

Following are links:

http://watch.bnn.ca/#clip1081690

http://watch.bnn.ca/#clip1081692

http://watch.bnn.ca/#clip1081687

http://watch.bnn.ca/#clip1081689

http://watch.bnn.ca/#clip1081688

http://watch.bnn.ca/#clip1081691

http://watch.bnn.ca/#clip1081694

http://watch.bnn.ca/#clip1081693

Interesting Charts

European equity markets and related ETFs are moving to six

year highs.

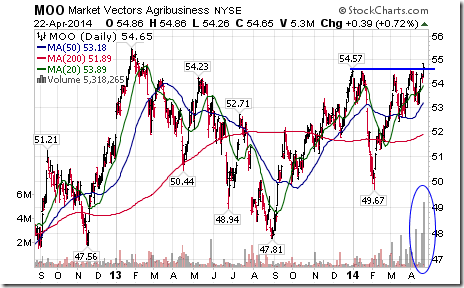

High grain prices have prompted strength in the Agriculture

sector. MOO reached a 15 month high yesterday.

Stock Tweets Yesterday

Magna International $MGA broke out this morning and is

leading auto stocks on the upside. ‘Tis the season! See

http://charts.equityclock.com/magna-international-inc-usa-nysemga-seasonal-chart

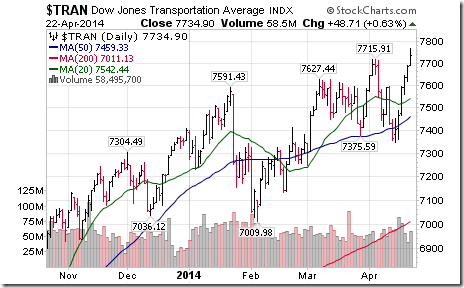

DJTransportation Average broke to an all-time high this

morning. ‘Tis the season until the first week in May. See

http://charts.equityclock.com/transportation-industry-seasonal-chart

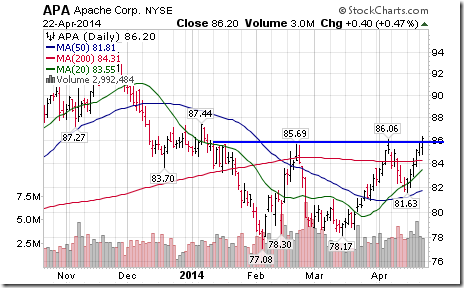

“Gassy” stocks in the U.S. are leading the energy sector.

Nice breakouts by $COG and $APA this morning. ‘Tis the

season!

Technical Action in Individual Equities

Yesterday

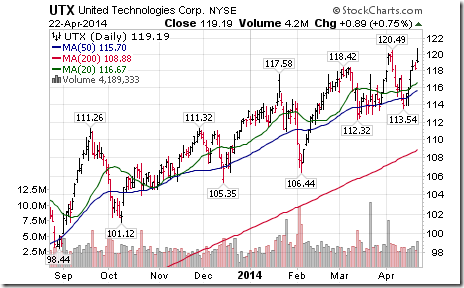

Technical action by S&P 500 stocks remains bullish.

Another 16 S&P 500 stocks broke resistance and two broke

support (PNR and KMB).

Two TSX 60 stocks broke resistance (Magna and Canadian

National Railway) and none broke support.

FP Trading Desk Headline

FP Trading Desk headline reads, “Things are finally

looking up for the loonie”. Following is a link:

http://business.financialpost.com/2014/04/22/things-are-finally-looking-up-for-the-loonie/

FP Trading Desk headline reads, “Advisors turn bearish on

Canadian stocks in the second quarter”. Following is a

link:

http://business.financialpost.com/2014/04/22/advisors-turn-bearish-on-canadian-stocks-in-q2/

Special Free Services available

through www.equityclock.com

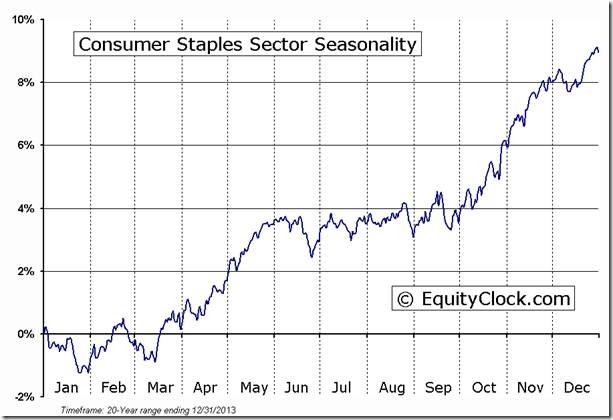

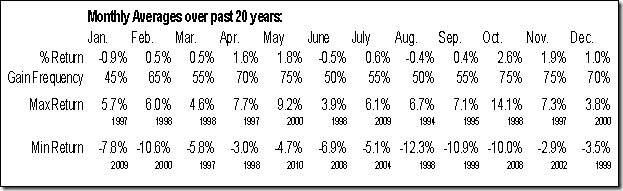

Equityclock.com is offering free access to a data base

showing seasonal studies on individual stocks and sectors.

The data base holds seasonality studies on over 1000 big and

moderate cap securities and indices. To login, simply go to

http://www.equityclock.com/charts/

Following is an example:

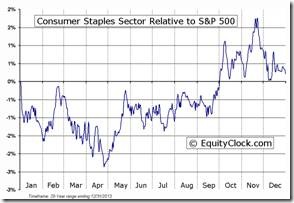

STAPLES Relative to the S&P 500 |

A chart to watch

A technical analyst noted on CNBC’s Fast Money last night

that Facebook is forming a potential reverse head and

shoulders pattern. Facebook is scheduled to release first

quarter results today. The stock is worth watching.

Completion of the pattern above the neckline will attract

significant interest in the Technology sector.

Disclaimer: Comments, charts and opinions

offered in this report by www.timingthemarket.ca

and www.equityclock.com

are for information only. They should not be

considered as advice to purchase or to sell mentioned

securities. Data offered in this report is believed to be

accurate, but is not guaranteed. Don and Jon Vialoux are

Research Analysts with Horizons ETFs Management (Canada)

Inc. All of the views expressed herein are the personal

views of the authors and are not necessarily the views of

Horizons ETFs Investment Management (Canada) Inc., although

any of the recommendations found herein may be reflected in

positions or transactions in the various client portfolios

managed by Horizons ETFs Investment Management (Canada)

Inc.

Twitter comments (Tweets) are not offered on

individual equity securities held personally or in the

Horizons Seasonal Rotation Fund.

Horizons Seasonal Rotation ETF HAC April

22nd 2014

Leave a Reply

Copyright © Don Vialoux, Jon Vialoux, Brooke Thackray

![clip_image001[5] clip_image001[5]](https://advisoranalyst.com/wp-content/uploads/2019/08/5f1777a3527b9412bd7a3e3e54593ab0.png)

![clip_image002[5] clip_image002[5]](https://advisoranalyst.com/wp-content/uploads/2019/08/6653439ae9a1a17750f6563c098033de.png)