Pre-opening Comments for Friday April

4th 2014

U.S. equity index futures were higher this morning.

S&P 500 futures were up 6 points in pre-opening trade.

Index futures moved higher following release of the March

U.S employment report. Consensus for March Non-farm

payrolls was 200,000 versus an upwardly revised February report

at 197,000. Actual was 192,000. Consensus for March Private

Non-farm Payrolls was 205,000 versus 162,000 in February.

Actual was 192,000. Consensus for the March Unemployment Rate

was a decline to 6.6% from 6.7% in February. Actual was

unchanged at 6.7%

The Canadian Dollar gained US0.55 cents following release of

the March Canadian employment report. Consensus was an

increase in employment of 22,500. Actual was 42,900. Consensus

for the March Unemployment Rate was unchanged at 7.0% from

February. Actual was down 0.1% to 6.9%.

Cisco added $0.19 to $23.28 after Northland Securities

initiated coverage with an Outperform rating.

Stillwater Mining (SWC $15.42) is expected to open

higher after BB&T Capital initiated coverage with a Buy

rating. Target is $18.

Blackrock (BLK $315.74) is expected to open higher after

Keefe Bruyette upgraded the stock from Market Perform to

Outperform.

JP Morgan gained $0.52 to $61.18 after Macquarie

upgraded the stock from Neutral to Outperform.

EquityClock.com’s Daily Market

Comment

Following is a link:

http://www.equityclock.com/2014/04/03/stock-market-outlook-for-april-4-2014/

Interesting Charts

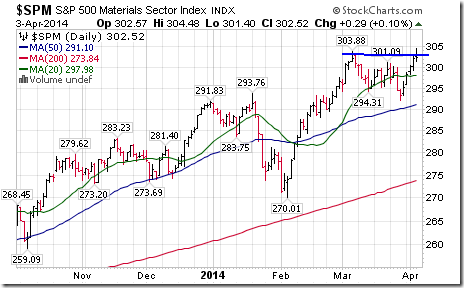

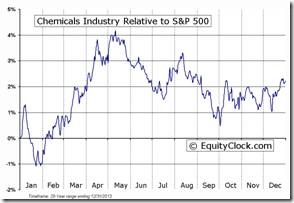

The S&P Materials sector and its related ETFs reached an

all-time high yesterday.

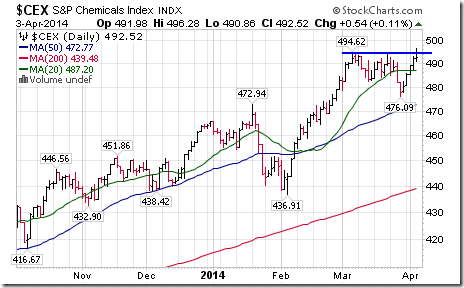

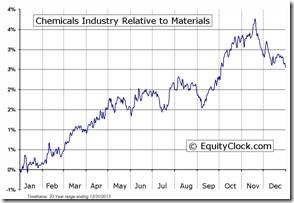

The main reason for strength in the Materials sector was

strength in its Chemical sub-sector. The S&P Chemicals

Index also reached an all-time high yesterday. Chemicals

represent a 70% weight in the S&P Materials Index.

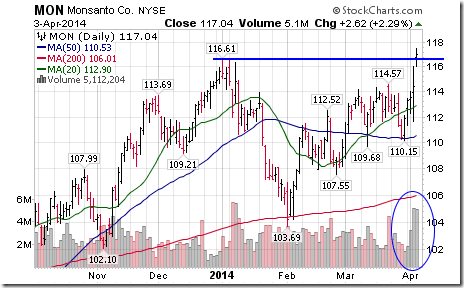

Strength in the chemical sector was led by Monsanto. The stock

broke to a six year high on higher than average volume

following release of better than expected fiscal second quarter

results.

Technical Action by Individual Equities

Yesterday

Technical action by S&P 500 stocks remained bullish. Ten

S&P 500 stocks broke above resistance and none broke below

support.

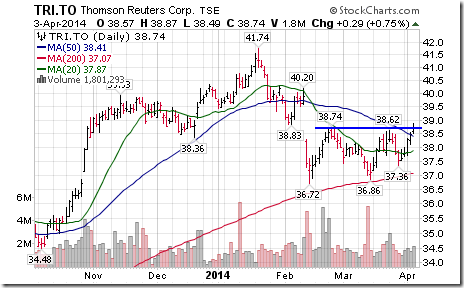

Technical action by TSX 60 stocks was quiet. Thomson Reuters

recorded an upside breakout.

Weekly Technical Review of Select Sector

SPDRs

Technology

· Intermediate trend remains up (Score: 1.0)

· Units recovered back above its 20 day moving average (Score:

1.0)

· Strength relative to the S&P 500 Index remains neutral

(Score: 0.5)

· Technical score improved to 2.5 from 1.5 out of 3.0

· Short term momentum indicators are trending up

Materials

· Intermediate trend changed from down to up on a move above

$48.07. Units reached an all-time high yesterday.

· Units recovered back above its 20 day moving average

· Strength relative to the S&P 500 Index improved from

negative to neutral

· Technical score improved to 2.5 from 0.0 out of 3.0.

· Short term momentum indicators are trending up.

Consumer Discretionary

· Intermediate trend remains up.

· Units recovered back above their 20 day moving average

· Strength relative to the S&P 500 Index remains negative.

· Technical score improved to 2.0 from 1.0 out of 3.0

· Short term momentum indicators are trending up.

Industrials

· Intermediate trend changed from down to up on a move above

$53.02 to an all-time high.

· Units recovered back above their 20 day moving average

· Strength relative to the S&P 500 Index changed from

negative to positive

· Technical score improved to 3.0 from 0.0 out of 3.0.

· Short term momentum indicators are trending up.

Financials

· Intermediate trend remains up.

· Units recovered back above its 20 day moving average

· Strength relative to the S&P 500 Index changed from

positive to neutral

· Technical score increased to 2.5 from 2.0 out of 3.0

· Short term momentum indicators are mixed

Energy

· Intermediate trend remain up. Units closed at an all-time

high.

· Units remain above their 20 day moving average

· Strength relative to the S&P 500 Index remains positive.

· Technical score remains at 3.0 out of 3.0.

· Short term momentum indicators are trending up, but are

overbought

Consumer Staples

· Intermediate trend remains up. Units closed at an all-time

high yesterday

· Units remain above their 20 day moving average

· Strength relative to the S&P 500 Index changed from

positive to neutral

· Technical score slipped to 2.5 from 3.0 out of 3.0

· Short term momentum indicators are trending up, but are

overbought.

Health Care

· Intermediate trend remains up.

· Units recovered back above their 20 day moving average

· Strength relative to the S&P 500 Index remains negative

· Technical score recovered to 2.0 from 1.0 out of 3.0.

· Short term momentum indicators are trending up.

Utilities

· Intermediate trend remains up.

· Units remain above their 20 day moving average

· Strength relative to the S&P 500 Index changed from

positive to neutral

· Technical score slipped to 2.5 from 3.0 out of 3.0.

· Short term momentum indicators are trending up, but are

overbought.

FP Trading Desk Headline

FP Trading Desk headline reads,” Monsanto

could be split targeted by activists: JP Morgan”.

Following is a link:

Special Free Services available

through www.equityclock.com

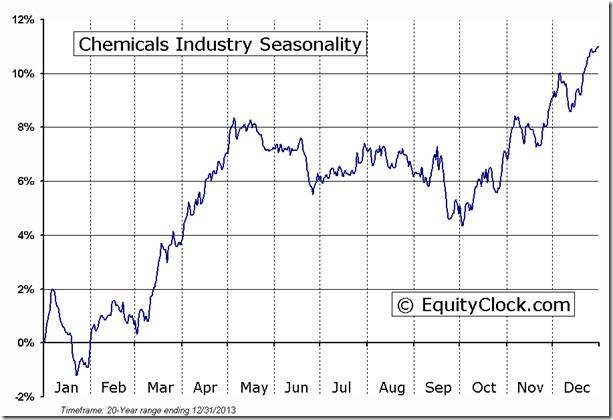

Equityclock.com is offering free access to a data base showing

seasonal studies on individual stocks and sectors. The data

base holds seasonality studies on over 1000 big and moderate

cap securities and indices. To login, simply go to http://www.equityclock.com/charts/

Following is an example:

Chemicals Industry Seasonal Chart

Disclaimer: Comments, charts and opinions

offered in this report by www.timingthemarket.ca

and www.equityclock.com

are for information only. They should not be

considered as advice to purchase or to sell mentioned

securities. Data offered in this report is believed to be

accurate, but is not guaranteed. Don and Jon Vialoux are

Research Analysts with Horizons ETFs Management (Canada)

Inc. All of the views expressed herein are the personal

views of the authors and are not necessarily the views of

Horizons ETFs Investment Management (Canada) Inc., although any

of the recommendations found herein may be reflected in

positions or transactions in the various client portfolios

managed by Horizons ETFs Investment Management (Canada)

Inc.

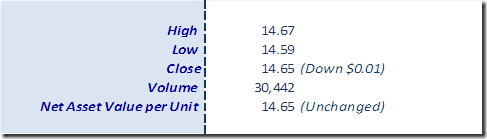

Horizons Seasonal Rotation ETF HAC April

3rd 2014

Copyright © Don Vialoux, Jon Vialoux, Brooke Thackray