by Paul Moroz, Mawer Investment Management

Today’s post is the conclusion to last week’s An Escape from Bangkok: Part 1.

I had arrived in Bangkok - without luggage (later found in Vietnam) - after a nearly 24 hour flight. The hotel I chose was situated somewhere near the U.S. embassy; a fact I mention only because its location had been a real debate for me. With the Canadian embassy smack in the middle of the protest zone, I had antagonized over the area that would be the most secure. Did it make sense to stay near the Americans? Was it even safer to stay close to an embassy? (Ever see the movie Argo?) I had painstakingly analyzed every aspect of the hotel location before I finally just chose a hotel near the American and Dutch embassies, based, in part, on some tangential logic that the Dutch might remember Canada’s role in the liberalization of Arnhem. Should the situation get out of control, I figured the Dutch might choose to take a Canadian in.

In any case, at 1am I found my hotel and stumbled into it, exhausted. By sheer luck, I had chosen a hotel where the TV automatically turned on when the door opened, so when I entered my room, Elon Musk, the eccentric billionaire and founder of car maker Tesla, greeted me on the TV:

“When I was a little kid I was really afraid of the dark, but then I eventually came to understand that darkness is really just the absence of photons in the visible wavelength, 400-700 nanometres. Then I thought: it’s really silly to be afraid of a lack of photons.”

I started to feel a bit silly about fretting over the location of the hotel. It made me think: had I been truly concerned about the uncertainty of the political situation in Thailand, or was I apprehensive simply because I didn't understand Thailand? What an interesting insight... how often are the decisions of investors made simply because they are scared of the dark and don`t know why?

As it turns out, there is no reason to be afraid of something simply because you do not fully understand it. Thailand was no different. I had travelled thousands of miles to at least make an attempt to understand this country. Investors must do the same whenever they are presented with a subject that differs from their normal experience. An open mind and neutral bias must always be applied to the things we are afraid of. It is education that allows us to rationally assess the odds.

Of course, even a solid foundation of knowledge cannot get rid of uncertainty. During my stay in Thailand, I gained a far deeper understanding of the complex socioeconomic and political history that has made Thailand what it is today. But this richer understanding did not endow me with the ability to predict what will happen to Thailand or its stock market. That is okay. Investors ultimately face uncertainty in every equity market.

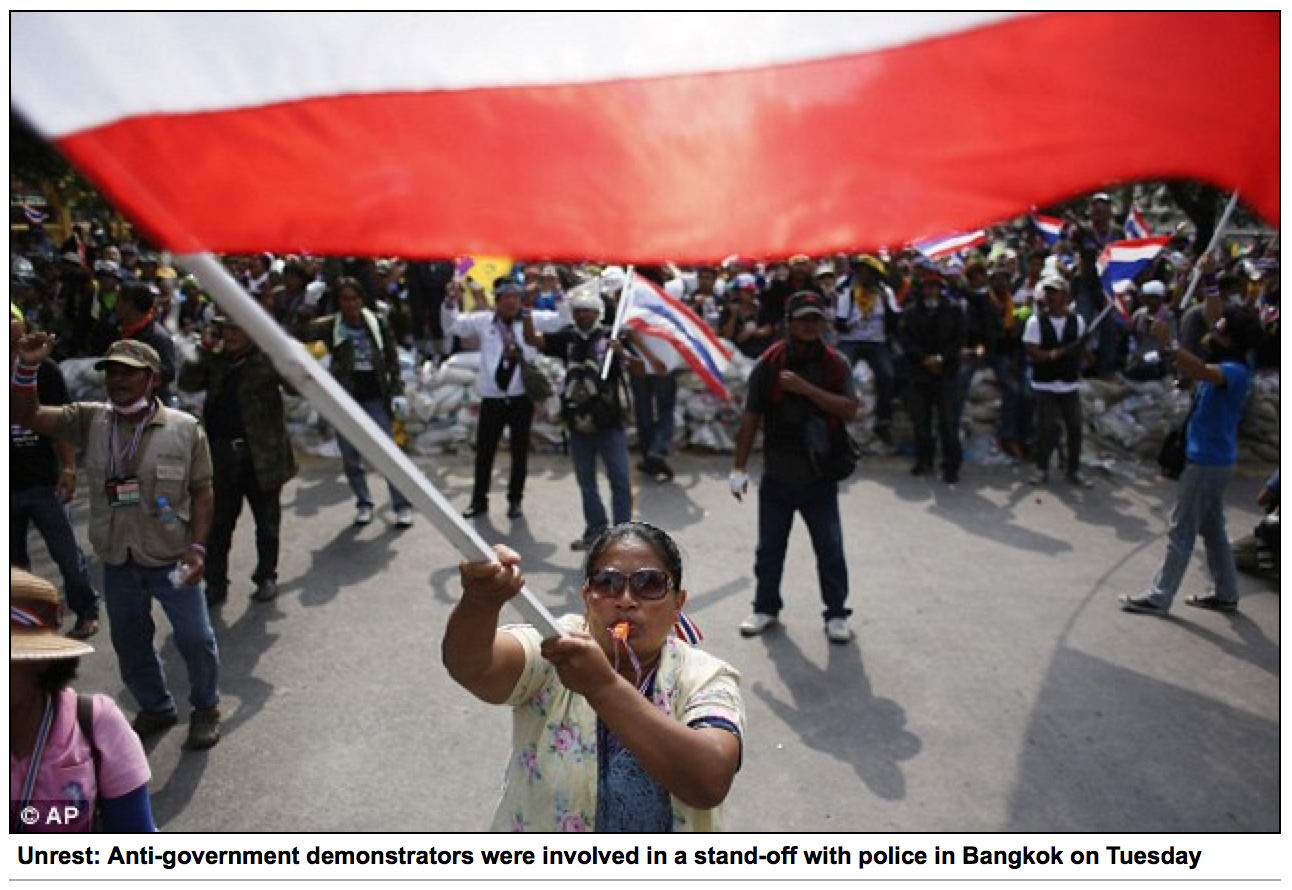

The "escape" from Bangkok is a misleading description, despite the escalating violence and state of emergency later declared. The Thai people, including the protesters, were friendly and considerate to me, emulating the wonderful Buddhist culture of the country. Thailand is different. It possesses unique characteristics that need to be evaluated without bias. It is still an emerging market. The road for Thailand will not always be smooth, as history and current events have recently demonstrated. Like every market, it is shrouded in uncertainty, but that should not take away from the investment potential associated with specific companies and entrepreneurs.

One week later, I arrived back in Canada safely, with a slate full of investment ideas, a greater frustration with United Airlines than Bangkok, and a slight phobia of the 5 foot monitor lizards I discovered in Lumphini Park. I keep telling myself it is silly to be afraid of a living creature comprised mostly of H20.

Paul Moroz

See photos of the shutdown here.

Copyright © Mawer Investment Management