by Del Stafford, iShares

Emerging market high yield bonds – about as risky as an asset class can get, right? After all, emerging markets are known for carrying a significant amount of risk, and high yield bonds are one of the more speculative sectors within fixed income. Put the two together, and aren’t you doubling down on risk? I thought the same myself before researching this very topic, but to my surprise I found that is not [always/necessarily] the case.

First, most investable emerging market high yield indices contain bonds that are issued in US dollars (USD), so with these indices there isn’t additional risk from owning other currencies. Also, emerging market high yield generally includes sovereign bonds (issued by a government) and quasi-sovereign bonds (issued by an agency backed by a government), while US high yield generally only includes corporate bonds.

Corporate bonds are typically viewed as riskier than government bonds, even when they have the same credit quality rating. In times of market volatility and stress, you can see that play out in what is commonly referred to as a “flight to quality”. For example, we saw this happen during the credit crisis of 2008 when the market largely sold out of corporate bonds and bought US Treasuries.

The sovereign and quasi-sovereign exposure in emerging market high yield caused it to behave differently from other risk assets during 2007-2009. The below chart shows correlations of emerging market high yield (Barclays EM High Yield Index), US corporate high yield (Barclays US Corporate High Yield Index), emerging market equities (MSCI Emerging Markets Index) and developed international equities (MSCI EAFE Index) to US equities (S&P 500 Index) during this time period. You can see that developed international equities, emerging market equities, and US high yield increased in correlation but emerging market high yield decreased in correlation.

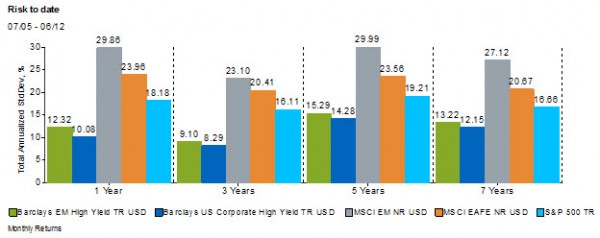

In addition, when you look at historical volatility in the below chart, emerging market high yield has experienced comparable levels of risk to US high yield over the past seven years.

Now, the intent here isn’t to say that emerging market high yield bonds are for everyone, but rather to challenge investor assumptions about the investment’s risk profile. Investors interested in emerging market high yield debt should still consider whether it suits their portfolio needs (Matt Tucker’s recent post may be helpful).

Source: Markov Processes International (MPI)

Del Stafford, CFA is the iShares Head of Product & Investment Consulting and a regular contributor to the iShares Blog. You can find more of his posts here.

Correlation is a statistical measure that captures the degree of the historical relationship between the returns of a pair of investments or indexes.

Correlation ranges between +1 and -1. A correlation of +1 indicates returns moved in tandem, -1 indicates returns moved in opposite directions, and 0 indicates no correlation.

Standard deviation is the statistical measure of the degree to which an individual value in a probability distribution tends to vary from the mean of the distribution. It is widely applied in modern portfolio theory, where the past performance of securities is used to determine the range of possible future performance, and a probability is attached to each performance.

Bonds and bond funds will decrease in value as interest rates rise. High yield securities may be more volatile, be subject to greater levels of credit or default risk, and may be less liquid and more difficult to sell at an advantageous time or price to value than higher-rated securities of similar maturity.

Copyright © iShares