Winning the War in Europe

March 2012

by Scott Minerd, CIO, Guggenheim Partners LLC

In centuries past, there have been many wars fought to bring Europe under one economic and political union. Today, in many ways, Europe is engaged in another war – a war to preserve the hard-fought gains of monetary and fiscal union built over the past five decades. Just as past European conflicts resulted in grave economic costs and massive amounts of debt, this fight has taken a similar path. How long will it take to resolve? The interwar period from 1918 to 1939 may offer some insight.

In centuries past, there have been many wars fought to bring Europe under one economic and political union. The Napoleonic Empire, the Prussian Empire, the Third Reich, and even the Ottoman Empire further to the east ultimately failed to achieve this goal. Today, in many ways, Europe is engaged in another war – a war to preserve the hard-fought gains of monetary and fiscal union built over the past five decades beginning with the Treaty of Rome in 1957.

The battles of this conflict, like previous European wars, are being fought across a broad theater. The Argonne, Waterloo and Normandy are among the many famous battlefields of the past. Greece, Portugal and Ireland are among the theaters of war in which European Union is currently engaged.

Just as past European conflicts resulted in grave economic costs and massive amounts of debt, this fight has taken a similar path. In the latest incursion, Greece has obtained a temporary cease fire in the form of a new €130 billion bailout plan, once again dodging an immediate threat of default and destabilization. Yet this plan will only reduce Greece’s debt to approximately 120% of the nation’s gross domestic product. Waiting in the wings are Portugal and Ireland, Italy and Spain – and later down the road, Belgium, and who knows what other European states – which may soon require their own restructurings.

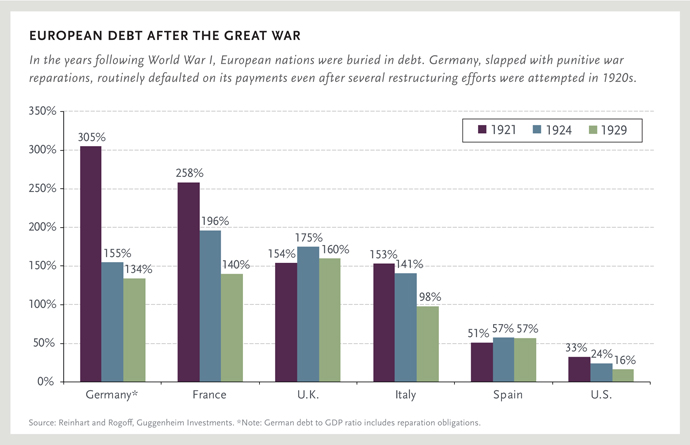

Highly indebted nations as a result of war are common in the European experience. In fact, today’s experience doesn’t look all that different from another period in history when European nations were saddled with huge debts, had little means to repay them, and stumbled through a series of bailout plans that ultimately failed to solve the fundamental problems.

The Interbellum

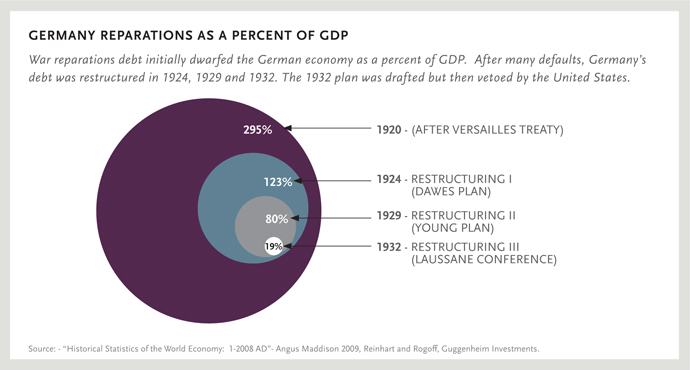

As the clouds of conflict lifted in 1918 and the Great War came to an end, the victorious Allies embarked on a plan – several plans, actually – to force Germany to pay for the incalculable destruction throughout Europe. The initial bill for war reparations was set at 269 billion gold marks, an amount that dwarfed the size of the German economy, amounting to approximately 300% of GDP.

Other European nations had borrowed heavily to fight the Great War. Many ended the war with astronomical amounts of debt, including Great Britain (154% of GDP), France (258% of GDP) and Italy (153% of GDP). Then, as now, there were strict demands for austerity measures, flat refusals to accept losses on certain debts, and constant infighting over bailout plan after bailout plan. Deadlines were missed; new plans proposed; the populous rose up in arms; and the whole process started over again. This serial restructuring saga continued throughout Europe for the entire interwar period.

Without the realistic ability to pay its enormous war debt, Germany spent the next 14 years on a path of multiple restructurings, occasionally paying installments (often in coal and timber) but more often defaulting on its financial obligations. Other European countries, particularly war-ravaged France, demanded full payment from the fledgling Weimar Republic. Initially, with its economy decimated by war and austerity measures, Germany responded by printing more and more money. In a startling surprise, the world was aghast as it watched Germany slip into hyperinflation where, at its height, one U.S. dollar was worth 4 trillion German marks.

Drawing parallels with Weimar may seem ironic – as Germany is now the strongest economy in Europe and the leading advocate for austerity measures in Greece – but if one digs deep enough into the Interbellum, there are many similarities today. Germany wasn’t the only debtor-in-crisis back then, just as Greece is not today, but it was the poster child for Europe’s post-war economic angst.

The Dawes Plan

The first indication that things were not going well came early on. During the 1919 Paris Peace Conference, British economist John Maynard Keynes resigned as the principal representative of the British Treasury and stormed out of the conference to protest the high reparations demanded of Germany. Keynes, one of the fathers of modern economics, warned that punitive reparations would cripple the German economy and could lead to future conflict. It didn’t take long for the rest of Europe to realize that Germany had neither the ability nor willingness to pay the full amount.

In August 1924, the Allied powers approved the first major restructuring package, known as the Dawes Plan. It was named for its principal architect, Charles G. Dawes – an American financier and later U.S. Vice President during Calvin Coolidge’s second administration. Without addressing the dollar amount owed, the Dawes Plan outlined a series of financial reforms for Germany, including currency stabilization, new taxes, and massive new loans primarily through American banks to help stimulate economic growth and pay off debts. Hailed an as an international hero in 1925, Dawes won the Nobel Peace Prize for his work.

The Young Plan

Within four years, however, it became clear that more needed to be done. In 1929, American businessman Owen D. Young (co-author of the Dawes Plan) led another restructuring effort. The Young Plan called for a more than 50% reduction in Germany’s reparations debt, extended the payments over a 58-year period, and imposed additional taxes. For his bold debt reduction plan, Young was named Time Magazine’s “Man of the Year.”