The Next Investment Catalyst? Accelerating Economic Growth??

by James Paulsen, Chief Investment Strategist, Wells Capital Management (Wells Fargo)

At least for the time being, the stock market seems to have survived yet another round of “Euro-Crisis Mania.” Recent policy actions announced yesterday by European officials have at least temporarily calmed fears of an imminent calamity. Most believe the rally in the S&P 500 Index to almost 1300 in the last month is due almost entirely to improvements in the European crisis outlook. While recent European developments certainly helped improve the mood of investors, we believe the recent stock market rally mostly reflects a huge reassessment of the potential recession risk in the U.S. economy.

The stock market collapsed in early August after a significant downward revision to real GDP growth in late July suggesting the pace of economic growth nearly flat lined in the first half of this year. Thereafter, the probabilities economists placed on an imminent U.S. recession rose significantly, and many prominent forecasters suggested a recession was indeed forthcoming. In recent weeks, however, a steady stream of “better-than-feared” timely economic reports from Main Street USA has calmed fears of an imminent recession. In combination with another robust corporate earnings season (which looks anything but recessionary) and capped by yesterday’s report that U.S. third quarter real GDP growth was a much stronger-than-anticipated 2.5 percent (with a robust and totally surprising real final demand growth of 3.6 percent!) has ultimately elevated investor greed beyond diminishing recession fears.

So now what? Investors have backed away from the recession cliff and the S&P 500 has returned to its approximate 1250 to 1350 trading range evident prior to the recession scare between February and July. Does the stock market remain trendless next year? Will it again come under intense selling pressure? Or is there a catalyst (beyond the notable currently attractive stock market valuation—that is, the stock market has trended sideways this year while earnings have continued to rise and competitive bond yields have declined) which would allow the stock market break out to new recovery highs?

Is Economic Growth Accelerating?

Although most have backed away from an imminent recession expectation, the consensus forecast still calls for only “muddling along” economic growth during the coming year. According to Bloomberg, the consensus economic forecast for real GDP growth is an anemic 2 percent for both the fourth quarter of this year and for all of 2012. Most believe the U.S. economy is destined for “sluggishness” since policy officials can no longer assist. Monetary officials are widely perceived as out of bullets and fiscal authorities seem helplessly gridlocked. Without another dose of stimulus, why should the economy improve?

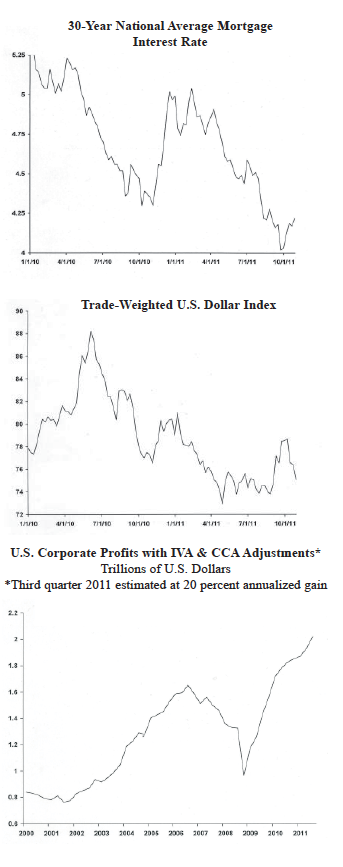

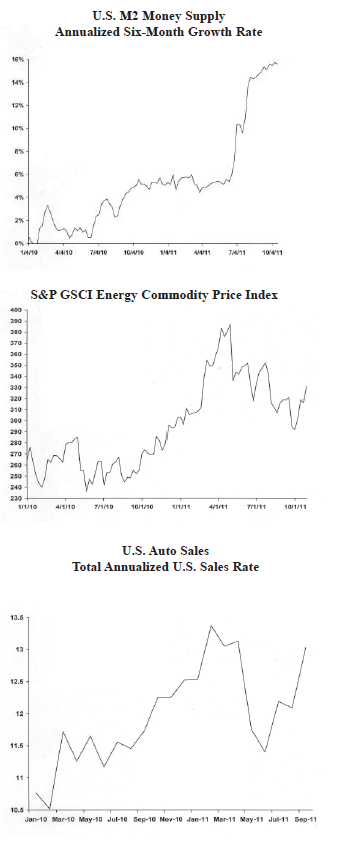

Although policy official assistance for the economy may be limited, the private sector has adopted a policy of “self-medication” which could produce a surprising acceleration in real GDP growth next year. Exhibit 1 illustrates six sources of “stimulus” implemented in recent months which should improve economic prospects in the coming year.

Exhibit 1: Economic Self-Medication

First, the national average mortgage interest rate has declined by more than 1 percent since early this year. Long-term interest rates have declined by similar amounts on Treasury securities and on corporate and municipal bond yields. Although no policy official is responsible, long-term credit costs for many economic sectors have been significantly reduced in the last several months.

Second, since the summer, the annualized growth in the U.S. money supply has surged! The annualized six-month growth rate in the M2 money supply has nearly tripled since June from about 5 percent to more than 15 percent. While some of this money supply surge is probably due to fallout from worries over the European crisis, it nonetheless has massively improved economic liquidity conditions, and similar to last year, should help improve the pace of economic growth in future quarters. During the 2010 economic soft patch, the annualized growth rate in the M2 money supply rose from about zero percent in June to about 6 percent by October probably helping lift the pace of economic growth by late 2010.

Third, despite a recent surge in the value of the U.S. dollar, the trade-weighted dollar index is still currently more than 15 percent below its highs in mid-2010 and about 8 percent lower than it was at the beginning of 2011. A weak dollar has typically been a good indicator of future improvements in U.S. net exports. After regularly subtracting from U.S. real GDP growth throughout 2010 and into early 2011, net exports have now “added” to real GDP growth in each of the last two quarters. U.S. dollar weakness during the last 18 months implies net exports should regularly add to real GDP growth in the coming year.

Fourth, although not by a large amount, energy prices have fallen since late spring. Overall, the S&P GSCI Energy Commodity Price Index is off by about 15 percent since April. The national average nonleaded gasoline price is down by a similar amount. Is a lower “energy bite” already evident in producing stronger consumer spending trends than most had anticipated?

Fifth, U.S. corporate profits posted yet another solid quarter of growth in the third quarter probably rising at an annualized pace of about 20 percent! Total U.S. corporate profits are more than 20 percent “higher” than their peak during the last recovery cycle in late 2006. This record-setting profit recovery cycle has produced tremendous “dry powder” in the business sector which could (with just a little improvement in business confidence which may be forthcoming as European fears calm and U.S. recession fears evaporate) be used to quicken business spending and improve job creation during 2012.

Finally, as evidenced by the recent recovery in U.S. auto sales, as the Japanese economy bounces back from its early-year tsunami, U.S. manufacturing supply chain problems are rapidly diminishing. This post-Japan disaster recovery is also illustrated by a bounce recently in most ISM manufacturing surveys across the country. A full year of economic growth without earthquakes and floods in Japan should allow even further U.S. manufacturing revival in the coming year.

The potential positive impact from “self-medicated economic stimulus” is probably being greatly underappreciated. Indeed, rather than muddle along at only about 2 percent growth, we expect U.S. real GDP growth to surprisingly jump to between 3 to 3.5 percent during 2012.

What About Europe and the Emerging World?

Our expectation for U.S. growth in 2012 is not based on a big recovery in Europe. Rather, the euro zone may already be in a mild recession or at best will exhibit nearly flat lined performance next year. However, we do think the slowdown evident among emerging world economies during the last year is coming to an end. Economic authorities in most of these economies now recognize inflation risk is ebbing and will soon likely begin adopting more accommodative economic policies. By early next year, we anticipate a consensus developing of a “soft landing” in the emerging world which will improve confidence in the longevity of the global economic cycle. Weaker growth in the European region may be largely offset by somewhat stronger growth next year among most emerging economies.

Investing Implications?

In the last month, the stock market has “reset” values as expectations backed away from an imminent recession thesis. The upside price action in the stock market from decaying recession probabilities has mostly already been incorporated into the stock market with the S&P 500 now near 1300. However, an “economic acceleration” catalyst is what may now carry the stock market to new recovery highs during 2012.

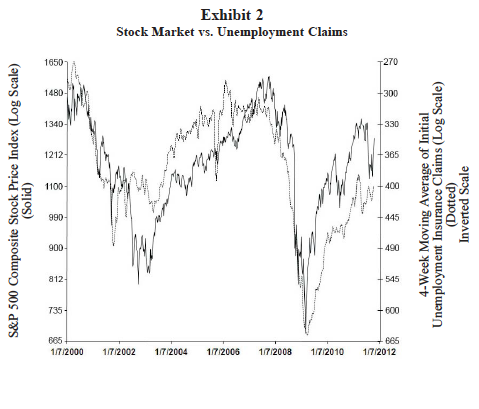

Exhibit 2 overlays the S&P 500 Stock Price Index with initial unemployment insurance claims. Since 2000, there has been an extremely close relationship between momentum on Main Street (as evidenced by declining jobless claims signaling an improving job market) and stock market momentum. As shown by this exhibit, during 2011 both the economic and stock market recoveries stalled (i.e., both the dotted and solid lines trended sideways).

If real GDP growth continues to remain sluggish in 2012 at about 2 percent, then both the level of unemployment claims and the stock market will likely remain range bound. However, if as we expect, the pace of real GDP growth surprisingly accelerates (and unemployment claims finally decline below 400 thousand towards 350 thousand) the stock market should again prove rewarding for “riskon” investors.

Wells Capital Management (WellsCap) is a registered investment adviser and a wholly owned subsidiary of Wells Fargo Bank, N.A. WellsCap provides investment management services for a variety of institutions. The views expressed are those of the author at the time of writing and are subject to change. This material has been distributed for educational/informational purposes only, and should not be considered as investment advice or a recommendation for any particular security, strategy or investment product. The material is based upon information we consider reliable, but its accuracy and completeness cannot be guaranteed. Past performance is not a guarantee of future returns. As with any investment vehicle, there is a potential for profit as well as the possibility of loss. For additional information on Wells Capital Management and its advisory services, please view our web site at www.wellscap.com, or refer to our Form ADV Part II, which is available upon request by calling 415.396.8000. WELLS CAPITAL MANAGEMENT® is a registered service mark of Wells Capital Management, Inc.

Copyright © Wells Capital Management